I got hit by a vehicle, I need my insurance from my country.

Nowadays people get their insurance for safety precaustions. No one can tell what might happen to you today. Everyone needs their security wherever they go. Not all people have insurance though. We need to be cautious on our sourroundings. You got an insurance for emergencies but your out of the country. You need help

No Name

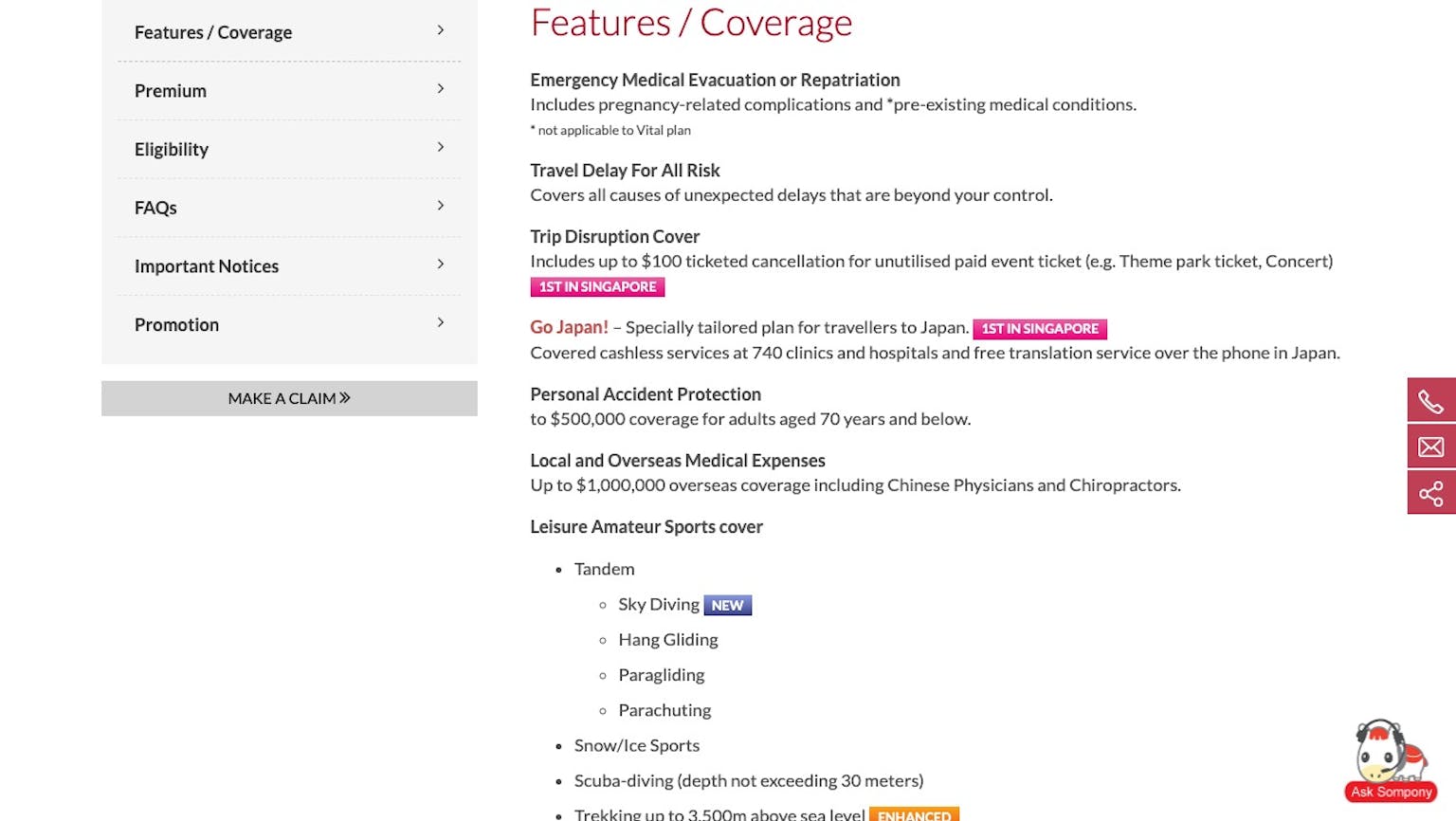

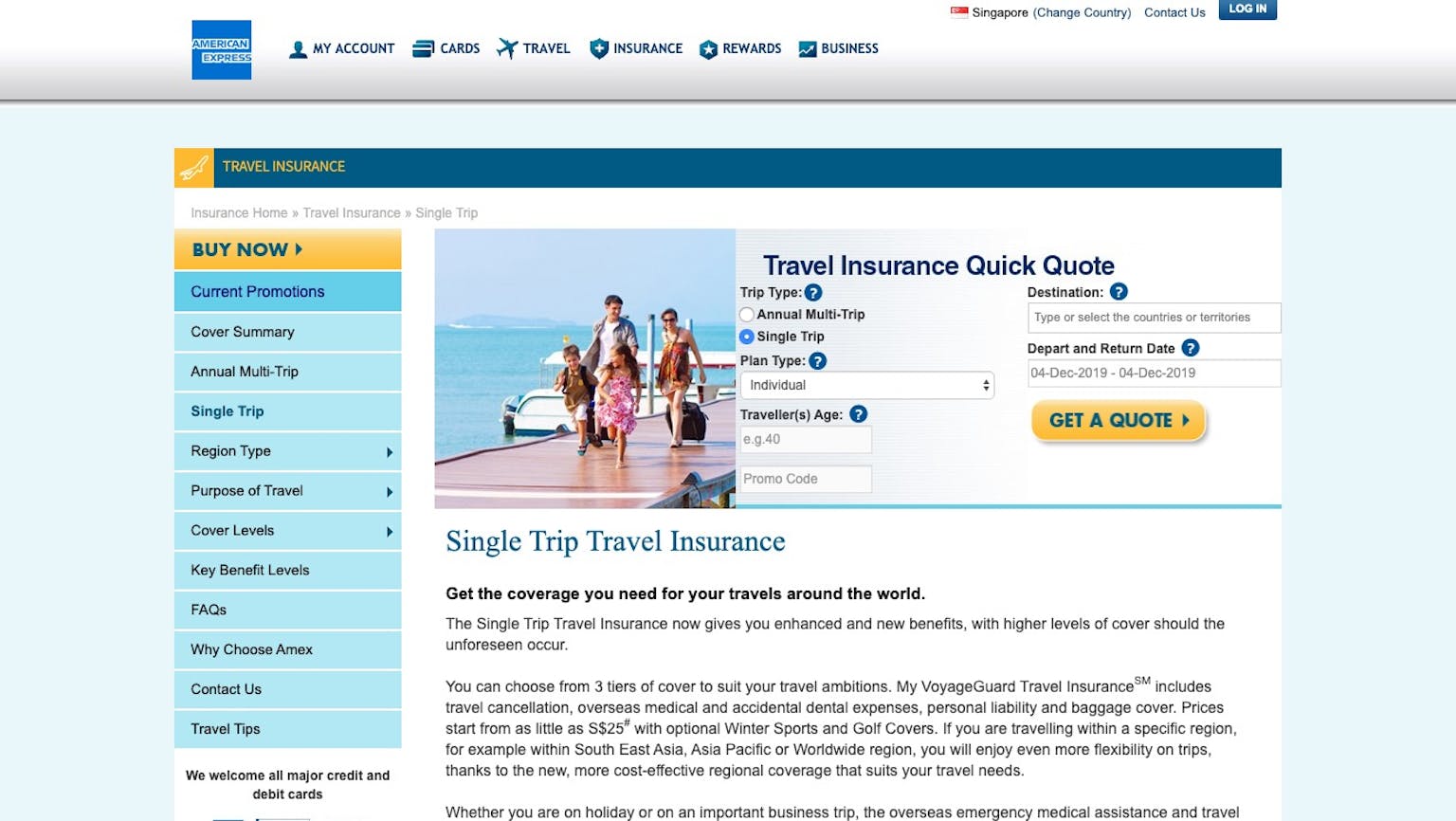

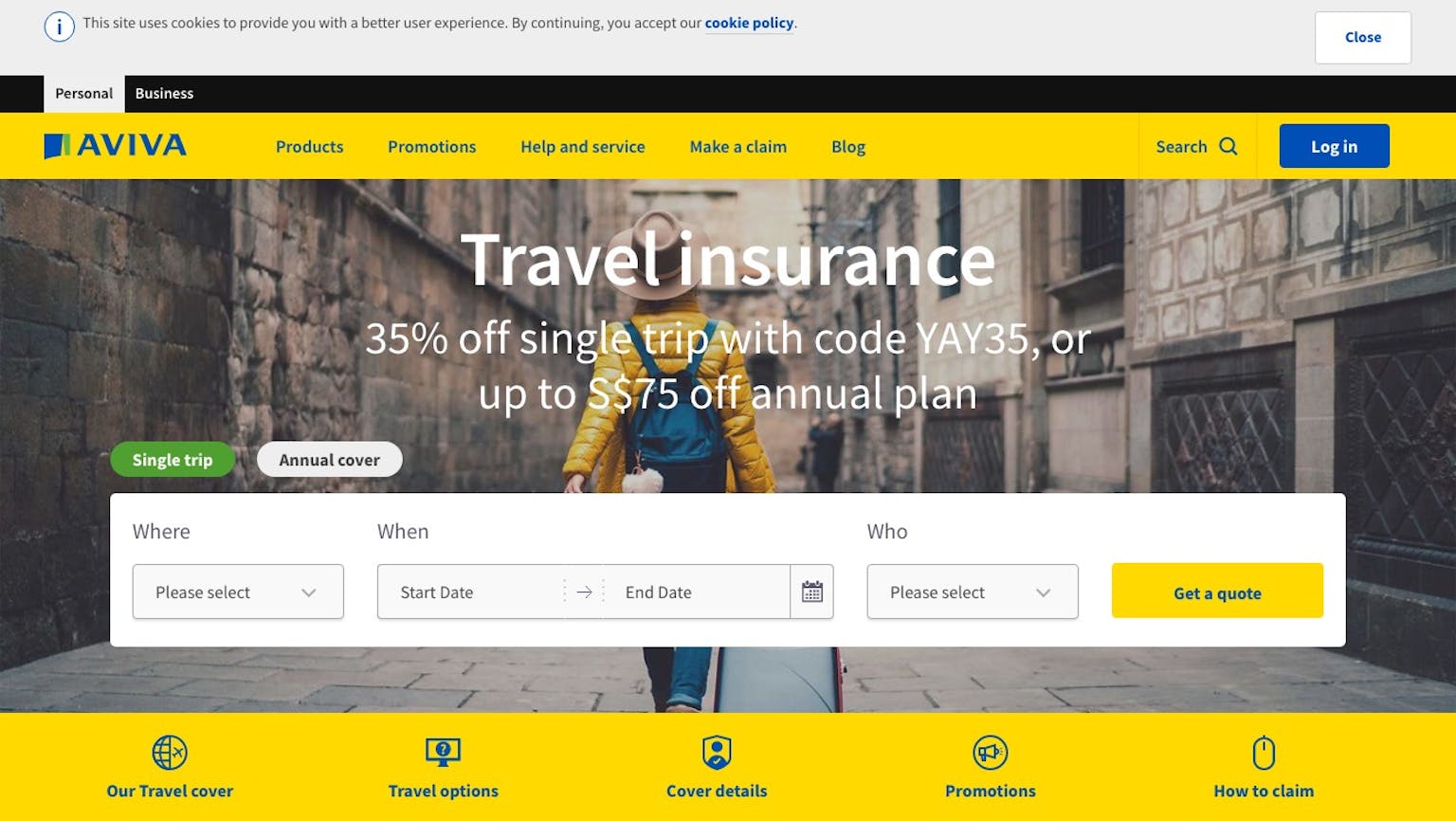

Check your insurance if you avail an insurance for overseas, most insurance have overseas category or listed with it. So most likely you can use your insurance wherever you go. Having insurance before going out of country is one of the best choices that you might make. Safety from travels can lessen your burden and might help you with your future tours.