$199 cashback for loans of $1,000 and above if you apply through MoneySmart

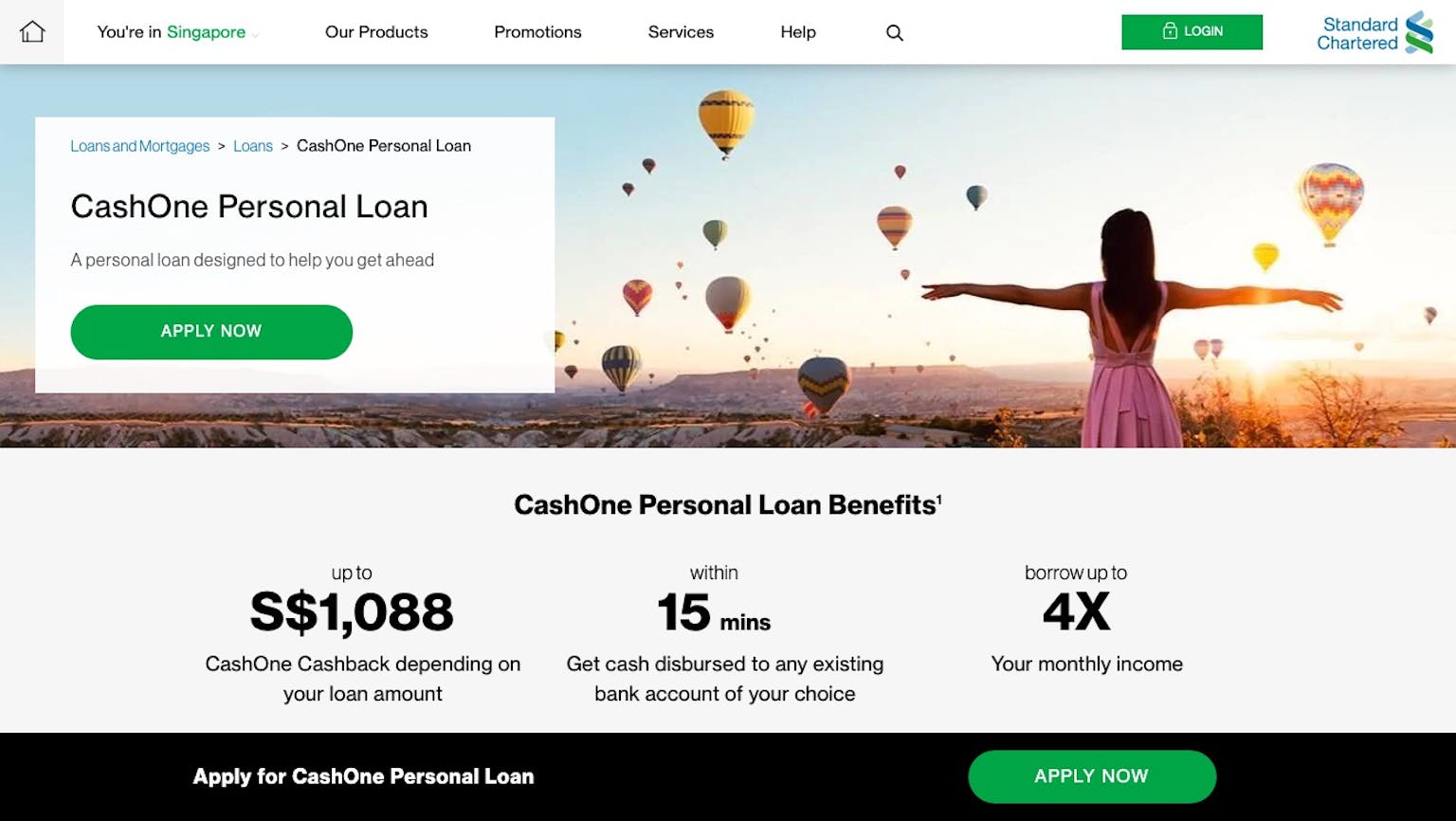

Although standard Chartered personal loan’s published rates aren’t that awesome, you still get a much lower interest rate as well as $199 cashback for loans of $1,000 and above if you apply through MoneySmart for your loan amounts of $1,000 to $250,000. Like most of its competitors, Standard Chartered Bank promises next-day cash. You can apply via MyInfo via MoneySmart to get instant approval and loan disbursement

Please leave your knowledge and opinion!