Review & Rating Citibank InterestPlus Savings Account 2024

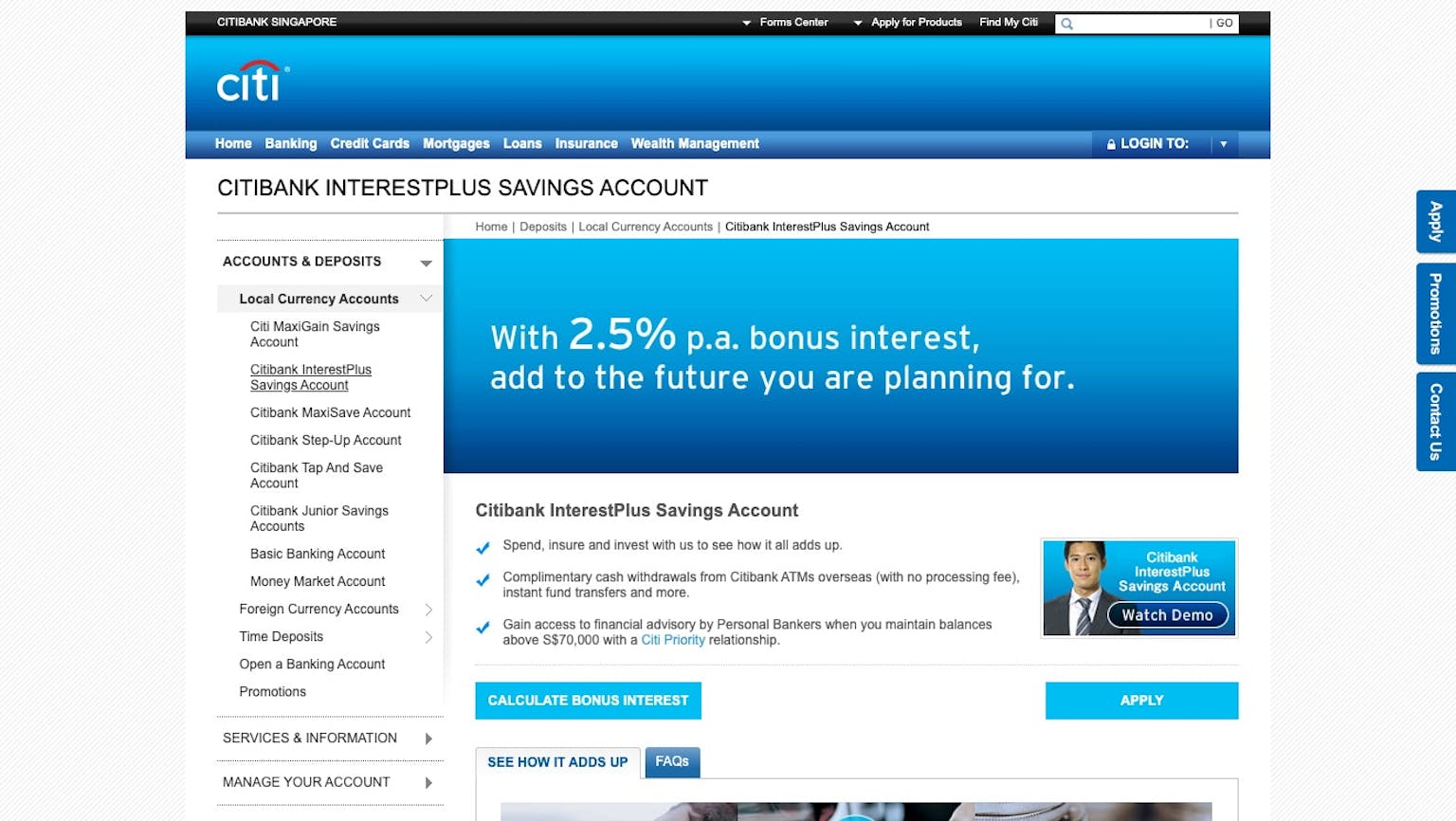

Citibank InterestPlus Savings Accounts enables individuals to spend, insure and invest in order to gain a bonus interest. Insuring gets you up to 1.2% p.a. bonus interest, spend and earn 0.1% p.a. bonus interest and invest to earn a 1.2% p.a. bonus interest which sums up to 2.5% p.a which is paid over a 12-month period for investments and insurance, every month if you spend S$25, on the first S$50,000 in your account or on top of your base interest.

Citibank Singapore

Citibank Singapore Limited is a branch bank of Citibank, N.A. headquartered in New York, U.S.A. and was present in Indonesia in 1918 through its previous company, The International Banking Corporation in Batavia and Surabaya. In 1989 Citibank started its credit card business in Indonesia. Citibank is one of the pioneers of the credit card business in Indonesia by always presenting quality products and making innovations for the satisfaction of its customers. This privilege then continued in the following years by introducing various other banking services online. Until now, Citibank Bank has issued a variety of banking service products, including credit card products that offer various facilities and ease of transactions for its users, as well as various attractive promo offers.