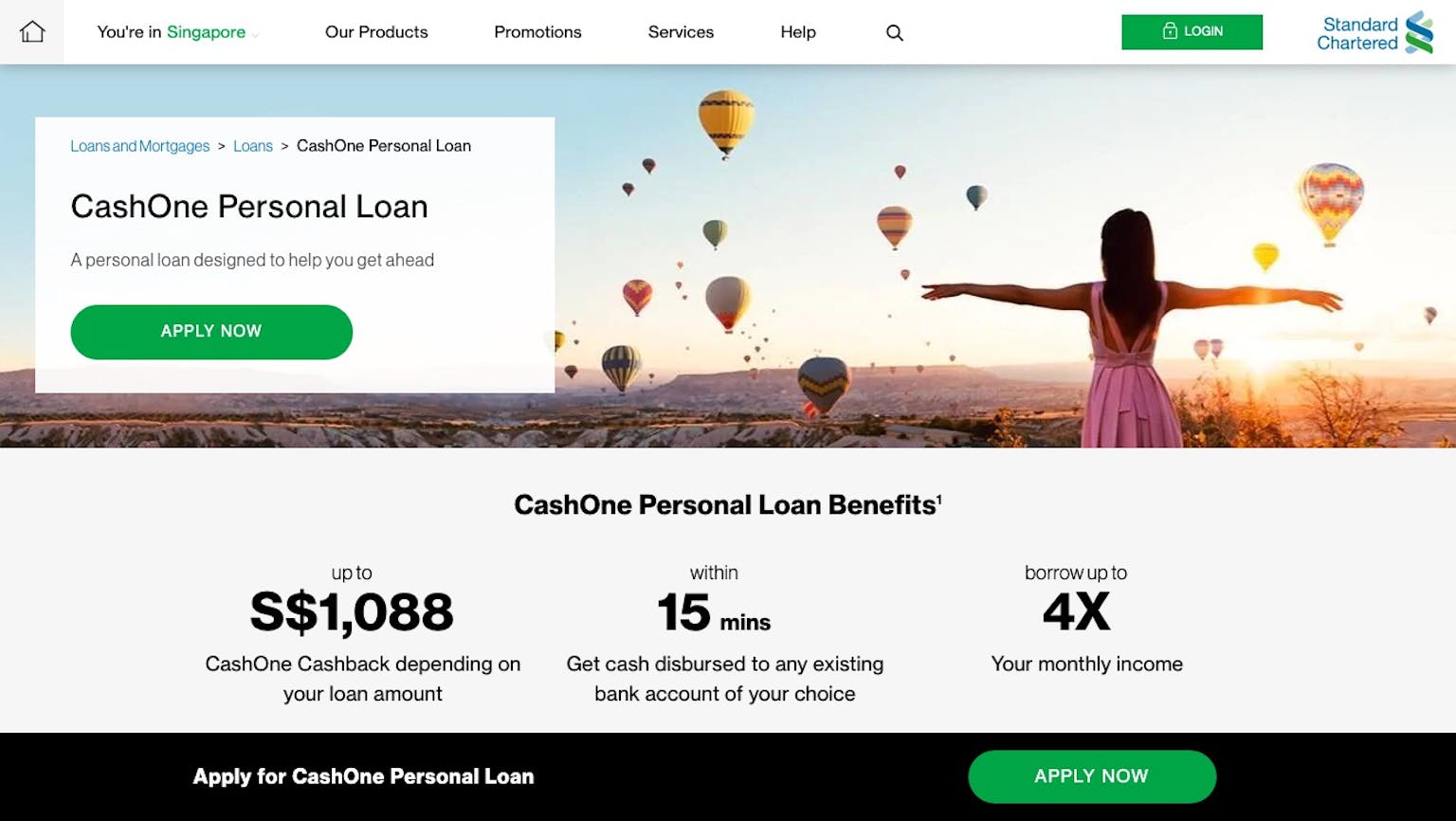

I'm a principal Standard Chartered Bank (Singapore) Limited Credit Card Cardholder. Do I have to provide any documents to apply for the CashOne Personal Loan?

What is interest rate for an annual income of S$20,000 to less than S$30,000 and how do I calculate the total interest charged on the CashOne Personal Loan, and can I proceed with the application and not be required to provide documents as?

No Name

If you already have a credit card with the bank you don’t need not submit any documents however, if you have recently experienced a change in income, you will need to submit your latest income documents during the application, so that they can review your credit limit and your CashOne Personal Loan application accordingly. For annual income of S$20,000 to less than S$30,000; 1-year loan tenor: 9.80% p.a. (EIR 27.56% p.a.), 2-year loan tenor: 9.80% p.a. (EIR 23.14% p.a.), 3-year loan tenor: 10.80% p.a. (EIR 22.99% p.a.), 4-year loan tenor: 10.80% p.a. (EIR 21.80% p.a.), 5-year loan tenor: 10.80% p.a. (EIR 20.92% p.a.). Interest is calculated based on the ‘front-end add-on’ method by multiplying the principal loan amount by the specified annual Applied Rate for the full tenor of the plan. The interest charged per month is not spread equally throughout the tenor.