HSBC Revolution Credit Card

HSBC Revolution Credit Card gives an offer you cannot resist by giving you a credit card with no minimum spend required but allows you to gain five times the reward points. Not only that it gives more reward points when it comes to dining and entertainment, but also helps you to do things without leaving home. It permits the user to purchase things online.The best thing about having these reward points is the fact that you can redeem any of the rewards using those points. More reward points will give you more chance to redeem a reward. This includes HSBC’s jewellery vouchers,

3.0 | |

2.0 | |

3.0 |

HSBC Bank Singapore

HSBC, a bank that came into existence over a simple idea- a local bank catering to international needs, is now one of the largest banking and financial services organizations in the world. HSBC is one the earliest banks to be established in Singapore with its history dating back to 1877 when its founding members' The Hongkong and Shanghai Banking Corporation Limited, inaugurated its first branch on the island. For more than 150 years HSBC has been connecting customers to opportunities, enabling businesses to thrive and helping people to realize their ambitions by offering a comprehensive range of banking and financial services such as Retail Banking and Wealth Management, Commercial Banking, Global Banking and Markets, and Global Private Banking. HSBC today is an integral part of the financial sector of Singapore by serving more than 40 million customers, covering over 65 countries and territories in Europe, Asia, North America, and Latin America. Shares in HSBC Holding plc are held by around 200,000 shareholders in 125 countries or territories and it is listed on the London, Hong Kong, New York, Paris, and Bermuda Stock exchanges.

Reviews of HSBC Revolution Credit Card

Poor and upleasant hotline

I am a fresh graduate and just started my first job, I signed up for this card due to the onetime $150 cash back reward for $800 spend within the first two months. However for its main monthly rewards, it is nothing to be pleasant about and the hotline is very bad, I even had to hold more than 20 minutes during non-peak hour.

HSBC Revolution Credit Card / HSBC Bank Singapore

Essentially I use this card only when there is dining discounts

Funny enough, I signed up for this card a couple of years back in order to get a free Samsonite luggage after spending $5,000. I still use this card howbeit not as frequently as I used to previously. Essentially I use this card only when there's dining discounts or when I use it along with the free HSBC Entertainer App. The HSBC Entertainer App provides 1-for-1 deals.

HSBC Revolution Credit Card / HSBC Bank Singapore

Online expenditure and dining rebates are decent with this card

While online expenditure and dining rebates are decent with this card, the card has been ousted by other credit cards. Aside from maybe the discounted Golden Village movie tickets they offer which in my honest opinion is far better than any other bank's credit cards or rebates. This card does not really have much to write home about.

HSBC Revolution Credit Card / HSBC Bank Singapore

I don’t see a point using this card frequently unless there’s a specific HSBC promotion

The cash rebates for supermarket and dining have been outshined by other family oriented card. Presently, I don’t see a point to use this card frequently unless there’s a specific HSBC promotion with the retailer or airline. I use to hold this card but nothing fantastic and signed up due to bank promotions. Regretted it and hope my review will make others to think twice about the purschase.

HSBC Revolution Credit Card / HSBC Bank Singapore

Forums mentioning HSBC Revolution Credit Card

How much credit limit will I be granted on my HSBC Revolution credit card?

HSBC Revolution Credit Card

Can I convert my Rewards points with the HSBC Revolution Credit Card into air miles?

HSBC Revolution Credit Card

Other products by HSBC Bank Singapore

HSBC Bank Singapore

HSBC Personal Loan

HSBC offers a personal loan of up to 4X or 8X of your monthly income with a fixed repayment amount or you can also have it on an installment basis. A wide variety of application channels and provides a low processing fee of *1% of the approved loan.

HSBC Bank Singapore

HSBC VISA Platinum Credit Card

HSBC Visa Platinum Credit Card paved way for a flexible program that allows cardholders to save from dining, groceries and fuel purchases while at the same time enables cardholders to earn cashback. As their slogan goes: "Make family time more fulfilling", it truly empower cardholders to spend more quality time with their loved ones, apart from the 5% cashback for Dining, Groceries and Fuel purchases,it also offers a wide variety of benefits for Leisure, Dining,Travel, Enrichment, Shopping and more offers that the cardholder and family can enjoy.

HSBC Bank Singapore

HSBC Advance Credit Card

HSBC Advance Credit Card provides a delightful deal for cashback lovers. You can get S$1500 and more cashback annually. The program entails 3.5% cashback for purchases local and overseas for all merchant categories. The great thing about the cashback is that it relies on the total amount that you spend per period rather than select-merchant-categories only. Additional feauters of the card includes: Apple Pay, Visa payWave, SimplyGo, HSBC Virtual Card and Travel Insurance Coverage.

HSBC Bank Singapore

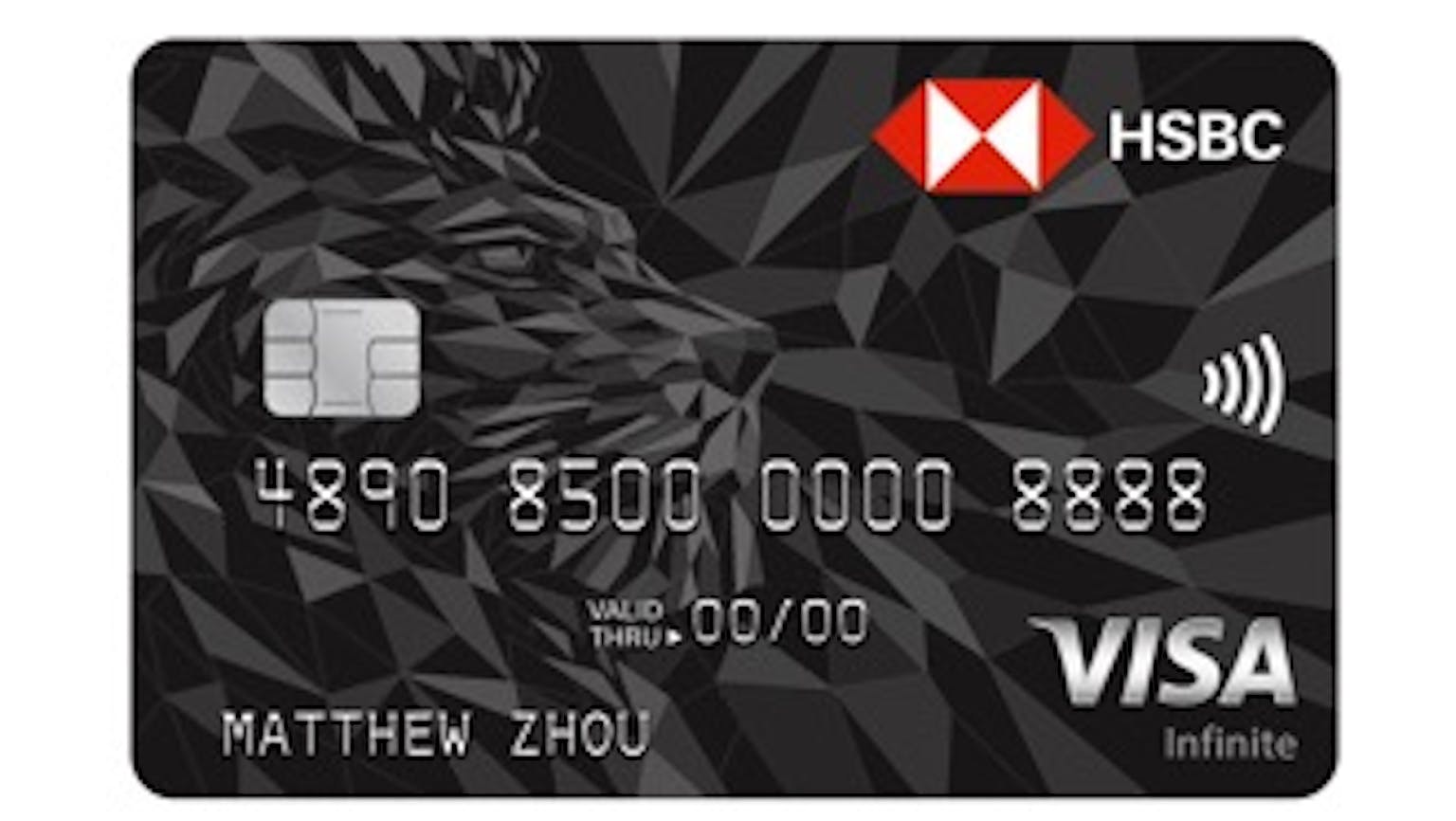

HSBC VISA Infinite Credit Card

HSBC Visa Infinite Credit Card will make you experience the extraordinary by giving the most exclusive travel and dining privileges you need. These are based on your own preference that will suit your style. Do not be afraid to travel because there is automatic travel insurance not only for you but also for your whole family. Be rewarded with 15,000 HSBC Reward points for successful card referrals whether a family member or other. Also, for every S$1 spent, 2.25 miles will be gained, which is the best way to gain miles.

HSBC Bank Singapore

HSBC Premier MasterCard

HSBC Premier Mastercard offers up to 5% cash rebate on grocery, dining, petrol, and transport on everyday spend, both at home and abroad. It helps gaining reward point by giving one reward point for every dollar spent. There is also no annual fee. And who wouldn’t want to travel? Gain travel rewards from planning the trip. Get up to S$60 cashback when applying for supplementary cardholder that can be used by your loved ones.

HSBC Bank Singapore

HSBC Debit Card

HSBC offers a debit card which introduces you to a world full of convenience. It is powered by Visa payWave, NETS contactless modes of payment, Apple Pay and it can also be used as a public transit card that you can also use to shop, travel and dine with ease.

HSBC Bank Singapore

HSBC Everyday Global Debit Card

The Everyday Global Debit Card gives you access to an account that enables multi-currency card which you can use wherever you are. You get a hefty amount of bonus interest on your SGD savings with Everyday Global Account.

HSBC Bank Singapore

HSBC Debt Consolidation Loan

HSBC's Debt Consolidation Plan aims to provide you with a refinancing program in order to consolidate all of your outstanding and existing unsecured credit facilties and includes a revolving credit facility to give you convenient mode for managing your daily financial needs.

I think it is usually the other way around, where you have to state your preferred credit limit first which will then be subject to the Bank's review and approval. The amount which the Bank will grant you may be lower than the amount you have requested. You should note that for individuals with annual income between S$30,000 and S$120,000, your aggregate credit limit with HSBC for all unsecured facilities will be capped at four times your monthly income as indicated in the income documents that you submit. Please note that because your unsecured facilities include all of your unsecured credit card, personal line of credit and personal loan, the credit limits for your unsecured credit cards, personal lines of credit and personal loans will be aggregated for the purpose of computing your maximum aggregate credit limit.