What do I need to do to qualify for the additional rebate provided by OCBC for the OCBC Plus! Visa Debit Card?

In addition to what I need to do to qualify for the additional rebate by OCBC, when and how will the additional rebate be credited to me?

Products mentioned in this forum:

No Name

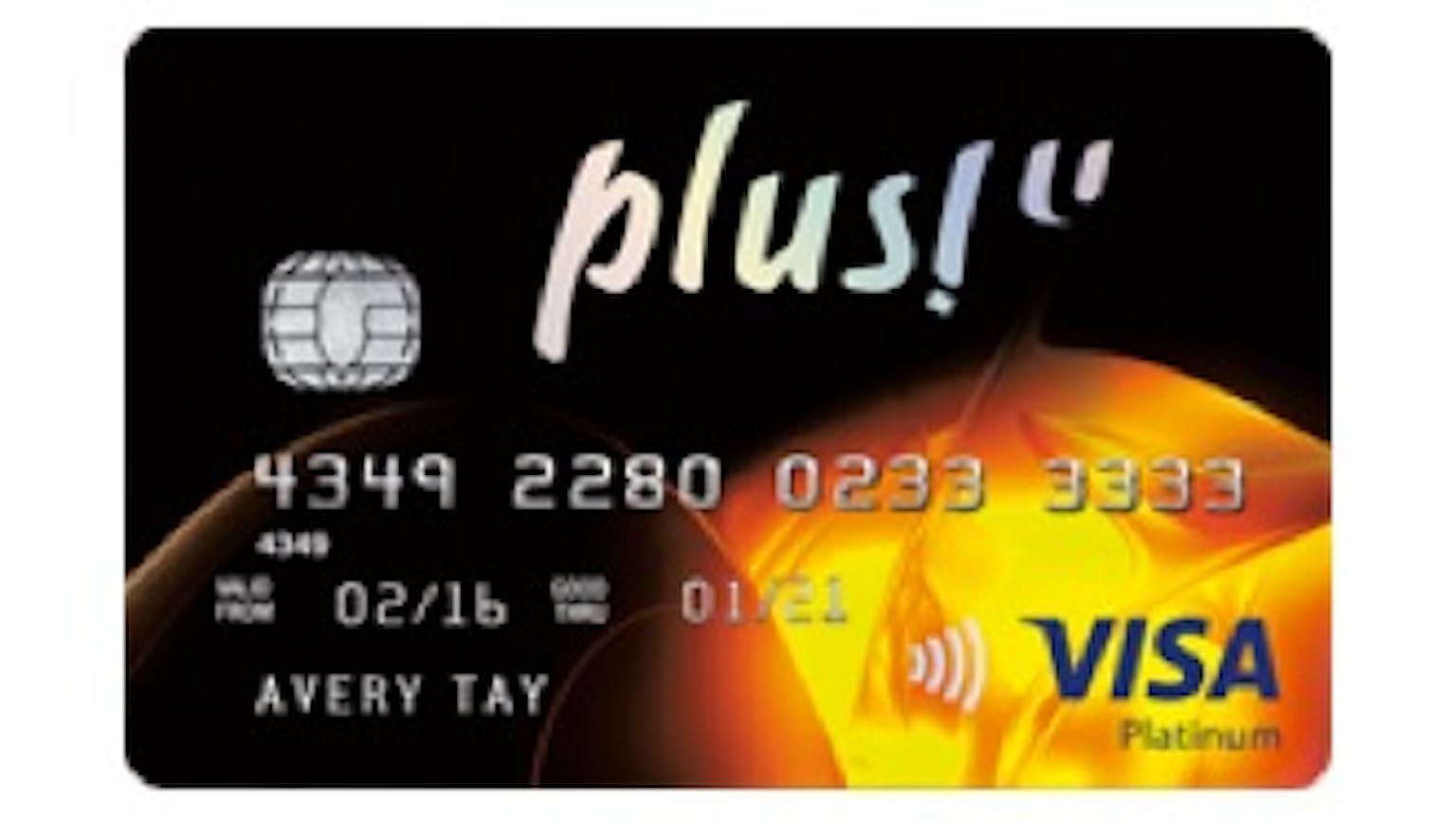

Firstly, you would need to be an existing OCBC card member holding any one of the Eligible Cards and have activated your OCBC-SCORE benefit via SCORE. The eligible cards are - OCBC Plus! Visa Credit Card; NTUC Plus! Visa Credit Card; OCBC Plus! Visa Debit Card; NTUC Plus! Visa Debit Card and FRANK Visa Debit Card. As for when and how you will receive the additional rebate, the consolidated rebate amount earned from your FairPrice store and Grab ride spend will be credited into the activated Eligible Card account within 60 days in which the spend occurred.