I know there are many but what is the best credit card to use to book Singapore Airlines for cash back?

I am in charge of bookings for holiday for a group of friends and I want to maximise on our spending. Just want to know what is the best credit card to make this booking?

Products mentioned in this forum:

No Name

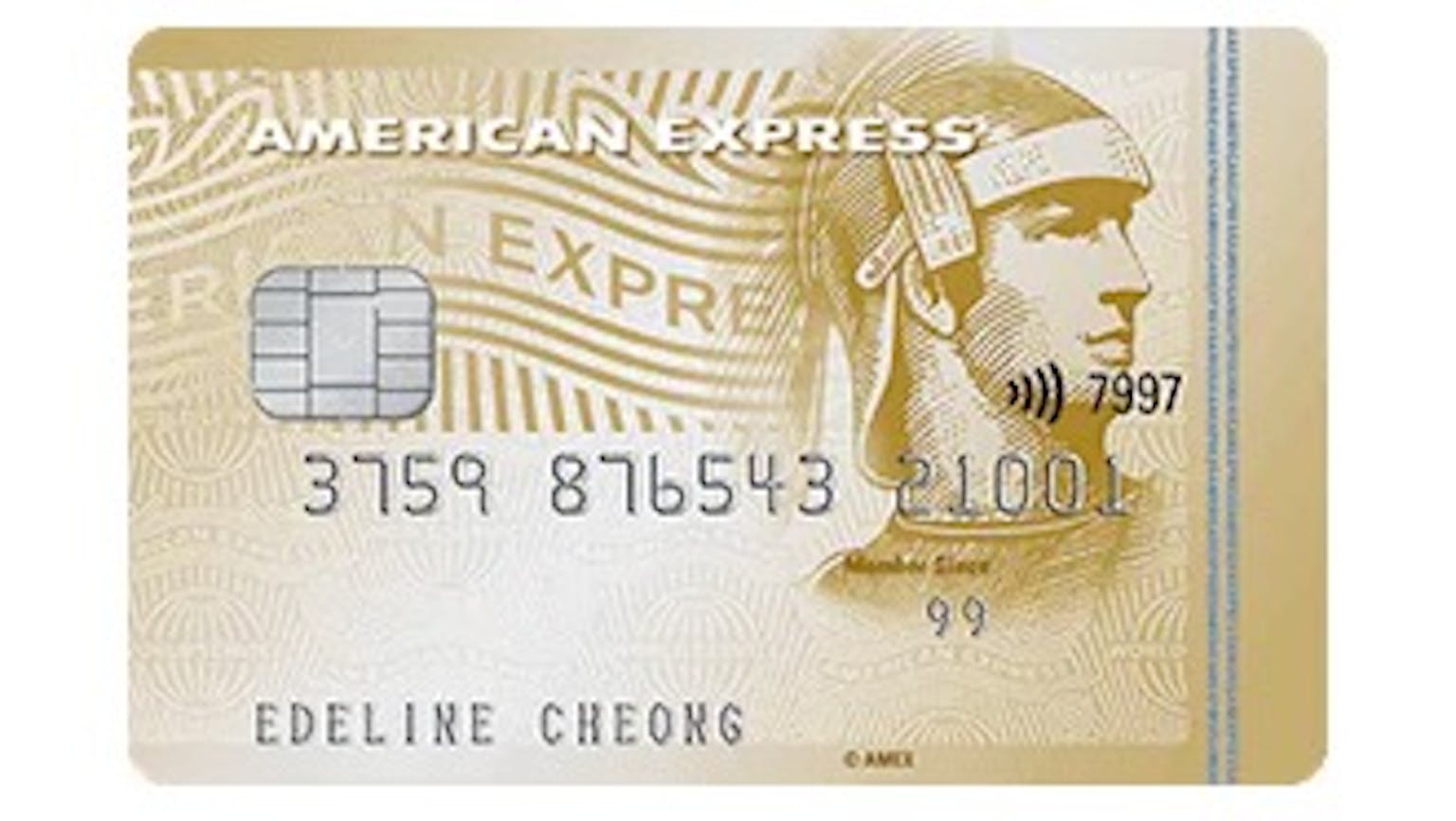

Try the Amex True Cash back card and take advantage of the welcome 3% on the first $5, 000 you spend in the first 6 month. They also have an attractive cash back package so give them a look.