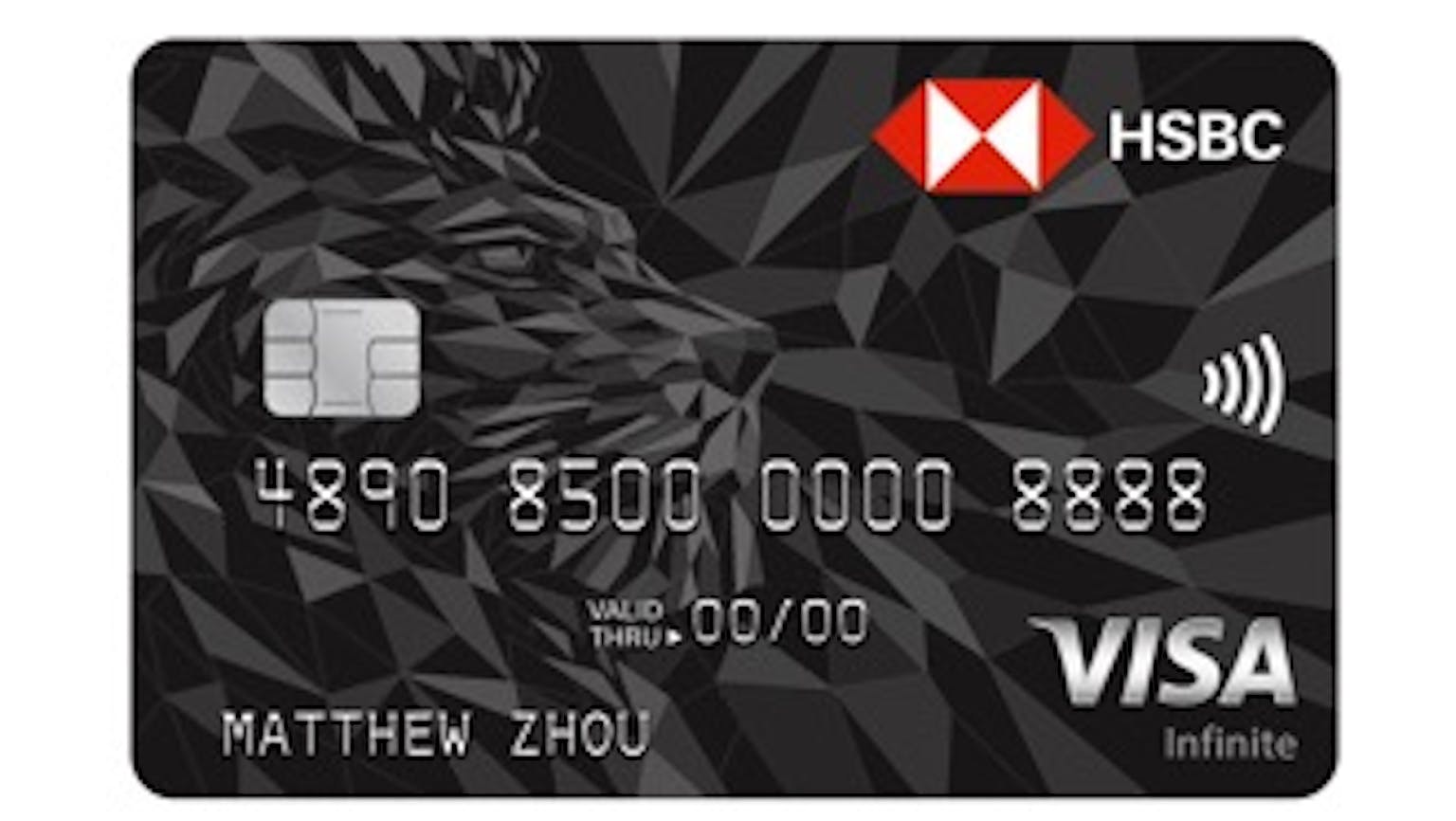

HSBC Advance Credit Card

HSBC Advance Credit Card provides a delightful deal for cashback lovers. You can get S$1500 and more cashback annually. The program entails 3.5% cashback for purchases local and overseas for all merchant categories. The great thing about the cashback is that it relies on the total amount that you spend per period rather than select-merchant-categories only. Additional feauters of the card includes: Apple Pay, Visa payWave, SimplyGo, HSBC Virtual Card and Travel Insurance Coverage.

4.0 | |

2.0 |

HSBC Bank Singapore

HSBC, a bank that came into existence over a simple idea- a local bank catering to international needs, is now one of the largest banking and financial services organizations in the world. HSBC is one the earliest banks to be established in Singapore with its history dating back to 1877 when its founding members' The Hongkong and Shanghai Banking Corporation Limited, inaugurated its first branch on the island. For more than 150 years HSBC has been connecting customers to opportunities, enabling businesses to thrive and helping people to realize their ambitions by offering a comprehensive range of banking and financial services such as Retail Banking and Wealth Management, Commercial Banking, Global Banking and Markets, and Global Private Banking. HSBC today is an integral part of the financial sector of Singapore by serving more than 40 million customers, covering over 65 countries and territories in Europe, Asia, North America, and Latin America. Shares in HSBC Holding plc are held by around 200,000 shareholders in 125 countries or territories and it is listed on the London, Hong Kong, New York, Paris, and Bermuda Stock exchanges.

Reviews of HSBC Advance Credit Card

Too bad it is not an unlimited cashback card

Unfortunately, the HSBC advance card is not an unlimited cashback card as they have a cap on the cashback per month, even for advance banking clients. Furthermore, if you are not an advance banking client, you would not get subsequent card fee waiver if you do not get to spend at least $12,000 in a year.

HSBC Advance Credit Card / HSBC Bank Singapore

I don't like their internet banking layout and i find it doesn't seem very friendly to me

I pretty much use this card only when I know that I will spend more than $2000 in a given month and these transaction does not earn more than 2.5% cash back in other card categories. I don't really fancy their internet banking layout as it doesn't seems very friendly to me. Therefore I always rely on the paper statement to make payment.

HSBC Advance Credit Card / HSBC Bank Singapore

It’s my card of choice especially with the 1.5% cashback across all categories

My experience with their customer service is not clement furthermore not getting back to me on the queries I had highlighted but overall, it’s my card of choice especially with the 1.5% cashback across all categories, which allows me to buy discounted Golden Village Tickets and have access to HSBC 1 to 1 Dining deals. Until another credit card offers a greater than 1.5% cashback across all categories without a time frame, this is the card I am sticking to now.

HSBC Advance Credit Card / HSBC Bank Singapore

This is a good cashback credit card for those who have high spending amount every month

I am a low spender hence it may not be easy for me to clock $500 monthly expenditure on credit cards but this is actually a good cashback card at 2.5%, especially where you spend above $2,000. Otherwise, other cards will be a better alternative to this for smaller purchases. This is a good cashback credit card for those who have high spending amount every month. My father uses it to pay for insurance premium as it gives cashback for insurance premium too.

HSBC Advance Credit Card / HSBC Bank Singapore

When I signed up for this card I got $100 vouchers for it

I only just recently purchased this card. There are a lot of rebates features that come with the card, some I am still getting familiar with which I can use to offset my next purchases. When I signed up for this card I got $100 vouchers for it. However there are yet still a lot of promotions going on for this card.

HSBC Advance Credit Card / HSBC Bank Singapore

Forums mentioning HSBC Advance Credit Card

Would I earn a cashback on my HSBC Advance credit card if I charge my University fees to it?

HSBC Advance Credit Card

Who has knowledge about the HSBC Advance Credit Card balance transfer and the HSBC spend instalment?

HSBC Advance Credit Card

Other products by HSBC Bank Singapore

HSBC Bank Singapore

HSBC Personal Loan

HSBC offers a personal loan of up to 4X or 8X of your monthly income with a fixed repayment amount or you can also have it on an installment basis. A wide variety of application channels and provides a low processing fee of *1% of the approved loan.

HSBC Bank Singapore

HSBC VISA Platinum Credit Card

HSBC Visa Platinum Credit Card paved way for a flexible program that allows cardholders to save from dining, groceries and fuel purchases while at the same time enables cardholders to earn cashback. As their slogan goes: "Make family time more fulfilling", it truly empower cardholders to spend more quality time with their loved ones, apart from the 5% cashback for Dining, Groceries and Fuel purchases,it also offers a wide variety of benefits for Leisure, Dining,Travel, Enrichment, Shopping and more offers that the cardholder and family can enjoy.

HSBC Bank Singapore

HSBC Revolution Credit Card

HSBC Revolution Credit Card gives an offer you cannot resist by giving you a credit card with no minimum spend required but allows you to gain five times the reward points. Not only that it gives more reward points when it comes to dining and entertainment, but also helps you to do things without leaving home. It permits the user to purchase things online.The best thing about having these reward points is the fact that you can redeem any of the rewards using those points. More reward points will give you more chance to redeem a reward. This includes HSBC’s jewellery vouchers,

HSBC Bank Singapore

HSBC VISA Infinite Credit Card

HSBC Visa Infinite Credit Card will make you experience the extraordinary by giving the most exclusive travel and dining privileges you need. These are based on your own preference that will suit your style. Do not be afraid to travel because there is automatic travel insurance not only for you but also for your whole family. Be rewarded with 15,000 HSBC Reward points for successful card referrals whether a family member or other. Also, for every S$1 spent, 2.25 miles will be gained, which is the best way to gain miles.

HSBC Bank Singapore

HSBC Premier MasterCard

HSBC Premier Mastercard offers up to 5% cash rebate on grocery, dining, petrol, and transport on everyday spend, both at home and abroad. It helps gaining reward point by giving one reward point for every dollar spent. There is also no annual fee. And who wouldn’t want to travel? Gain travel rewards from planning the trip. Get up to S$60 cashback when applying for supplementary cardholder that can be used by your loved ones.

HSBC Bank Singapore

HSBC Debit Card

HSBC offers a debit card which introduces you to a world full of convenience. It is powered by Visa payWave, NETS contactless modes of payment, Apple Pay and it can also be used as a public transit card that you can also use to shop, travel and dine with ease.

HSBC Bank Singapore

HSBC Everyday Global Debit Card

The Everyday Global Debit Card gives you access to an account that enables multi-currency card which you can use wherever you are. You get a hefty amount of bonus interest on your SGD savings with Everyday Global Account.

HSBC Bank Singapore

HSBC Debt Consolidation Loan

HSBC's Debt Consolidation Plan aims to provide you with a refinancing program in order to consolidate all of your outstanding and existing unsecured credit facilties and includes a revolving credit facility to give you convenient mode for managing your daily financial needs.

Yes I believe you can as it is an online transaction or a recurring bill. Cash backs are awarded to eligible purchase of which fees and charges including finance charges, late charges, interest charges, annual fees are considered eligible. Do note that in the case of HSBC's Balance Conversion Plan, only the total purchase amount will qualify as an Eligible Purchase in the month of purchase. The subsequent instalment amounts under the Balance Conversion Plan will not qualify as Eligible Purchases.