It's not that you don't have a job. You work hard, but you never seem to have enough money. Having a firm grasp on your finances is essential so you can afford the things that you want as well as investing some money in your future. Here are 11 tips for better spending habits and how to spend money wisely.

designer491/shutterstock.com

Tip 1: Create a Budget

Budgeting is the perfect balance between income and expenses. It ensures that you have enough money for the things you need by allocating a certain amount of funds for each category.

Based on your monthly income, divide up what you make into main categories: housing (rent, mortgage), utilities, food, transport, insurances, entertainment, education, personal care, savings, and debt. The goal is not to surpass the pre-determined dollar amount. A budget will help you avoid overspending and going into debt.

Tip 2: Plan Your Purchases

A quick way to fall off your budget is through impulse purchases. These are unplanned transactions that happen on the spur of the moment. For me, my weakness is a sale. As a result, I avoid window shopping or aimlessly surfing the web. Advertisements sneak up on you and tempt you into taking advantage of discount prices.

Don't purchase things when your judgment is impaired. Impaired judgment can be as extreme as if you are under the influence of alcohol or medication. On the other hand, even been sleep deprived or hungry can result in poor decision making. For example, don't go grocery shopping when you are hungry. You almost always tend to buy more and end up buying because of your stomach, instead of your wallet.

Tip 3: Shop by Yourself

If you need to go to the store because you need something, avoid shopping with children or friends. It's best to shop alone. This advice may sound depressing and antisocial. However, when you shop with children, they don't have a complete understanding of a budget, what they want, and what they need. They may pressure you to make additional purchases because they see something they like. My personal experience is that my son is always suddenly starving when we are in a store and needs to eat right then and there, as his eyes scan the aisles. After many discussions, I somehow end up buying him a snack even though we will be home in ten minutes. Shop alone!

When you shop with friends, the errand suddenly turns into a fun hobby. Your friends may genuinely enjoy shopping, may be a deal finder, or his or her presence may just influence you to spend extra money. By shopping alone, you can quietly reflect on your budget and what your goals are. Plus, without someone else's company, you are more likely to buy what you need and then leave the store.

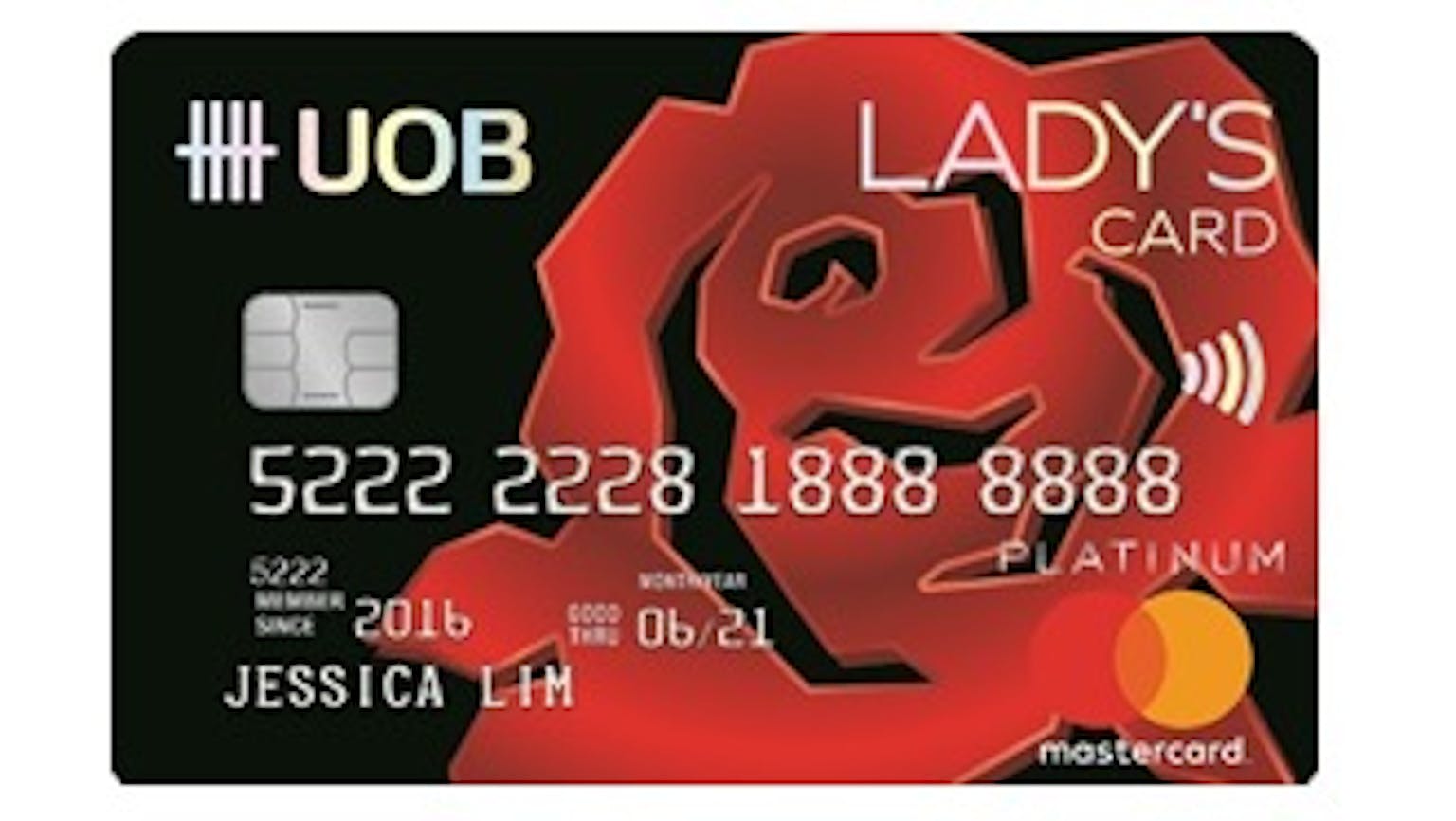

Tip 4: Use Cash

A credit card is a tricky thing. It allows you to spend money now and delay payment. Furthermore, because it is a card instead of cash, no money visible changes hands. It is almost as if the transaction never happened and you got that skirt for free! However, reality will set in later that month when you receive your credit card bill.

A way to avoid the credit card hole is to use cash. Only bring the cash that you need and can afford to spend, according to your budget. Once you're out of money, you physically will not be able to make the purchase. This is why the "Envelope System" works for many people.

The Envelope System is a budgeting technique that helps consumers visualize and maintain a budget. You work with cash exclusively. Each envelope is for a different category of your budget. However much money you have allocated for that category is the amount of cash that you put into that envelope at the beginning of the month or when you receive your payslip. Every time you withdraw money from an envelope, you visually see the amount depleting. As a result, once the cash runs out, you can't spend any more until the next month or until the next payslip.

Tip 5: Buy Generic or Store Brand Groceries

When you shop at the supermarket, consider the generic label instead of the name-brand. Many times the price markup is due to the brand name's marketing costs. The ingredients are likely the same. Of course, read all the labels and test it out. You honestly may not even taste the difference.

Tip 6: Make a Grocery List Based on Meals

On the topic of cooking, it is essential to have a grocery list based on what you will actually cook. Some people go to the grocery store and buy things that they feel that they need. They like to have certain foods in the house. However, most families end up throwing away a lot of food because it goes bad or expires before it can be eaten.

Before going shopping, write down a weekly schedule with meals you will cook for each day. This means going through recipes and taking down the ingredients. Of course, this process is time-consuming. It is much easier to pop over to the market and buy what you think you need. However, with a well-prepared grocery list, you may be surprised how much less you end up spending on your next trip to the store.

As an extra tip, keep the recipes that you cook often written down and on hand. When you know you want to cook that meal for that week, you can quickly refer to the recipe's ingredients list and transfer the information from the recipe to your grocery list.

Tip 7: Don't Eat Out

Now that you have your weekly schedule with meals every day, you can avoid eating out. Of course, how much you save cooking instead of dining out depends on your food preferences. However, by bringing lunch from home instead of buying it, you can save some money.

Furthermore, consider a refillable water bottle instead of purchasing bottled water. If you are an avid coffee drinker, skip the café and brew it yourself by preparing it at home.

Tip 8: Wait for a Sale

Faces Portrait/shutterstock.com

You may have enough money in your clothing budget to get that jacket that you have been eyeing. However, considering waiting for it to go on sale. This is not permission to go on a shopping spree during the sale.

Stores need to make room for new inventory. If you are patient, that jacket will likely be marked down at the end of the season. You will be able to get that jacket for less and still have enough money for something else in the future.

Alternatively, you may even consider shopping at consignment or thrift stores. Though, be careful with where you go. Find thrift stores that have a critical eye and high standards for the clothing pieces that they accept. You may be surprised to see what brand-name items you find.

Tip 9: Avoid Marketing Traps

Stores that advertise a limited time sale may resort to marketing traps to get customers. First, know your prices. If you know the going rate for a pair of shoes, don't be fooled when stores raise the price only to offer a discount. It may not be a real sale, and you end up paying regular price.

Second, do the math. One sales marketing strategy is to offer "buy 3 get 1 free" deals. Most consumers get stuck on the word "free." If you get something for free, it must be a good deal! However, convert that bargain into what percentage of the price you are truly saving. For example, if you must purchase 3 tubes of toothpaste to get the 4th one free, you are paying 75% of the regular price. In essence, you are saving 25%, but now you have 4 of them. Now ask yourself, would you buy 4 tubes of toothpaste at a 25% discount? Suddenly, you may not need it anymore.

Third, don't buy something just because the price is reduced. Even though you can save 20% on it now, you will save 100% if you don't buy it at all.

Tip 10: Buy Quality

Cheap isn't always better. If you buy an inexpensive pair of shoes that wear out within a few months, you will eventually need to buy another pair of shoes. Poor quality items put you in a purchasing cycle. However, if you purchase a quality pair of shoes that may cost more but lasts two years, you will end up saving money in the long run.

Tip 11: Do Research

Before making purchases, compare the prices from different stores. This takes a bit more legwork and research, but the savings add up.

You may also want to read customer reviews about the product before purchasing. By learning from other people's experiences, you will know if you are getting a product that comes with a lot of problems, or if many people have had success with it. There is wisdom in the masses.

Final Thoughts

Spending money wisely requires careful planning. Impulsive purchases during a sale and grocery shopping when hungry are surefire ways to spend more than you can afford. Instead, have a budget and stick to it. Be patient and wait for quality items to go on sale.

You will be able to afford the things you need and want by making careful decisions. Moreover, you can even cheat a little and reward yourself every once in a while. Go out for that latte and enjoy it! You earned it by brewing your own coffee every single day. Remember, good spending habits don't happen overnight. But each wise decision you make will help you stay out of debt and help you reach your financial goals sooner.

Please leave your knowledge and opinion!