What are the advantages of an Amex True Cashback Card for a fresh graduate earning about $3,000 with a monthly spend of $1,500?

Hello, I am looking for a suitable cashback Credit Card but am not really a big spender so I'm looking at one that doesn't require a minimum spend. Would AMEX True Cashback Card be a good fit?

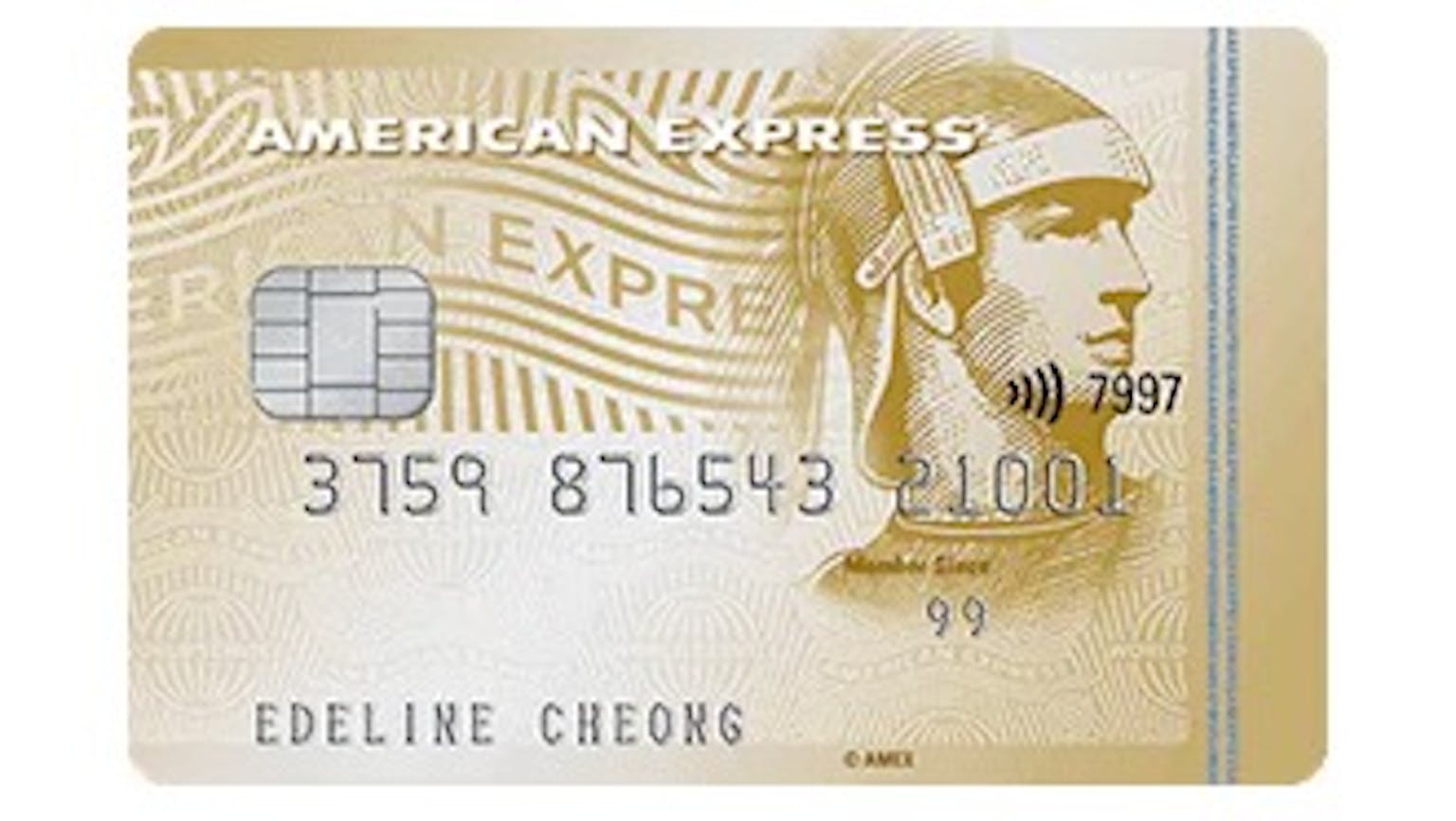

Products mentioned in this forum:

No Name

It really depends on your spending habits, categories and merchants you frequent as Amex true cashback is a flat cashback for everything. In my case I recently cancelled my True Cashback Card. This is because it seems not many merchants accept Amex. But that is just in my opinion based on my own spending habit as the card may be good for you.