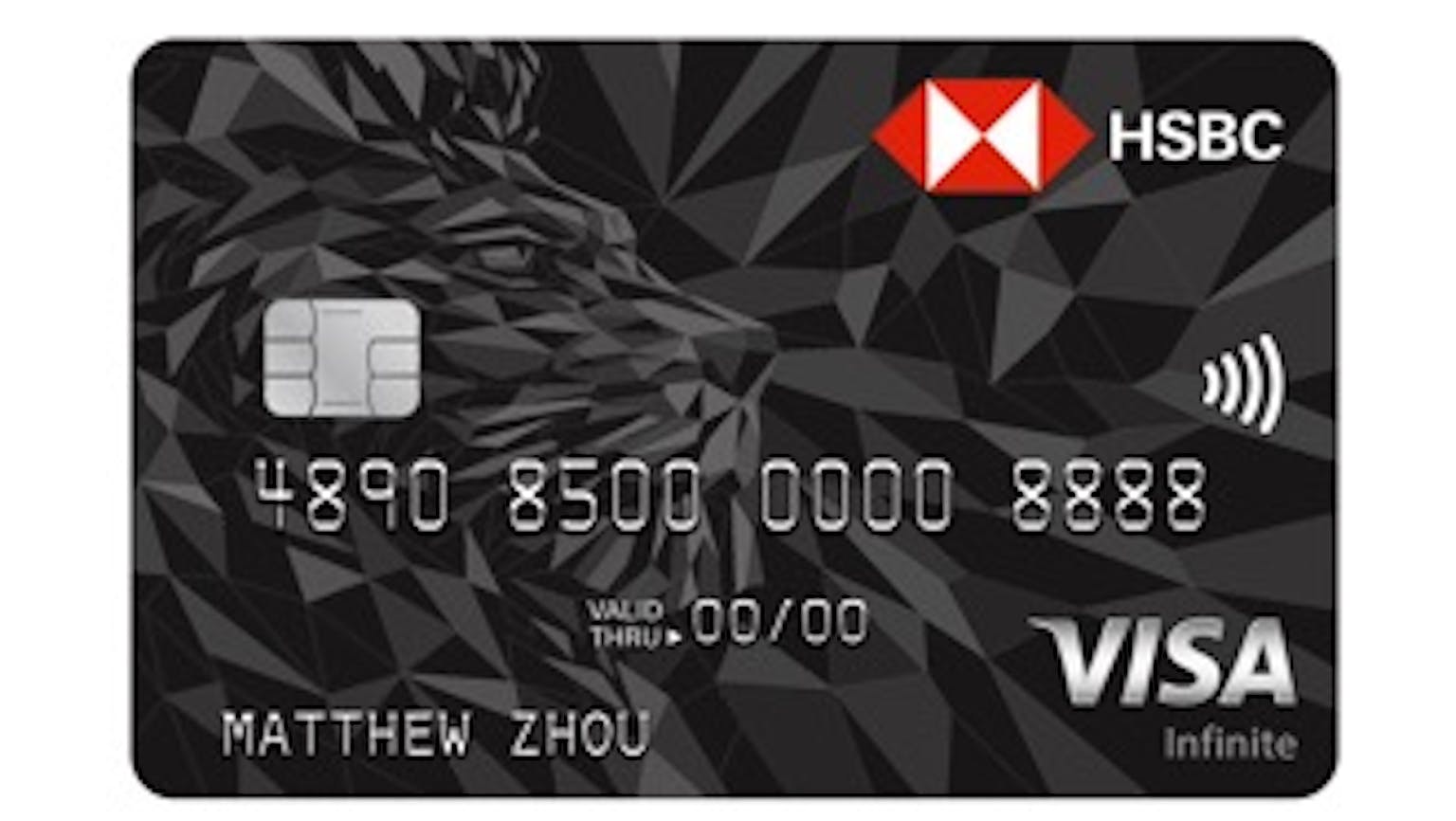

HSBC VISA Infinite Credit Card

HSBC Visa Infinite Credit Card will make you experience the extraordinary by giving the most exclusive travel and dining privileges you need. These are based on your own preference that will suit your style. Do not be afraid to travel because there is automatic travel insurance not only for you but also for your whole family. Be rewarded with 15,000 HSBC Reward points for successful card referrals whether a family member or other. Also, for every S$1 spent, 2.25 miles will be gained, which is the best way to gain miles.

4.0 | |

3.0 | |

5.0 |

HSBC Bank Singapore

HSBC, a bank that came into existence over a simple idea- a local bank catering to international needs, is now one of the largest banking and financial services organizations in the world. HSBC is one the earliest banks to be established in Singapore with its history dating back to 1877 when its founding members' The Hongkong and Shanghai Banking Corporation Limited, inaugurated its first branch on the island. For more than 150 years HSBC has been connecting customers to opportunities, enabling businesses to thrive and helping people to realize their ambitions by offering a comprehensive range of banking and financial services such as Retail Banking and Wealth Management, Commercial Banking, Global Banking and Markets, and Global Private Banking. HSBC today is an integral part of the financial sector of Singapore by serving more than 40 million customers, covering over 65 countries and territories in Europe, Asia, North America, and Latin America. Shares in HSBC Holding plc are held by around 200,000 shareholders in 125 countries or territories and it is listed on the London, Hong Kong, New York, Paris, and Bermuda Stock exchanges.

Reviews of HSBC VISA Infinite Credit Card

Looking to maximize on the number of priority pass visits and other privileges

If you are like me an HSBC Premier client and also a frequent traveller that can maximize the number of priority pass visits, limo and meet-and-assist services as well as your supplementary cardholders too, then this is the card for you. The reduced general mile earn rate is worth the trade-off for the unlimited priority pass memberships, as well as the high number of limo and meet-and-assist services that you can use.

HSBC VISA Infinite Credit Card / HSBC Bank Singapore

A good miles-buying opportunity for 40,000 miles at S$488 for HSBC Premier Clients

I find this card to be a good miles-buying opportunity for 40,000 miles at S$488 for HSBC Premier Clients. The unlimited priority pass for both the principal and supplementary cardholder(s) makes this card worth the fee alone but provided of course that there are supplementary cardholders to share the benefits with and that it will be heavily utilized.

HSBC VISA Infinite Credit Card / HSBC Bank Singapore

The meet-and-assist can be helpful at overly crowded airports without Fast-Track/ABTC/Diplomatic lines

On my last overseas trip I discovered that the departure airport limo service offered by the card is a major plus point while the meet-and-assist can be helpful at overly crowded airports without Fast-Track/ABTC/Diplomatic lines. HSBC Premier Clients get to receive four of each benefit upon registration and an additional one of each service for every block of SGD 2,000 spent in a month, all up to 24 a year. Although the services can only be utilized by the principal cardholder only. This card is overshadowed by its poor mile earn rate of 1.0 mpd for local spend and 2.0 mpd for overseas spend, that is superseded by non-fee cards such as the PrviMiles.

HSBC VISA Infinite Credit Card / HSBC Bank Singapore

Purchase discounted Golden Village movie tickets at a rate that is far better than any other bank's credit cards or prevailing rebates

To me the HSBC cards have only one good benefit in which they are able to purchase discounted Golden Village movie tickets at a rate that is far better than any other bank's credit cards or prevailing rebates. I find that this is the only plus point of this HSBC credit card and otherwise, this card is a hit and run for me and you can sign up for only its sign up gift and also for discounted Golden Village tickets.

HSBC VISA Infinite Credit Card / HSBC Bank Singapore

Awesome travel and lifestyle privileges offered with personalised assistance from their dedicated concierge service,

This card offers the most of travel and lifestyle privileges extended to you with personalised assistance from their dedicated concierge service, who can actually be called upon anytime of the day and from wherever one may be. Whether it's making flight or hotel bookings, reserving spa appointments, or recommending dining options, they are always delighted to be at your service.

HSBC VISA Infinite Credit Card / HSBC Bank Singapore

Forums mentioning HSBC VISA Infinite Credit Card

How do I access LoungeKey lounges as an HSBC Visa Infinite Credit Card holder?

HSBC VISA Infinite Credit Card

Other products by HSBC Bank Singapore

HSBC Bank Singapore

HSBC Personal Loan

HSBC offers a personal loan of up to 4X or 8X of your monthly income with a fixed repayment amount or you can also have it on an installment basis. A wide variety of application channels and provides a low processing fee of *1% of the approved loan.

HSBC Bank Singapore

HSBC VISA Platinum Credit Card

HSBC Visa Platinum Credit Card paved way for a flexible program that allows cardholders to save from dining, groceries and fuel purchases while at the same time enables cardholders to earn cashback. As their slogan goes: "Make family time more fulfilling", it truly empower cardholders to spend more quality time with their loved ones, apart from the 5% cashback for Dining, Groceries and Fuel purchases,it also offers a wide variety of benefits for Leisure, Dining,Travel, Enrichment, Shopping and more offers that the cardholder and family can enjoy.

HSBC Bank Singapore

HSBC Advance Credit Card

HSBC Advance Credit Card provides a delightful deal for cashback lovers. You can get S$1500 and more cashback annually. The program entails 3.5% cashback for purchases local and overseas for all merchant categories. The great thing about the cashback is that it relies on the total amount that you spend per period rather than select-merchant-categories only. Additional feauters of the card includes: Apple Pay, Visa payWave, SimplyGo, HSBC Virtual Card and Travel Insurance Coverage.

HSBC Bank Singapore

HSBC Revolution Credit Card

HSBC Revolution Credit Card gives an offer you cannot resist by giving you a credit card with no minimum spend required but allows you to gain five times the reward points. Not only that it gives more reward points when it comes to dining and entertainment, but also helps you to do things without leaving home. It permits the user to purchase things online.The best thing about having these reward points is the fact that you can redeem any of the rewards using those points. More reward points will give you more chance to redeem a reward. This includes HSBC’s jewellery vouchers,

HSBC Bank Singapore

HSBC Premier MasterCard

HSBC Premier Mastercard offers up to 5% cash rebate on grocery, dining, petrol, and transport on everyday spend, both at home and abroad. It helps gaining reward point by giving one reward point for every dollar spent. There is also no annual fee. And who wouldn’t want to travel? Gain travel rewards from planning the trip. Get up to S$60 cashback when applying for supplementary cardholder that can be used by your loved ones.

HSBC Bank Singapore

HSBC Debit Card

HSBC offers a debit card which introduces you to a world full of convenience. It is powered by Visa payWave, NETS contactless modes of payment, Apple Pay and it can also be used as a public transit card that you can also use to shop, travel and dine with ease.

HSBC Bank Singapore

HSBC Everyday Global Debit Card

The Everyday Global Debit Card gives you access to an account that enables multi-currency card which you can use wherever you are. You get a hefty amount of bonus interest on your SGD savings with Everyday Global Account.

HSBC Bank Singapore

HSBC Debt Consolidation Loan

HSBC's Debt Consolidation Plan aims to provide you with a refinancing program in order to consolidate all of your outstanding and existing unsecured credit facilties and includes a revolving credit facility to give you convenient mode for managing your daily financial needs.

No, since you are already signed up for a GIRO arrangement with IRAS upon its approval, you will receive a GIRO Instalment Plan from IRAS. You can then fill in the application form online and submit your GIRO Instalment Plan to HSBC for processing. You will earn Rewards points for every dollar charged to your HSBC credit card from HSBC Visa Infinite Credit Card if you sign up.