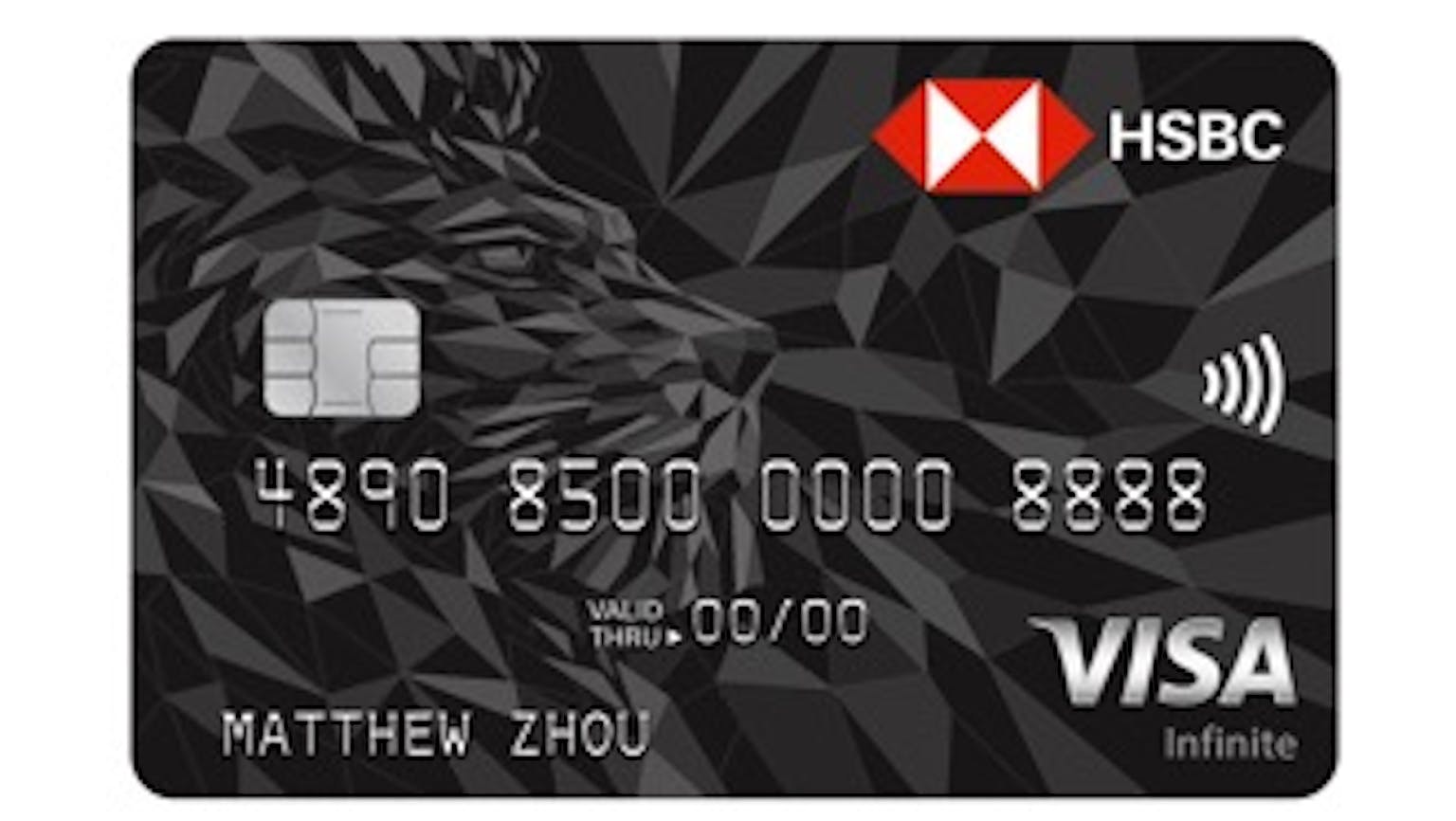

How do I access LoungeKey lounges as an HSBC Visa Infinite Credit Card holder?

I am all for seamless and luxurious travel with exclusive retail and dining benefits and these motivated my choice of the HSBC Visa Infinite Credit Card. Are there any particular protocols I must observe to gain access to LoungeKey lounges

No Name

No not exactly my friend, you just need to simply present your HSBC Visa Infinite Credit Card, boarding pass and mention LoungeKey at participating lounges to gain complimentary access. However when accessing the lounge on your own, LoungeKey will perform a pre-authorisation amount to validate your card. A pre-authorisation amount is a temporary hold of your credit balance and no funds will be charged to the card. The ‘Total number of users’ reflected on the card terminal should be one but when accessing the lounge with guests, guest charges will be USD 27 per guest including children and infants unless otherwise stated by the lounge. Do ensure the ‘Total number of users’ reflected on the card terminal is correct. For example, if the ‘Total number of users’ on the card terminal is 3, total of USD54 will be charged (i.e. for 2 guests with cardholder). Guest charges are subject to change at the lounge operator’s discretion. All the best friend!