Is there a limit on how much Cashback one can earn every month using The American Express True Cashback Card?

Who can confirm the limit on how much Cashback one can earn every month using the American Express True Cashback Card and are there any complicated requirements to qualify for Cashbacks like minimum spends and category tracking?

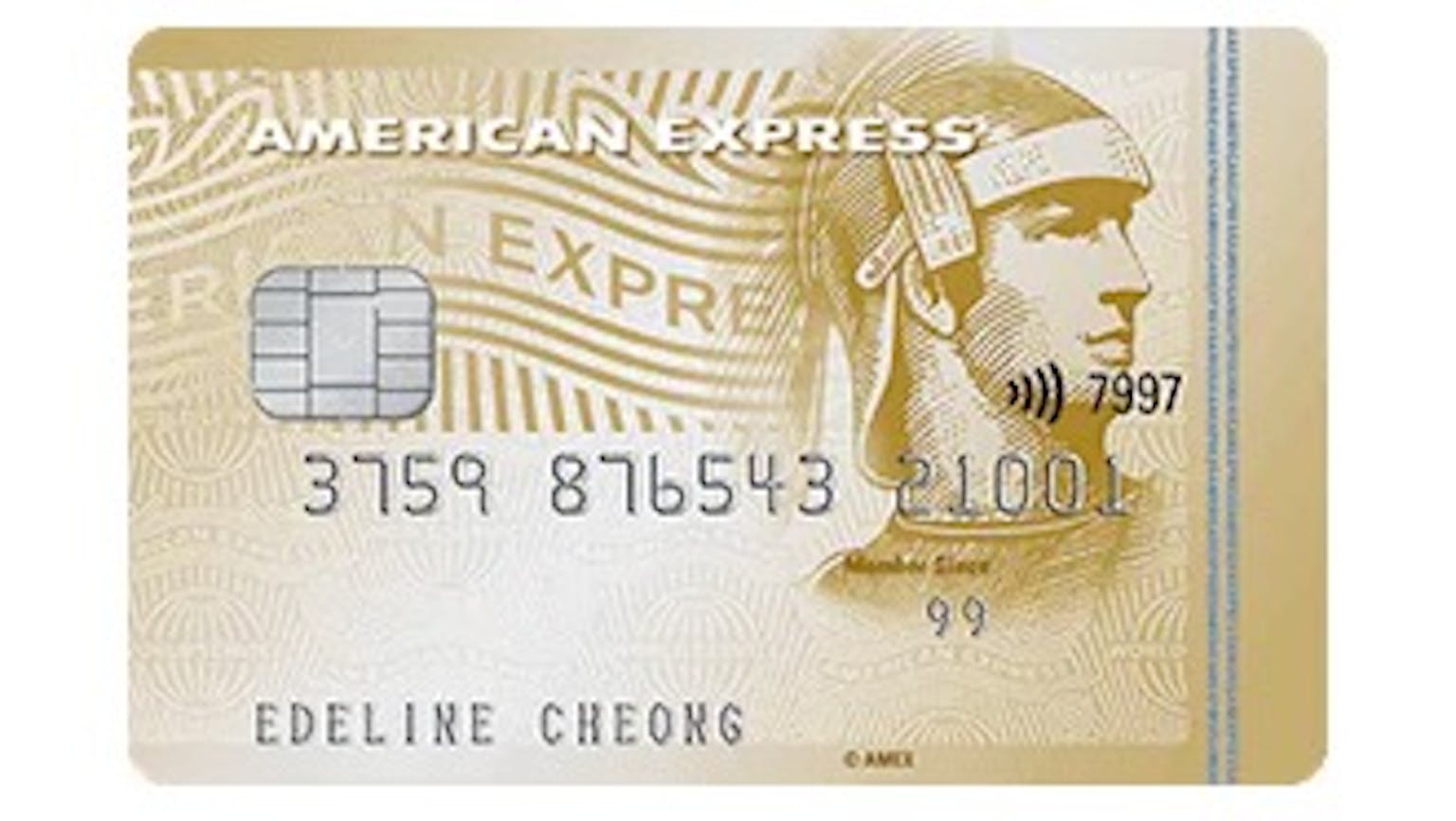

Products mentioned in this forum:

No Name

The American Express True Cashback Card gives a 3% Cashback on all eligible purchases you make locally and overseas all up to S$5,000 spend for the first 6 months. After the welcome Cashback bonus, you can continue to earn 1.5% Cashback on all your eligible purchases, locally and overseas. From small to large expenses like home improvement or a plane ticket for the next getaway, there are endless ways to earn Cashback. And you can even register your Card to enjoy additional 1% Cashback on all your Foreign Currency spend, on top of the 3% Welcome Bonus or 1.5% Cashback thereafter. With no minimum spend and no earn cap. There are no minimum spend and no categories to track with complicated requirements to qualify for Cashback. You will be earning Cashback on every eligible dollar spent. Finally note there is no limit on how much Cashback you can earn every month. You earn Cashback for all eligible purchases you make on your Card, with instant gratification in getting your Cashback immediately in the same month's statement as your purchases.