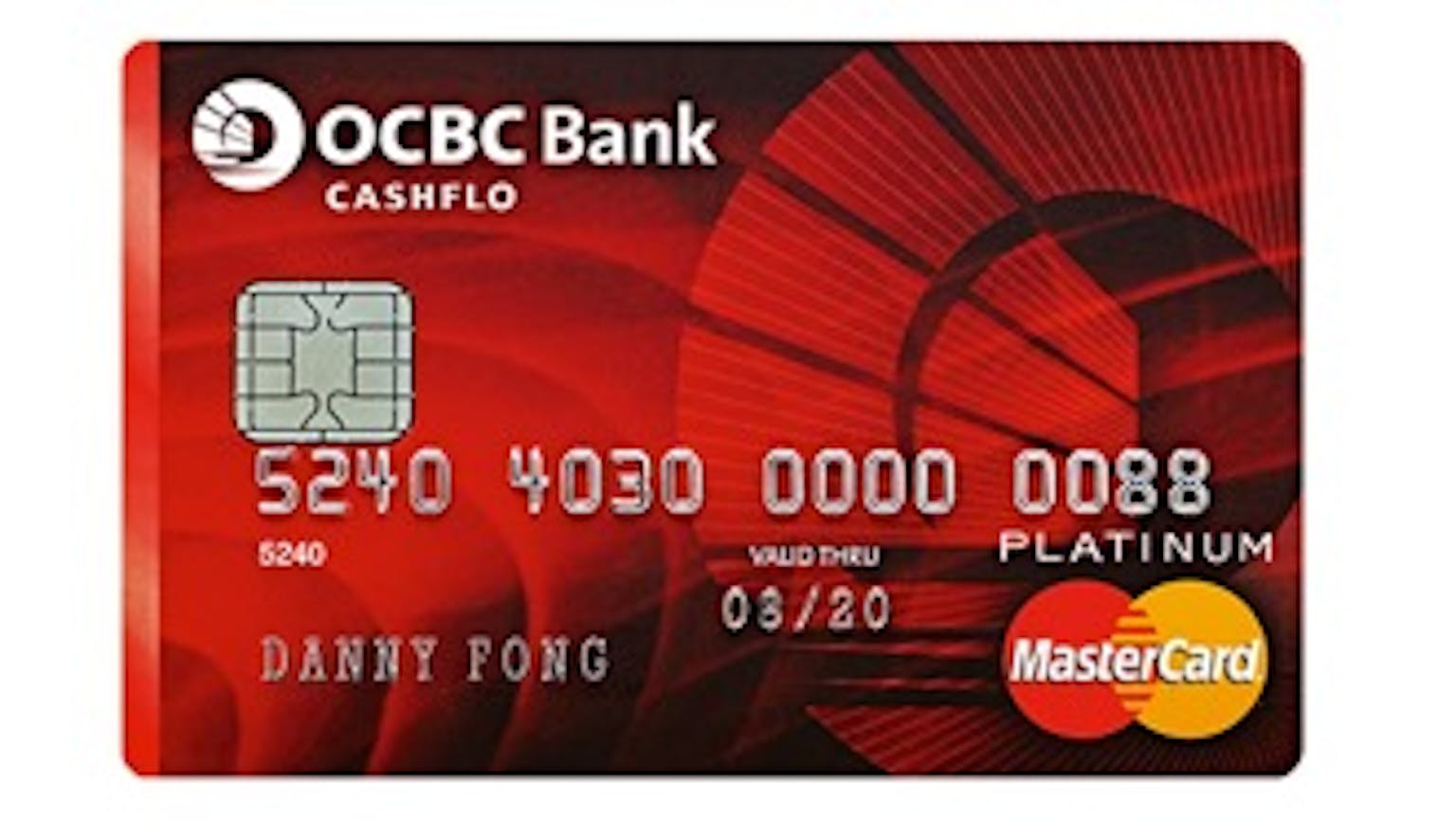

Earn up to 1% rebate on your purchase

If you target to spend on major event tickets and high price items with the plan to split by instalment then this card is for you. However I notice that if you have an existing OCBC saving account, it makes bill payments much more seamless. And aside from being able to split payment into monthly instalments interest free, you can earn up to 1% rebate on your purchase. Only few cards in the market that allow auto convert spending into interest free instalment and still be entitled to 0.5% or 1% cash rebate.

Please leave your knowledge and opinion!