What are the benefits of a UOB Lady’s Card for a single lady?

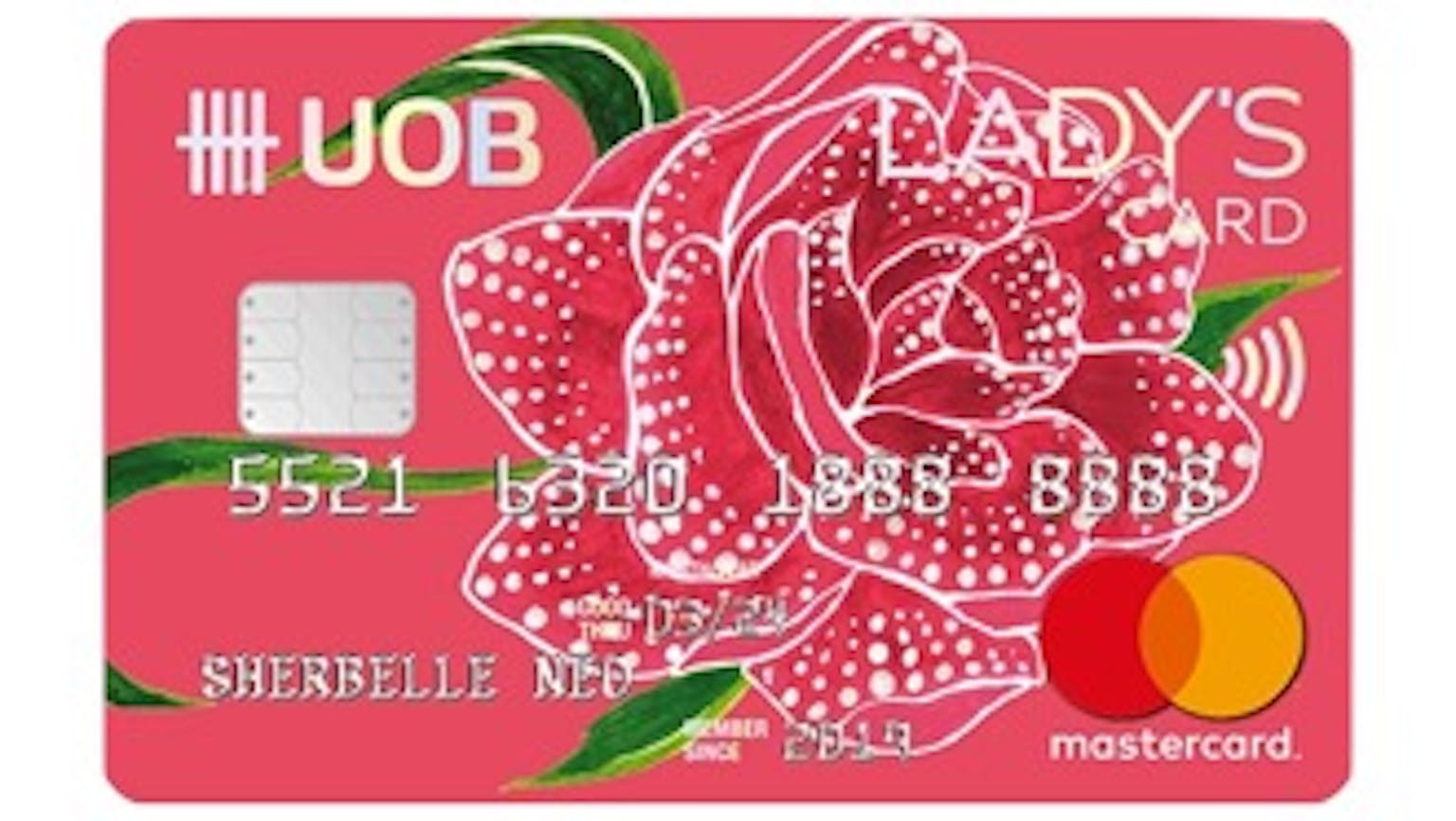

My wife’s sister is single and mentioned wanting to get the UOB Lad’s card but we don’t know anything about the card except that we see people use it often and it really as a colourful and attractive look. Please who can share the benefits of the card?

Products mentioned in this forum:

No Name

Basically the UOB Lady’s Card is the only credit card that offers women the freedom of choice to define their rewards from Travel, Dining, Beauty & Wellness, Family, Fashion, Transport and Entertainment. In addition to the flexibility of changing your categories every quarter, to suit your ever-changing lifestyle and interests. Either you shop online or in stores locally or overseas, you stand to earn 10X UNI$ (or 20 miles) per S$5 spent on your preferred category’s with no minimum spend required. Other benefits include coverage for online purchases and faster online checkout with Interest Free Payment Plan for over 6 or 12 months and e-Commerce Protection on online purchases.