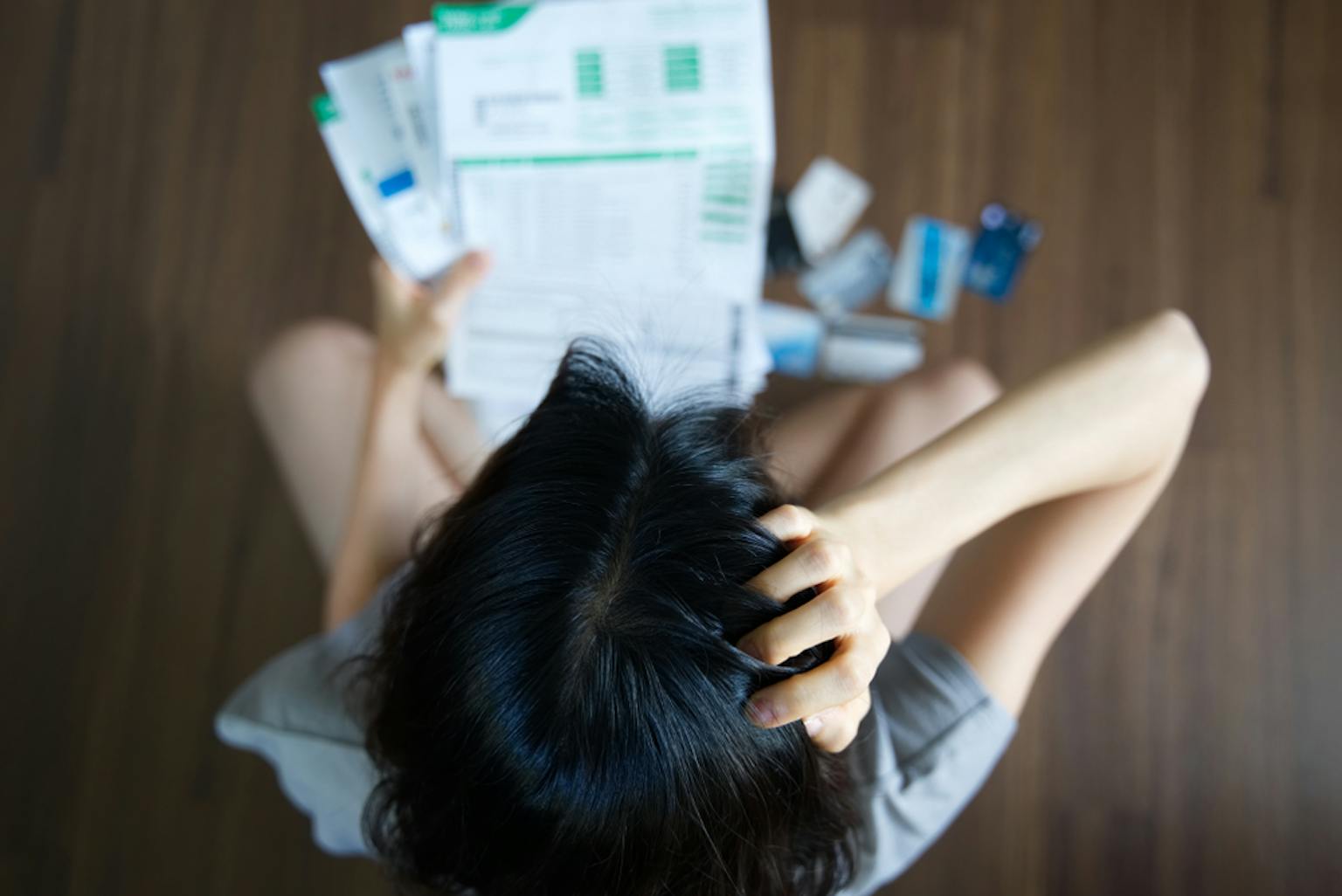

Personal loans are usually easier to obtain than mortgage loans. They are customarily unsecured because you don’t put down any assets or collateral against the loan amount. Instead, the bank is trusting you to pay back your loan, exclusively based on your creditworthiness. As a result, the loan is charged a higher interest rate. Therefore, if you miss a payment, there are numerous serious consequences that follow. Here’s what you should expect.

Andrii Yalanskyi/shutterstock.com

1. A Lower Credit Score

If you miss your monthly installment, a lender may consider your loan to be in default after 30 days from your missed payment. Some banks allow 60 to 90 days before reporting. Fortunately, a lender won’t report a late or missed repayment to a credit bureau until your loan is actually in default.

Therefore, if you miss your payment, do your best to immediately make it up so it won’t damage your credit score. More than two late or missed payments will bring your score down. In Singapore, more than three missed payments mean your loan account is automatically considered in default. Credit grades of BB and CC show that you may have several delinquencies in your payments. On the other hand, D grades and below mean you have defaulted in the past.

2. Difficulty Qualifying for Future Loans

Your repayment history is a very influential factor in your credit history. A default on your loan will stay on your credit report for over seven years. Therefore, besides merely a lower rating, your credit history will make it difficult to qualify for future lines of credit or loans. For seven years, your potential lenders will see all delinquencies in payment and may feel that you are not a trustworthy borrower because you have struggled to repay your debts on time.

3. Penalty For Missing a Loan Payment

Most lenders will charge a penalty for a late payment. Some banks charge a percentage of the outstanding balance, while others charge a flat fee. For example, the HSBC Personal Loan charges a flat penalty fee of S$75, whereas the Standard Chartered Cash One Personal Loan is more complicated.

If your payment is not received by the due date twice within 6 consecutive months, 4% p.a. will be added to your original interest rate and applied to the outstanding balance. The loan tenure will then be adjusted so that your monthly payments stay the same. And finally, there is a late payment penalty of S$80, as well as daily finance charges will be added. Check your loan’s terms and conditions for the exact penalty.

4. Loan Tenure Extension

Similar to the penalty fee that Standard Chartered Cash One Personal Loan charges, many lenders will extend your loan tenure by as many installments that you skip. Therefore, on top of late payment charges, a longer tenure would naturally increase the amount of interest you need to pay back, thereby increasing the total amount you pay.

5. Lose Your Collateral

If you took out a secured loan, you offered assets or collateral to lock in that lower interest rate. Unfortunately, the collateral is no longer yours if you default. Your lender will send someone to collect it.

6. Legal Action

If you default on your loan, the bank will pursue a legal settlement. Since most personal loans are unsecured, the bank doesn’t have any collateral that they can use to get their money back. As a result, any legal action they pursue may lead to your bank accounts being seized. It is possible that the bank may agree to settle at a negotiated amount. However, if you do not have the money, the lender may turn to one or more of your assets to get their money back.

How to Avoid Missing Your Loan Payment

Tip 1: Always budget for your monthly installment. This requires that you first, actually need the loan, and second, can comfortably afford the payment.

Tip 2: If you link your loan account and your savings account, you can set up auto-debit transactions. Your monthly payment will automatically be deducted from your account. It is important that you always make sure to have enough in your account for this.

Tip 3: Keep a reminder on your calendar to pay your monthly installment. This is similar to paying a credit card every month. Allow yourself 5 days to get your affairs in order and actually make the payment.

Tip 4: Do not try to take out another loan to pay this loan. Your credit score has already taken a plunge and this method is extremely dangerous to get into a cycle of debt.

Tip 5: If you have difficulty making your payments, it may be possible to get a pay advance from your employee. Check your employer’s policy if they have this option.

Tip 6: Contact your lender and be honest with your situation. They may be willing to work with you by adjusting your loan term to lower your monthly payments. For example, HSBC offers banking services to help you through financial difficulty, provide temporary relief from repayments, and offer an in house Debt Relief Program (DRP).

What to Do If You Are Already in Default

Tip 1: Try to pay your late payment and fees. By doing this, you are trying to avoid your loan from going into collections. This is when a debt collector will target your assets and bank accounts to make sure you pay. Always try to prevent the collections process.

Tip 2: If you are already in collections, try to settle the loan with the bank. If they are willing to settle at a negotiated amount, you will pay less than what you actually owe and they will close the account. You can try to settle it yourself or hire a debt settlement company to do it for you.

Tip 3: Consider talking to a credit counselor. They can give you strategies and a plan of action to help pay off your loan, stay out of debt, recover your credit score, and get your back on financial track.

Final Thoughts

Missing one monthly payment puts you on a slippery slope to defaulting on your personal loan. This has serious long term consequences. Never sit on your debt. Time is critical to prevent losing all your assets. Take action as soon as possible to pay off your debt, before it snowballs out of control.

Please leave your knowledge and opinion!