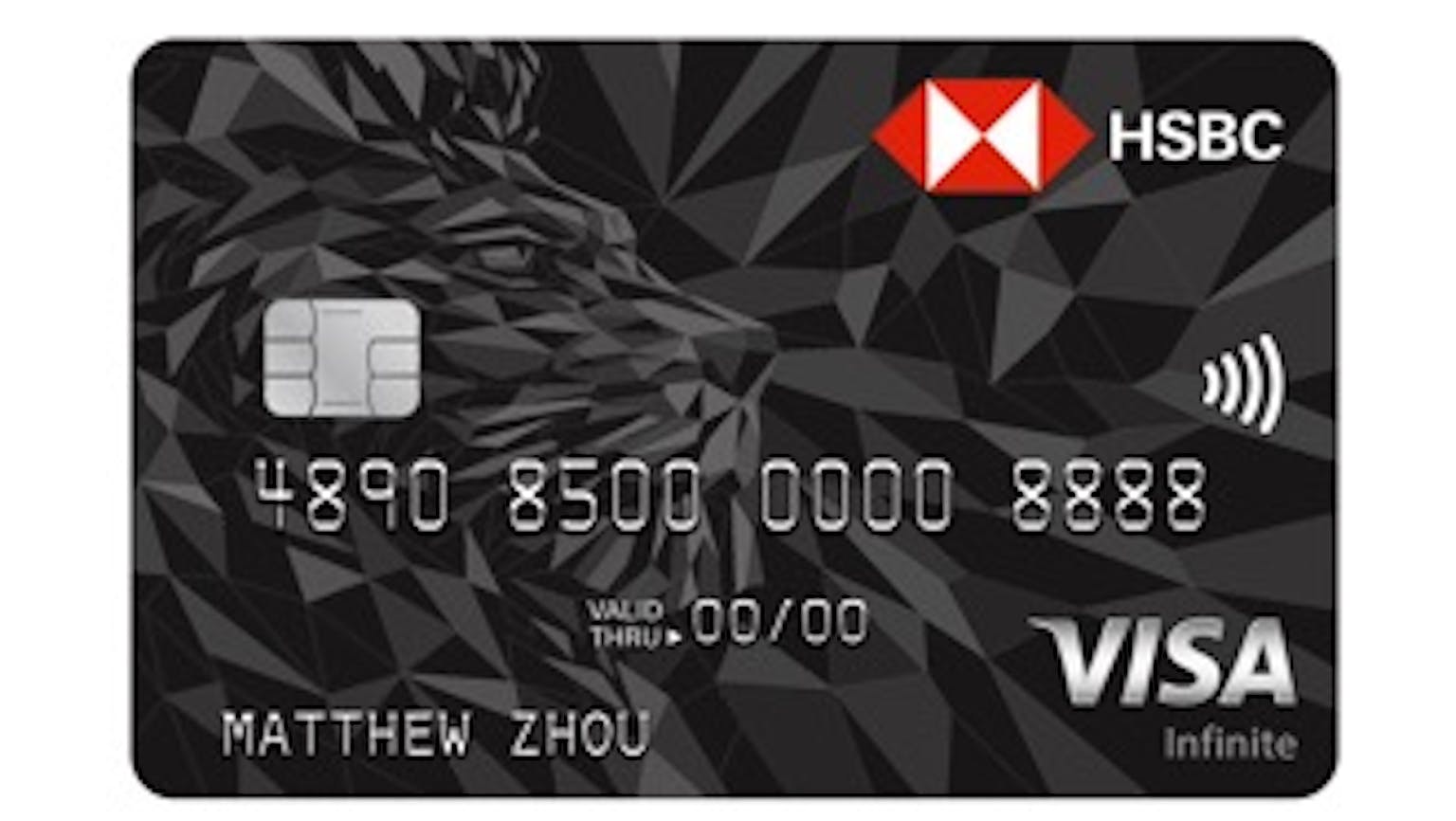

If I already have a monthly GIRO arrangement with IRAS, is there any point signing up for a payment facility with my HSBC Visa Infinite Credit Card?

If I choose to pay by monthly instalments for the HSBC Income Tax Payment Programme, can I sign up for this payment facility if I do not have a GIRO arrangement with IRAS?

No Name

No, since you are already signed up for a GIRO arrangement with IRAS upon its approval, you will receive a GIRO Instalment Plan from IRAS. You can then fill in the application form online and submit your GIRO Instalment Plan to HSBC for processing. You will earn Rewards points for every dollar charged to your HSBC credit card from HSBC Visa Infinite Credit Card if you sign up.