What is so good about the Unlimited Cashback Credit Card’s - The Good Life program?

I am just curious to know what is so special about the Unlimited Cashback Credit Card’s program called the Good Life program and if it is turns out to be that good and special, how then do I enjoy the privileges that come with it?

No Name

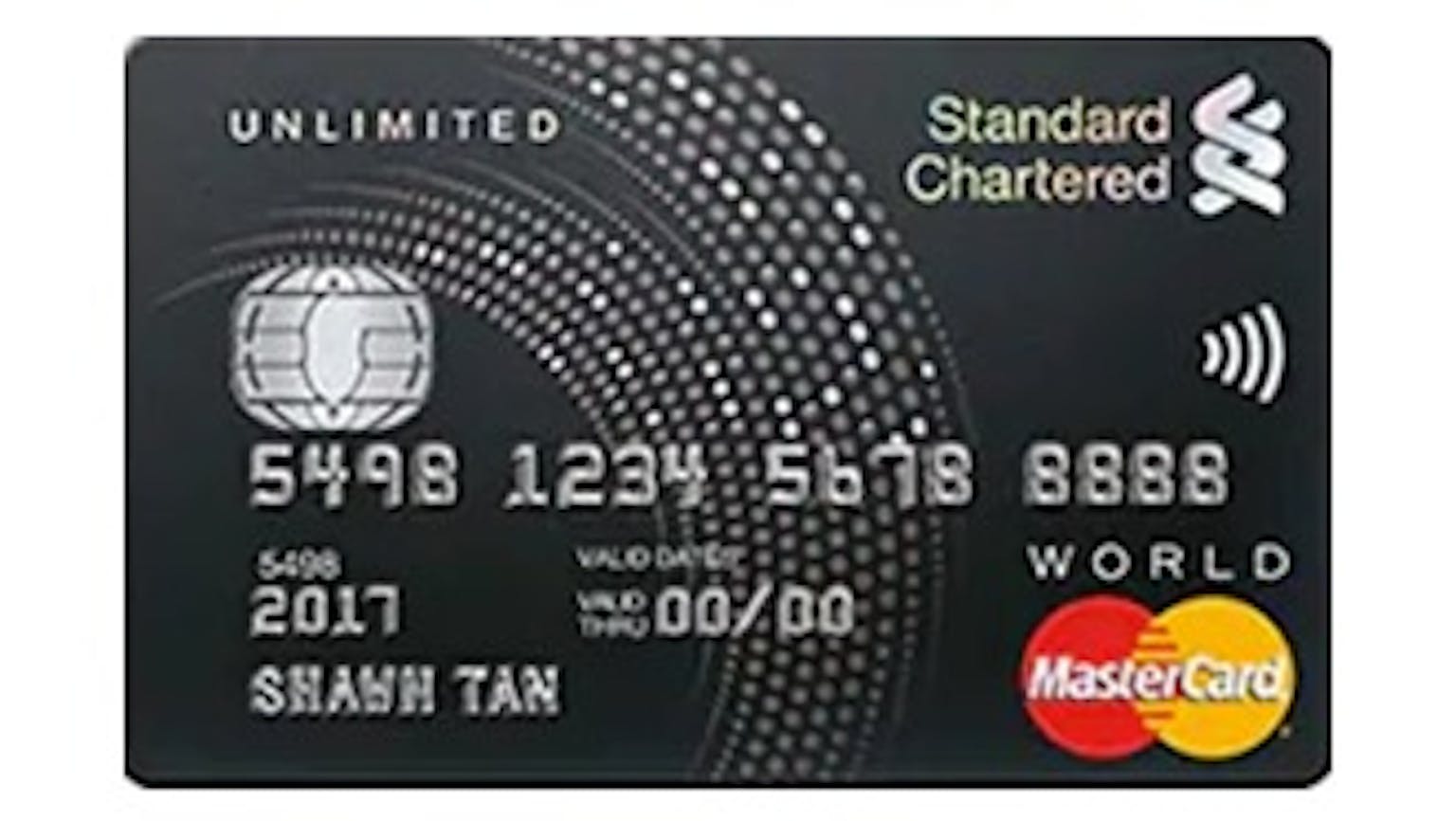

First and foremost, The Good Life (TGL) program is Standard Chartered’ privileges program that allows for credit and debit cardholders the enjoyment of best-in-class privileges at popular establishments by way of a simply spend using the credit or debit cards at participating partners. The list of participating partners can be found at www.sc.com/sg/promotions/the-good-life-privileges/ and at the same time you can even download the TGL mobile application, available on both the App Store and Google Play to better enjoy these offers. Nothing beats that much good and efficient benefit would you not agree?