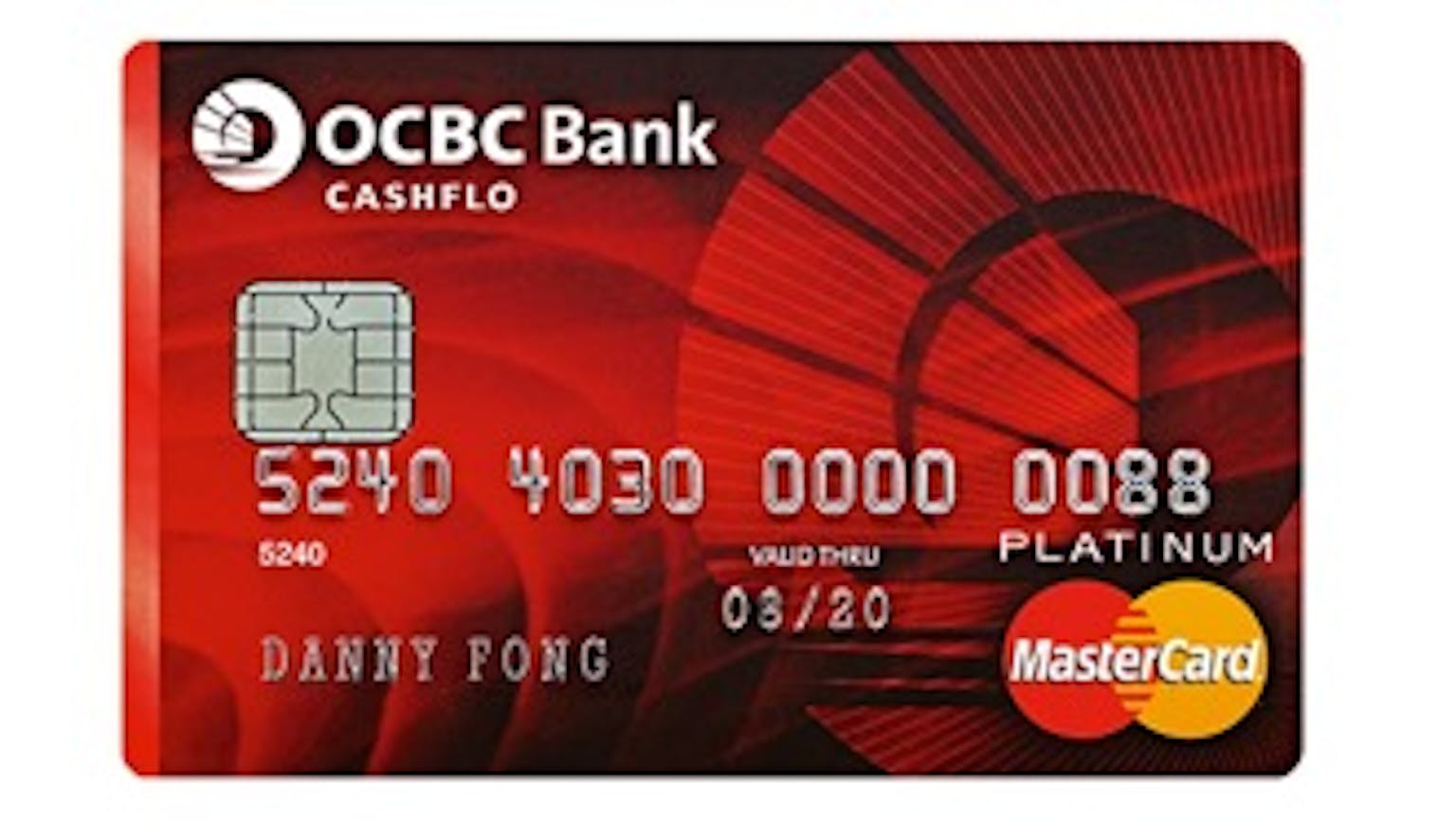

Does anybody know the Annual Fee Waiver Criteria for an OCBC Cashflo Credit Card?

I am a 23 year old Singaporean with an annual income of $60,000 and would like to know the Annual fee waiver criteria for an OCBC CashFlo Credit Card. How do I earn an annual fee waiver?

No Name

In order to earn an annual fee waiver for your OCBC Cashflo Credit Card, you must meet the minimum spending of at least $10,000 in one year, starting from the month in which your OCBC Cashflo Credit Card was issued to you.