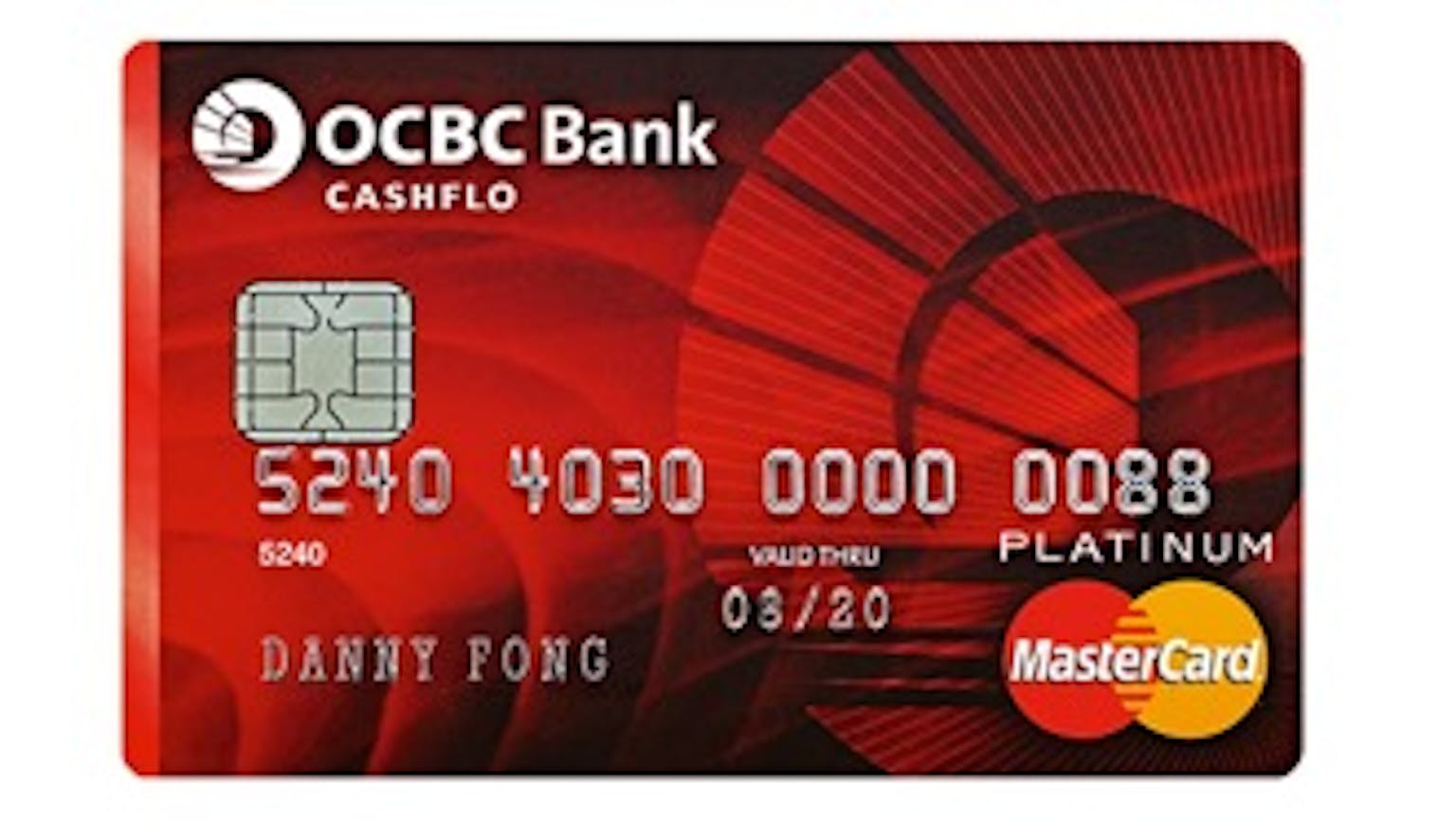

What are the criteria to earn an annual fee waiver for an OCBC Cashflo Credit Card?

I will be 21 in two months and hope I will be eligible for the credit card but I would in particular like to know what criteria I have to meet to be eligible for an annual fee waiver?Cash Rebate 1% Cash Rebate with monthly bill of more than $1,000

No Name

To earn an annual fee waiver for your OCBC Cashflo Credit Card, you must meet the minimum spending of at least $10,000 in one year, starting from the month in which your OCBC Cashflo Credit Card was issued. And yes in two months when you turn 21 years old, you will be eligible for the product but bear in mind you also need an annual Income of $30,000 and above for Singaporeans and PRs while the annual income of $45,000 is fixed for foreigners