Customer care service at top notch

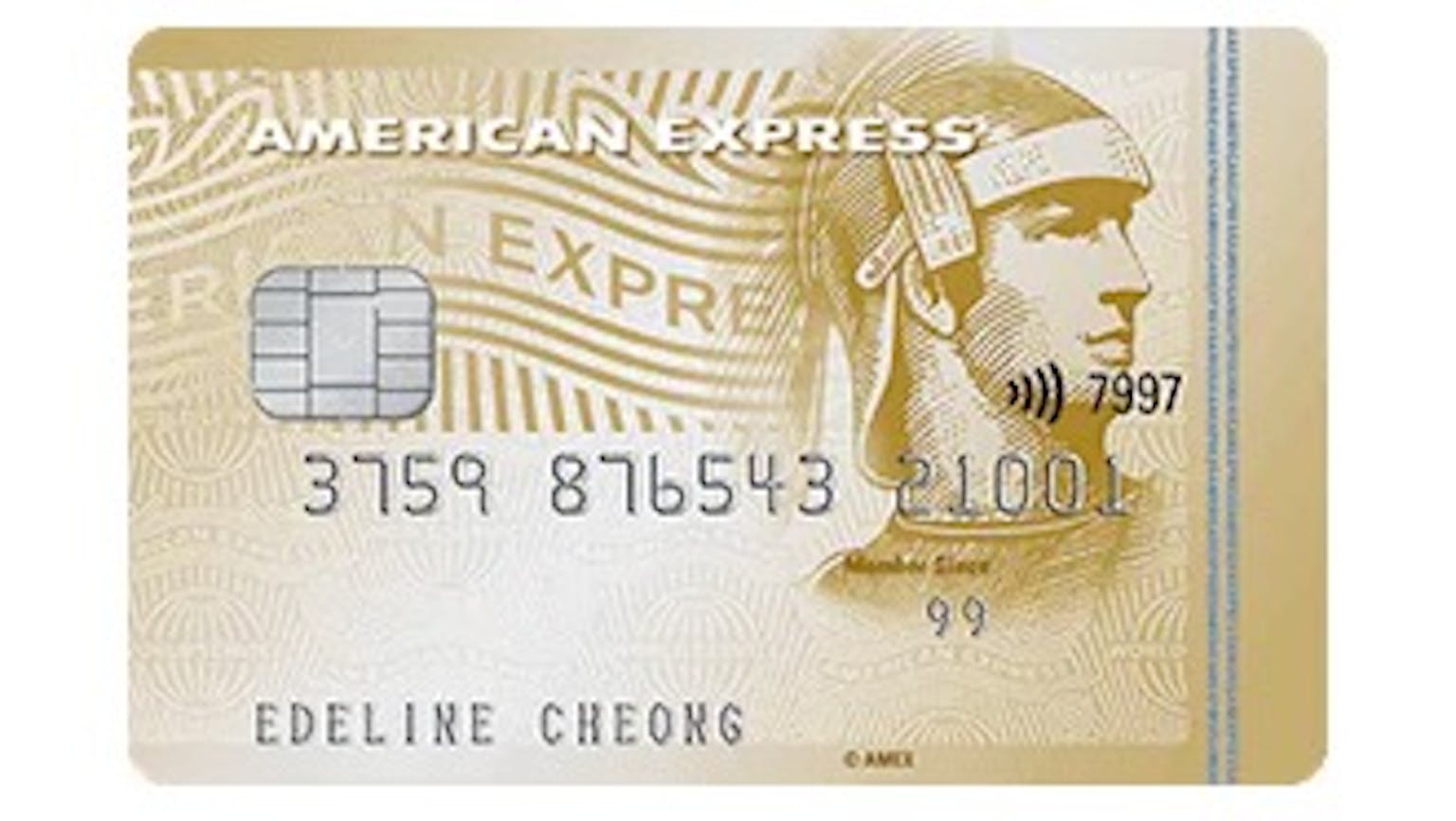

This is my first credit card and I was pleased with the process as the application was absolutely stress free and smooth with customer care service at top notch. I actually felt taken care of and it appeared I could rely on customer care service for virtually any issue. Plus they have a simple tracking system of cashback rewards, with a good App and web UI/UX.

Please leave your knowledge and opinion!