There is nothing like a new addition to your family to make you reassess your finances and life situation. While the most enjoyable moments will be with your new little bundle of joy, parents now have a greater responsibility.

As your family grows, you will need to prepare well financially to protect your family's future. You may wonder, "What will happen to my family if something happens to me? How will they support themselves? Will they be able to afford a good education?" Here are the best insurance policies for parents to consider.

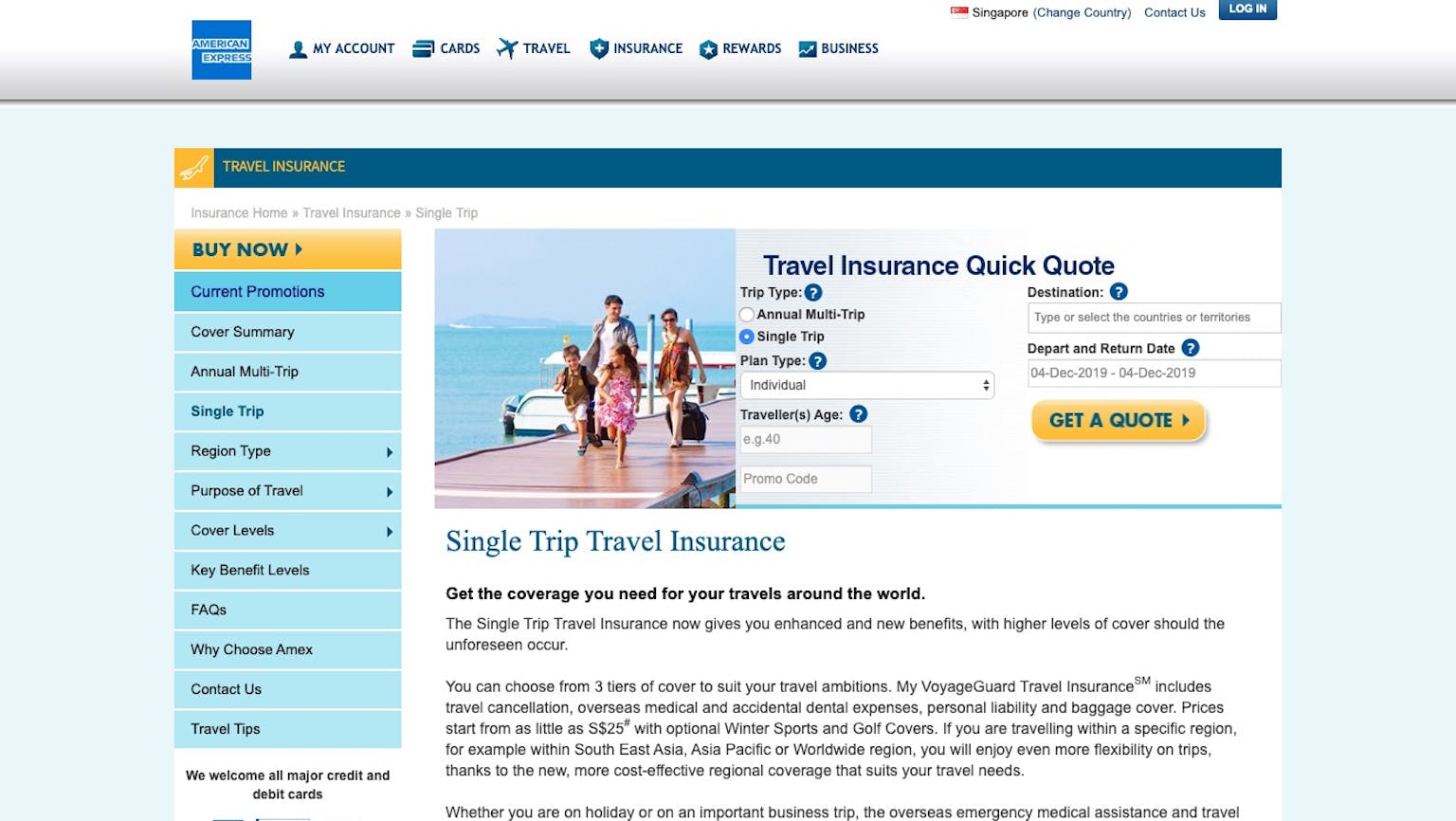

Asia Images Group/shutterstock.com

If Something Serious Happens to You

In the event of your death, you want a life insurance policy to protect your surviving beneficiaries. Term insurance plans and whole life insurance plans pay out a lump sum if you die, so your family can continue to pay the bills, mortgage, and other living expenses.

You may consider purchasing additional insurances such as critical illness and disability. You can add on critical illness cover and disability cover to your term life policy. Alternatively, you can purchase these insurances separately.

Critical illness insurance reimburses your expenses for medical treatment of 37 critical illnesses listed by the Life Insurance Association. It typically pays out in a lump sum when you are first diagnosed. This insurance is beneficial because your family can use the money to cover everyday expenses during the loss of your monthly income.

Disability insurance can pay a maximum of 80% of your average monthly salary up to 5 to 10 years if you experience a disability that affects your ability to work. This cash benefit can help assist your family during this transition of loss of income. However, since it only replaces part of your salary, this is just a short term solution.

Health Insurance - Especially for Children

It is advisable to have health insurance yourself as well as your children, even though they are young. The earlier they have coverage, the more likely they are healthy and free from illness. As a result, they will likely be able to obtain full health coverage with no exceptions. Furthermore, if a condition develops later, it will be covered.

Medishield Life is a basic health insurance plan for all Singaporeans and Permanent Residents. This basic government-initiated subsidized medical insurance provides basic coverage on hospitalization and surgical costs, including your children, regardless of age or pre-existing health conditions. This policy reimburses for public hospitals up to B2 wards.

To supplement and enhance this coverage, you may consider additional health insurance. It is recommended to find an insurance policy that reimburses for private hospitals or at least public A.

Future Investment

As education costs rise, the cost of a child's tertiary education can rival some medical bills. You may consider some type of savings plan as an investment for your child's future. One kind of program is known as the Education Endowment Insurance Plans.

These insurance plans are an investment. You pay the premium, and the policy accumulates and grows. Ideally, if you start early enough, the returns from the endowment plan can fund your child's tertiary education. This is a good option because the money appreciates faster than a bank savings account.

These plans are considered both an insurance plan and an investment plan. It has life insurance cover and some other cash benefits, such as hospital cash payouts. Moreover, these plans also have decent returns. One additional benefit is that you pay premiums for 5 to 10 years, and not throughout the policy period.

Alternatively, there are savings plans with guaranteed cash benefit payouts at different stages of your child's education from primary school to university. If you opt not to withdraw the money, you can accumulate your cash benefits at an interest rate.

These types of savings plans also come with death, total and permanent disability, and hospital payouts for the child. For the parents, most plans come with a rider that protects the policyholder. If you die, become total or permanently disabled, or are diagnosed with a dread disease, all future premium payments will be waived, but your child's education fund will continue to grow and be waiting for them.

Life Insurance for Your Child

Most families do not purchase life insurance for children. It is true that if a child dies, there is no loss of income. However, getting a life insurance policy for a child is recommended because of the same principle as obtaining health insurance for a child. By getting coverage before experiencing health problems and developing a pre-existing condition, you can avoid the higher premiums in the future.

The right type of life insurance can also serve as an investment opportunity for your child. Term life insurance only provides coverage during the term period. Once it expires, the policy disappears with no return. On the other hand, whole life insurance provides coverage for life.

Most whole life plans have a limited pay policy where you pay for a set number of years. Even when you finish the payments, the coverage will remain in effect for life. Furthermore, it has the potential to grow in cash value.

Whole life policies come with a cash value component: savings or investment. A whole life policy with a savings component is a Whole Life Endowment Policy. Fortunately, part of the returns is guaranteed. This option is safer but has lower yields. On the other hand, a whole life policy with an investment component is a Whole Life Investment-Linked Policy (ILP). There are no guaranteed returns and better suited for people who enjoy a higher risk.

Both whole life policies will provide financial protection with the possibility of a cash return.

Final Thoughts

We can't protect our children from everything in life. However, we can take precautions and preventive measures to provide for them, even after our death. We can sleep better knowing that there are policies in place that will continue to take care of our families. All we need to worry about now are the diapers and tantrums.

Please leave your knowledge and opinion!