Securing Your Income

Many of us will go straight into finding out what whole life insurance plan is, but some of us can also no longer comprehend the motive at the back of getting it (or simply have a vague idea).

A existence insurance coverage pays a certain sum of money when something awful takes place to you – accident, injury, complete everlasting disability (TPD) or death.

Usually the payout varies depending on how extreme the effect is. It’s supposed to compensate your decreased incomes ability – so it’s no longer pegged to the price of clinical treatment, for example.

The cash is intended to assist your family if you’re now not able to support them or are no longer round to do so. So, it’s solely imperative when you have kids, or if you have other dependents such as siblings or parents.

Term vs Whole Life Insurance

Term insurance plan and complete existence insurance plan are the solely 2 plans that can remedy the earnings safety issue. It's "either this or that."

Other than coverage, there are a entire lot of different factors that will steer you to one camp or the other.

There are instances when people do get both plans and nowadays, there are plans that are a aggregate of term and complete lifestyles factors - multipliers

These multiplier plans can furnish the satisfactory of each worlds...

Before I get to the "debate", let me give you a brief overview of what time period and total life insurance plan are.

What Is Whole Life Insurance?

A total lifestyles insurance is a policy that affords coverage that lasts till the give up of existence or usually up to one hundred years old.

There are 2 predominant kinds of whole lifestyles insurance policies: Participating and Investment-Linked Plans.

- Participating Whole Life Insurance One principal cause why people get it is because it accumulates cash value. Meaning if you had been to give up in the future, you can acquire payouts. The amount you get again depends on how lengthy you held the plan. The longer you hold, the greater the money value would be.

The different reason is because the insurance lasts for life.

This is the most common type of total life insurance and it will be what I'm referring to in this article.

- Investment-Linked Whole Life Insurance The other type of entire existence insurance plan is linked to investments.

Part of the premiums you pay goes to paying for the insurance plan coverage, the rest goes into investments.

You can nevertheless maintain this format for existence (or till 100), but usually the insurance plan fees go up with age, and will become extremely costly, till it eats into the value of the investments heavily.

As investments are volatile, the "cash value" internal will upward thrust and fall depending on the market prerequisites and therefore are not guaranteed.

For these few reasons, investment-linked total existence plans may additionally no longer the most beneficial solution.

What Is Term Insurance?

A term insurance is a coverage that has a fixed time period for coverage, which is set upon application.

After the time period is up, you might not be protected anymore. Having said that, the premiums you pay goes straight into safety and as a result the time period format can provide a greater coverage for a constant price range as compared to the whole life plan.

One drawback is that there's no cash value. If nothing takes place to you, then you might not get lower back anything.

Do I Need Life Insurance?

-

Life Insurance is imperative for a variety of reasons. While cash can by no means substitute a person, it can help ease the monetary burden in already hard instances of dealing with a non-public loss.

-

Life insurance plan can help make a contribution to your peace of thinking when you recognize that your cherished ones will be properly provided for in case the unexpected happens.

-

Ability to foresee situations is one of the defining traits of life. Hence, all the more motive to guard ourselves and our loved ones in opposition to something lifestyles may have in save for us.

-

When it comes to enhancing your credit score, a life insurance plan coverage can be regarded an asset. Timely top rate fee can make a contribution positively to your credit score making it less difficult for you to obtain a loan in the future.

-

Some insurance insurance policies like annuities are designed mainly to supply retired individuals with a everyday circulate of earnings in lieu of a lump sum amount which they are required to invest in the policy.

-

Insurance isn’t simply intended to protect individuals. It can additionally be taken to protect your enterprise from any potential or unforeseen monetary risk, liability or instability.

-

The passing away of a cherished one is a very challenging time which also brings with it the burden of some surprising expenses. Life insurance can assist minimize the financial stress when your household is present process an already challenging time.

Check Out The Following Top 3 Companies that Offer Life Insurance

ADragan/shutterstock.com

Here are the advantages that you will get with Singapore Life: - If you have any queries about your Singapore Life policy, you can have them clarified every time and anywhere with the aid of having a chat with their group online.

-

You will be rewarded if you lead an energetic lifestyle. Just be a part of the Stay Active application via Singapore Life and sync your fitness machine with the Singapore Life Activity Tracker. By doing so, you will earn money again every month on your policies.

-

Singapore Life has made the entire method of buying a existence insurance product user-friendly and paper-free. - Singapore Life has an easy-view dashboard that helps in retaining song of the entirety about your Singapore Life coverage. - Singapore Life affords you the alternative of comparing their rate with other insurers online. You simply have to enter a few small print about yourself and evaluate the expenses supplied by other insurers.

Singapore Life Insurance

AIA Life Insurance

Here are the number of promotions that you are eligible for as an AIA Vitality member are: - S$3 off per fashionable film ticket at Golden Village Multiplex. Ticket expenditures begin at S$5.50 and are restricted to 2 film tickets per week. - Members who have finished Platinum Vitality Status after 1 January 2019 are entitled to a bonus amount of S$150. - Members whose membership anniversary is between 1 January 2018 and 31 December 2018 are entitled to an annual cashback. Members who have performed Gold Vitality Status will obtain an annual cashback of S$60, whilst Platinum Vitality Status members will acquire S$120. - AIA Vitality individuals are entitled to bargain for bookings made from AirAsia’s website. The bargain will be given to you in the form of a cheque as cashback and no longer a discount at the time of booking. - You can also experience reductions up to 50% whilst booking economic system tickets on Emirates flights that begin from Singapore. The bargain percentage varies depending on your AIA Vitality Status. - You can book a Royal Caribbean Cruise leaving from Singapore at reductions of up to 50% depending on your membership status. - A 15% bargain can be loved at Marriott accommodations and hotels problem to room availability. If your AIA Vitality Status is Silver or higher, you can enjoy additional discounts up to 35% in the form of cashback.

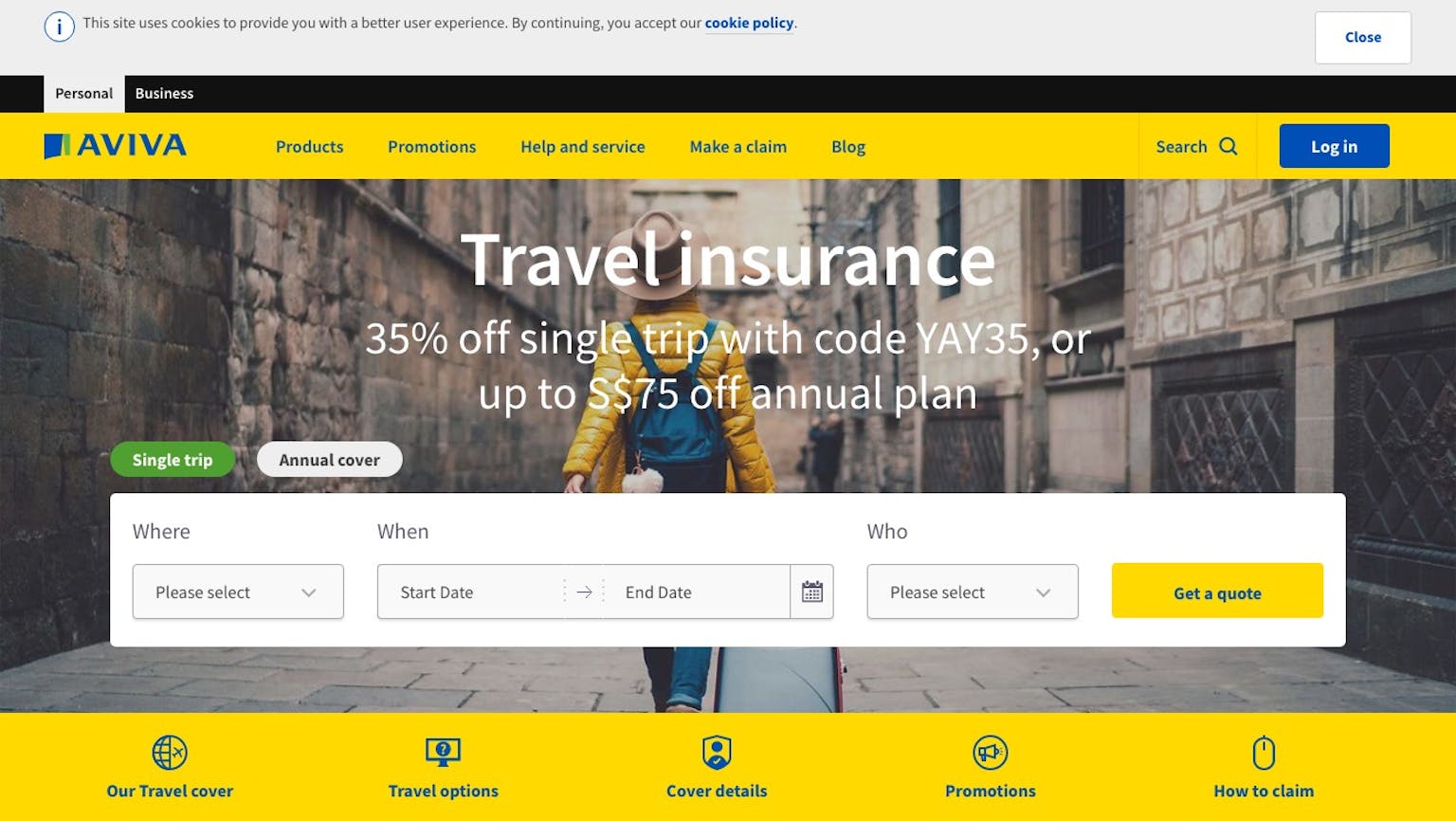

AVIVA Life Insurance

Below are the benefit for AVIVA Clients - Minimum annual premiums of vary S$3,600 to $5,399 will get you items valued at S$200. - Minimum annual premiums of vary S$5,400 to S$7,199 will get you presents valued at S$300. - Minimum annual premiums of vary S$7,200 and above will get you gifts valued at 6% of your premium values. - Rewards and presents valued at S$100 are: - Zalora buying credits - Tangs on-line buying credits - Digital gift codes for books, music, and apps - Grab vouchers - UNIQGIFT voucher - Comprehensive fitness screening bundle with the aid of Lifescan Medical Centre - 1 pamper programme at LPG Endermospa - The Royals Steakhouse dining present certificates

Please leave your knowledge and opinion!