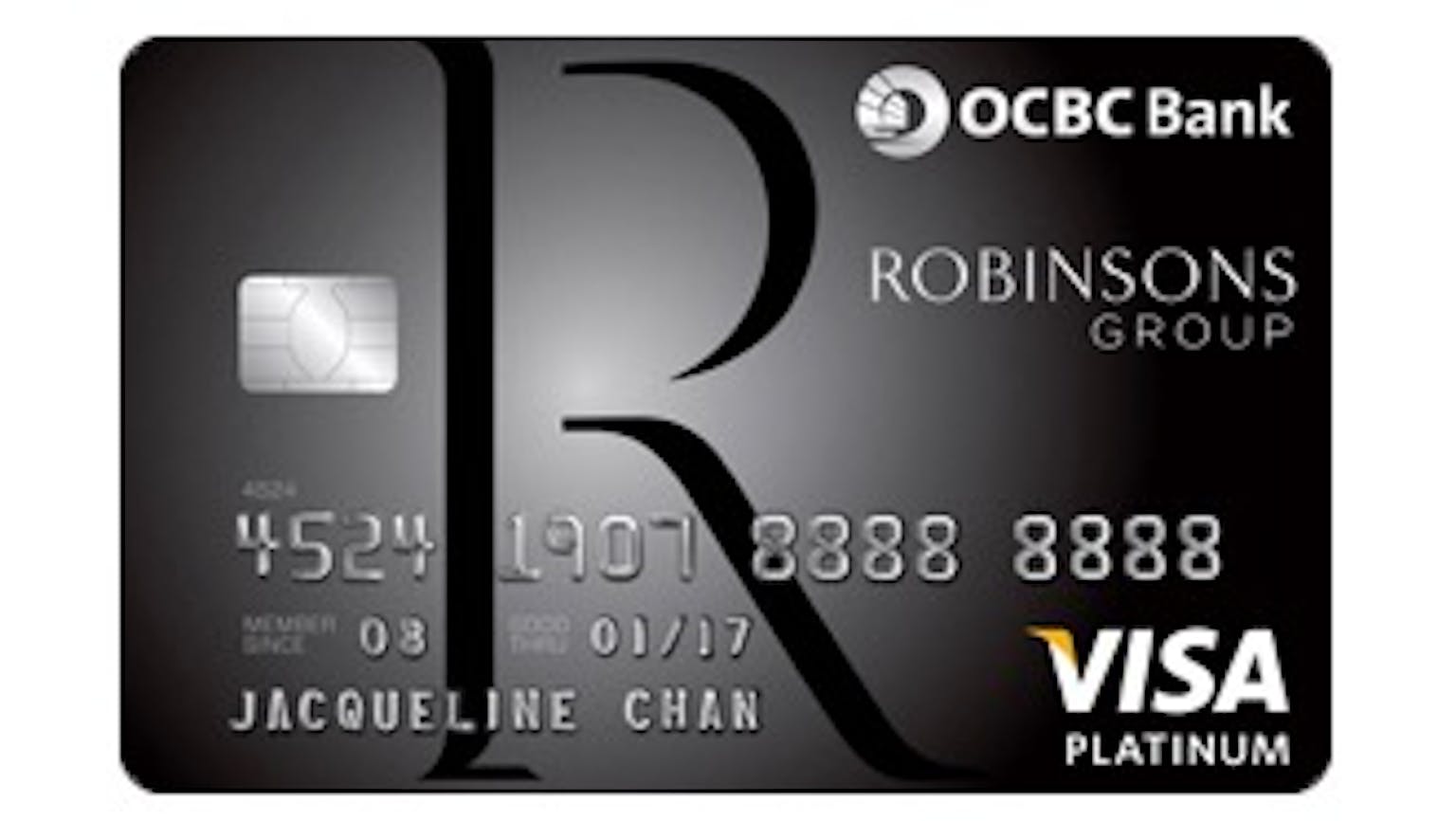

Anyone heard of the OCBC Robinsons Group Credit Card and is willing to share on the exclusive card member perks?

I spotted an advertisement claiming that the OCBC Robinson Group Credit Card offers unlimited 5% rebate on all your purchases in over 10 retail brands, what other exclusive card member perks are there?

Products mentioned in this forum:

No Name

Other card member perks include a 25% Robinsons bonus discount letter when you spend at least S$500 at Robinsons and/or Marks & Spencer during the qualifying periods which run from 1 Jan - 30 Jun or 1 Jul - 31 Dec. I can also point out the In-store privileges which allows you to enjoy card member prices, card member promotions, and exclusive invitations to private sales and members-only events. You also get the Interest-free instalment plans which affords you 6 or 12 months 0% interest payment plans at Robinsons. To enjoy a 6-month or 12-month instalment payment plan as the case may be at Robinsons and Marks & Spencer, your purchases need to be at least S$250 in a single receipt. Payment by instalment payment plan must be done at point of sale. Special perks with the card continue with a 5% off at Angela May Food Chapters, Gyoza-Ya, Sushi Goshin, The Scene, and & Made Burger Bistro at Robinsons the Heeren, all enabled with Visa payWave so you can pay easier with a wave of your card. Finally as a special perk you can enjoy an automatic waiver of your card annual fee with S$3,000 charged by each anniversary date of your OCBC Robinsons Group Visa Card.