An emergency fund can be the difference between going into debt and finding the money to cover unexpected expenses. Many who have had an emergency fund when they have needed it, have expressed their happiness for their careful planning. Here's why you need an emergency fund now and how to build one for the future.

Monthira/shutterstock.com

What is an Emergency Fund?

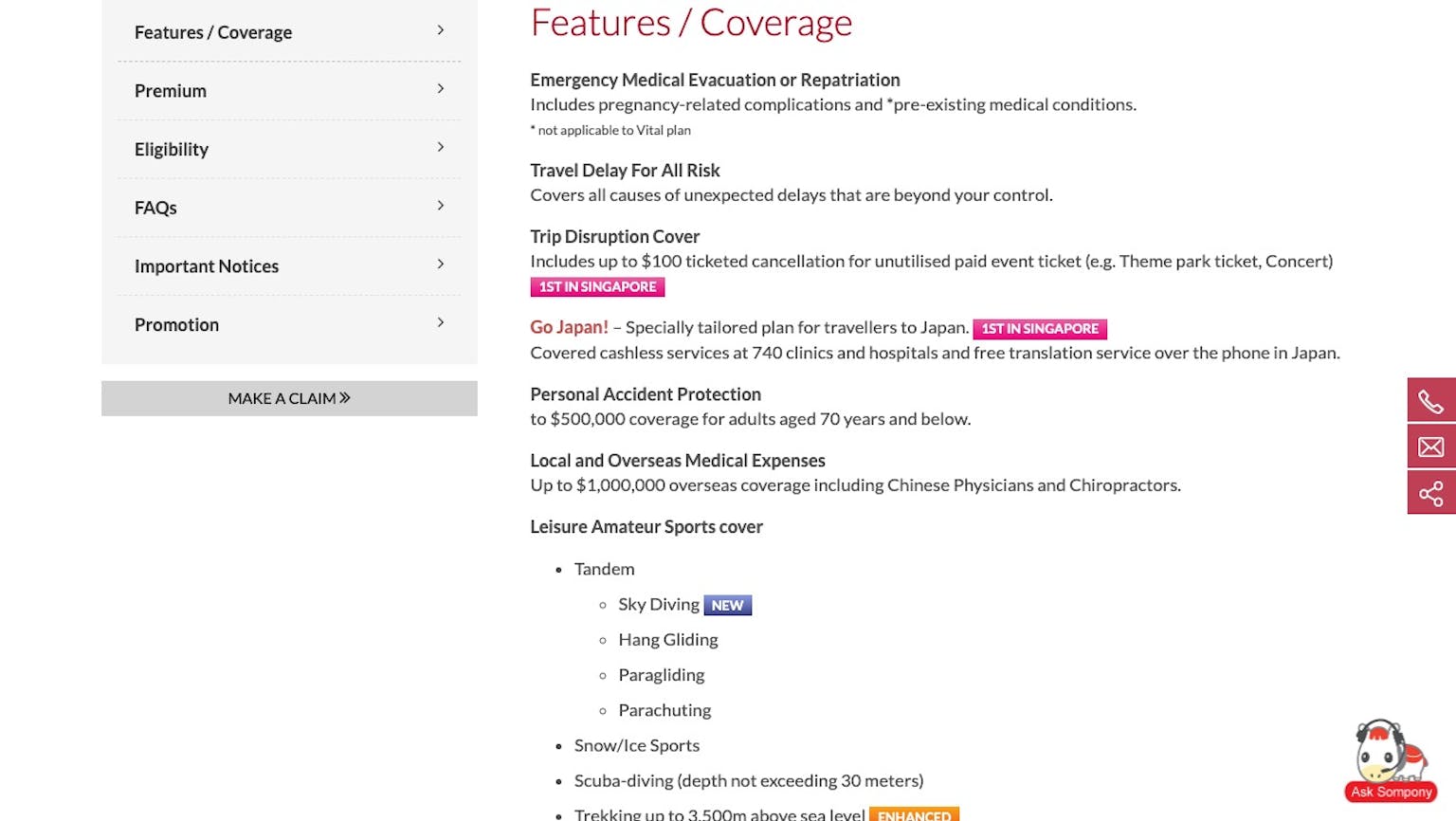

An emergency fund is money that has been set aside to cover any of life's unexpected bills. The need can arise from job loss, an accident, significant medical payments, or unforeseen home or auto repairs. Your emergency fund can get you out of a financial bind and help you avoid maxing out your credit cards or taking out a loan, which can exacerbate the problem.

Even if you have insurances, such as medical insurance, hospital cash insurance, or even disability insurance, there are usually waiting periods. At best, these insurances will reimburse you for all of your medical expenses. However, this will not help your family with the loss of income during your recovery time and help relieve some financial burden to pay for your family's daily expenses.

Why do You Need an Emergency Fund?

If you only have one source of income, it is critical that you have an emergency fund. If you experience any sudden job loss or illness that prevents you from working, an emergency fund can continue to provide for your family without going into debt.

If you are self-employed or a commission based employee, you likely do not have a regular income. Additionally, if you are a freelancer or an independent contractor, your work is probably by contract basis. For this type of employment, an emergency fund is crucial to cover expenses when business is slow.

If you want to get out of debt, you would want to avoid adding to your current debt. An emergency fund will help pay for any additional expenses that you may encounter. This will help you focus on paying down your debt.

Similar to if you are trying to get out of debt, if you are saving for a goal, such as a downpayment on a house, an emergency fund can help keep you on track. By preventing you from dipping into your savings, you can continue to reach your financial goals.

If you own your own home, you should have an emergency fund. Your home repairs and all maintenance costs are likely all out-of-pocket expenses. Furthermore, if you are still paying a mortgage, an emergency fund is crucial so that you don't miss any payments. Defaulting on a mortgage can mean that you may lose your home and your future investment.

If you live far away from your family, an emergency reserve will come in handy in case of a medical emergency or a funeral. If your family abruptly needs you, the price of last minute flights, bookings, and accommodations may be more than what you have allocated in your budget.

If you have medical issues, an emergency fund is essential to pay for anything that the insurance company does not cover or simply if you need to miss work during this time. This cash reserve can supplement medical bills and help cover daily expenses in case of lost wages.

Finally, an additional benefit of an emergency fund is for people who have just started learning to budget. When you first design your budget, you may forget to include all expenses, such as seasonal bills or annual payments like car insurance. Your emergency fund will help you adjust for these costs and allow you room to accommodate them in your budget for the future.

How Much do You Need in Your Emergency Fund?

Some financial experts recommend at least three months worth of salary in your emergency fund. The purpose of three months is in case you lose your job, you will have sufficient time to get back on your feet until you find a new source of income. Three months is the minimum goal for someone with their first job.

Ideally, an emergency fund should be able to sustain you for six months to a year. If you are self-employed with variable income, one year of expenses is preferred because it is difficult to predict your income on a month-to-month basis.

A few other factors that go into how large your emergency fund should be. For example, if you have additional debt obligations, such as several personal loans, you will need to account for these extra expenses. If you have a family, specifically dependent children, you will need more than three months of income in your cash reserves. Moreover, if your children are attending tertiary education, you may need to account for the extra tuition expenses.

Additionally, if you are in a double-income household, it is unlikely that both income earners will lose their jobs at the same time. As a result, you may not require as much in your emergency fund.

Finally, if you have several insurance policies that are already designed for emergencies, you may be able to afford a slimmer emergency fund. For example, if you have several different health insurance policies and your family is relatively healthy with no major illnesses, you likely do not need to save extra for medical bills.

How to Build Your Emergency Fund?

Building your emergency fund comes from your income. Let's say your monthly income is S$3,000 per month, and your bare expenses total S$2,500. The difference between your income and expenses is your excess cash flow. You could spend that money on a night out or a vacation, or you can save all of it and put it towards your emergency fund.

If you make S$3,000 per month, six months of your monthly income will put your ideal emergency fund at approximately S$18,000. As a result, by putting away S$500 per month into your emergency fund, it would take you three years to get it to the recommended amount.

To be truly critical, you only need to cover six months of expenses, or S$2,500 times six months. Your bare-bones emergency fund would be S$15,000. That would take you 30 months, or two and a half years to build.

Final Thoughts

It may take some time to build your emergency fund. After you have reached the ideal amount, you may consider accounting for inflation and the increased annual cost of living.

One thing to note is that you want access to your emergency fund when you need it. Even though savings accounts don't offer the best interest rates, it is the best option to keep your funds accessible and liquid. As a result, you should not tie up your money in stocks, bonds, or mutual funds. Plus, your savings account will generate some interest, which can help you account for inflation.

Remember, an emergency fund is precisely for that - emergencies. It should only be used for purchases that are absolutely necessary and will end up costing you more money if you don't pay. You should definitely consider using your emergency fund if it protects your credit score. For example, you unmistakably want to dip into your fund to pay outstanding loans and your credit card bill.

Your emergency fund is there to protect you and help you when you need it. Build it up, keep it funded and make sure it is accessible.

Please leave your knowledge and opinion!