OCBC FRANK Debit Card

The Frank Debit Card is your passport to the world of FRANK. Provided by OCBC, you save when you spend on the things that you aready love. It provides a 1% rebate when you shop, eat and ride and with various designs you can choose from!

Oversea-Chinese Banking Corporation

Oversea-Chinese Banking Corporation, Limited (OCBC), is consistently ranked amongst the World's Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker, was formed in 1932 by the merger of three local banks, oldest of which was founded in 1912. It is one of the highest-ranked banks as it is the second-largest financial services group in Southeast Asia by assets and is recognized for its financial strength and stability. OCBC Bank and its subsidiaries are widely acclaimed all throughout Singapore, Malaysia, Indonesia, and Greater China. It has more than 560 branches and representative offices in 19 countries and regions. OCBC Bank and its subsidiaries offer a comprehensive range of specialist financial and wealth management services and are listed on the SGT-ST as one of the largest listed companies in Singapore by market capitalization. It is also one of the largest listed banks in Southeast Asia by market capitalization and has more than 29,000 employees globally.

Reviews of OCBC FRANK Debit Card

Forums mentioning OCBC FRANK Debit Card

Can I open a FRANK Account in joint name?

OCBC FRANK Debit Card

Other products by Oversea-Chinese Banking Corporation

Oversea-Chinese Banking Corporation

OCBC Titanium Rewards Credit Card

OCBC Titanium Rewards Credit Card is the card the rewards you more than you deserve. You can be easily approved when you avail your card and use it instantly. OCBC Titanium now gives you more rewards points in more places. Only OCBC Titanium Rewards Card gets you 10X OCBC$. It supports and gives you 10x OCBC$ on any purchases when you shop at their supported merchants.

Oversea-Chinese Banking Corporation

OCBC 365 Credit Card

OCBC 365 Credit Card gives you an offer to an earn cashback 7 days a week, 365 days a year, everywhere. OCBC 365 Credit Card is one of the best everyday cashback cards on the market for average shoppers spending about S$2,000/month.

Oversea-Chinese Banking Corporation

OCBC Cashflo Credit Card

OCBC Cashflo Credit Card gains the customers who frequently spend more than they can afford right now through supplying a handy 0% activity installment layout and by using offering a 1% flat rebate after S$1,000 monthly spend.

Oversea-Chinese Banking Corporation

FRANK Credit Card

FRANK Credit Card is good for young adults who want to spend and get rebates. Easy to apply for new applicants. OCBC FRANK Card also offers excellent rewards. If you want an accessible, no-fee cashback, no need to look for another, OCBC FRANK Card is for you.

Oversea-Chinese Banking Corporation

OCBC VOYAGE Card

OCBC VOYAGE Card is more beneficial for those who travel a lot. It is for affluent consumers with a shifting travel schedule, who want to earn high miles locally and overseas. By using OCBC VOYAGE Card, you are opening a lot of privileges in your way.

Oversea-Chinese Banking Corporation

OCBC Plus! VISA Credit Card

OCBC Plus! Visa Credit Card calls themselves as Singapore’s card of choice at FairPrice and more because you can enjoy up to 12% rebate on your FairPrice and Unity spend and save even more with NTUC/OCBC Plus! Visa Credit Cards. OCBC Plus! gives you key benefits that will satisfy your qualities of wants. You can save a lot by using this card.

Oversea-Chinese Banking Corporation

NTUC Plus! Visa Credit Card

NTUC Plus! Visa Credit Card calls themselves as Singapore’s card of choice at FairPrice and more because you can enjoy up to 12% rebate on your FairPrice and Unity spend and save even more with NTUC/OCBC Plus! Visa Credit Cards. NTUC Plus! gives you key benefits that will satisfy your qualities of wants. You can save a lot by using this card. (for NTUC Union members)

Oversea-Chinese Banking Corporation

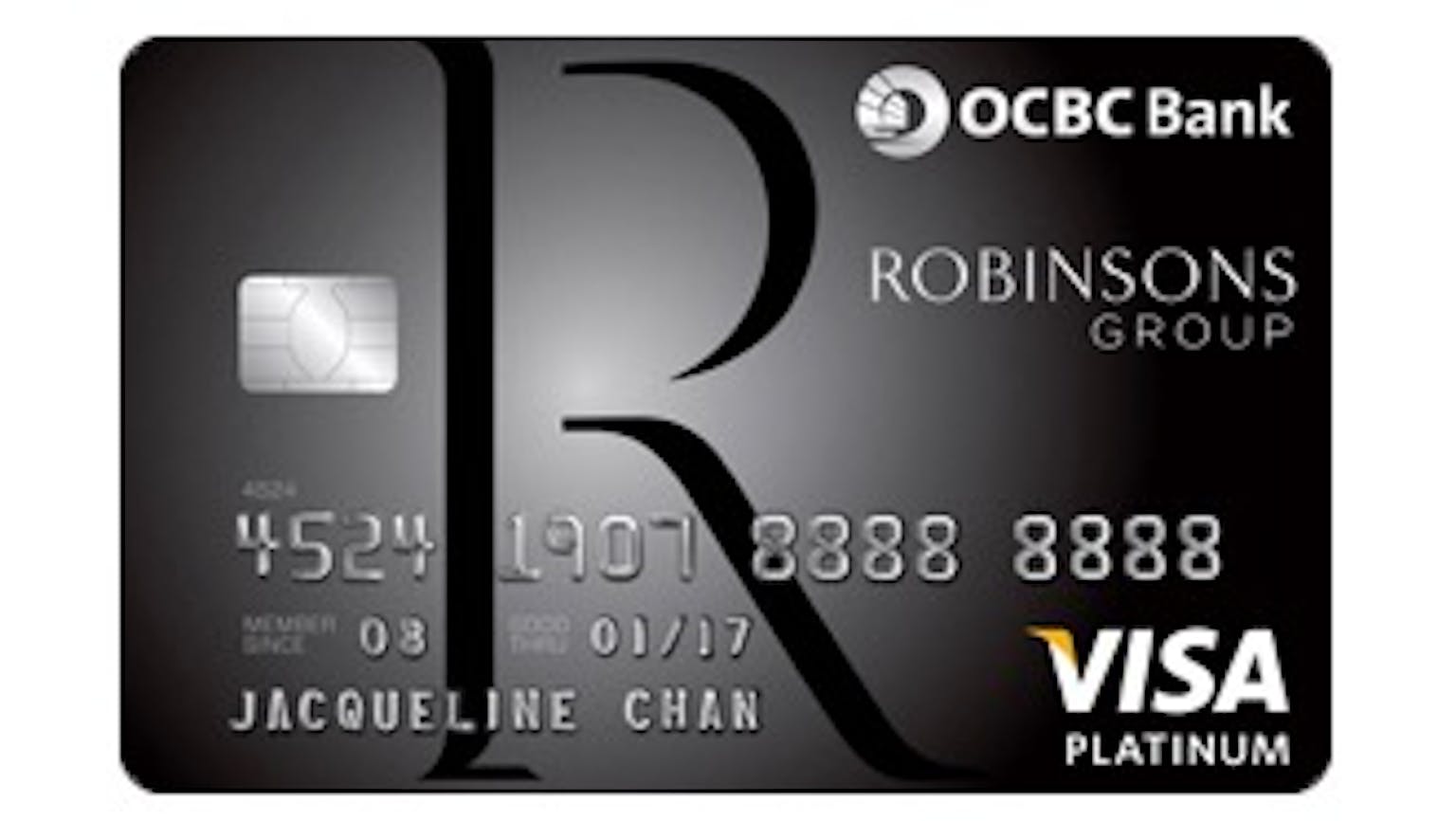

OCBC Robinsons Group Credit Card

OCBC Robinsons Group Credit Card gives you unlimited 5% rebate on all your purchases over 10 retail brands. You can also enjoy 10% rebate at Robinsons and/or Marks & Spencer. With OCBC Robinsons Group Credit Card you can get more exclusive cardmember perks with it.

Oversea-Chinese Banking Corporation

OCBC Arts Credit Card

OCBC Arts Credit Card gives you great discounts and priority booking for the latest art sceneries. OCBC Arts is well to be used for art classes and art galleries, ticket discounts, and priority bookings to concerts, events, shows and you can enjoy bonus points and redeem.

Yes certainly you can but you have to be aware that with the FRANK account you are limited to two joint account holders only. Thus if you’re planning to open a joint account with three or more people, you might want to consider doing that with some other existing OCBC banking accounts instead. Also, if the Primary account holder’s age is above 26, a service fee of S$2 will apply to the joint FRANK Account, and that is only if the average daily balance for the month is less than $1000.