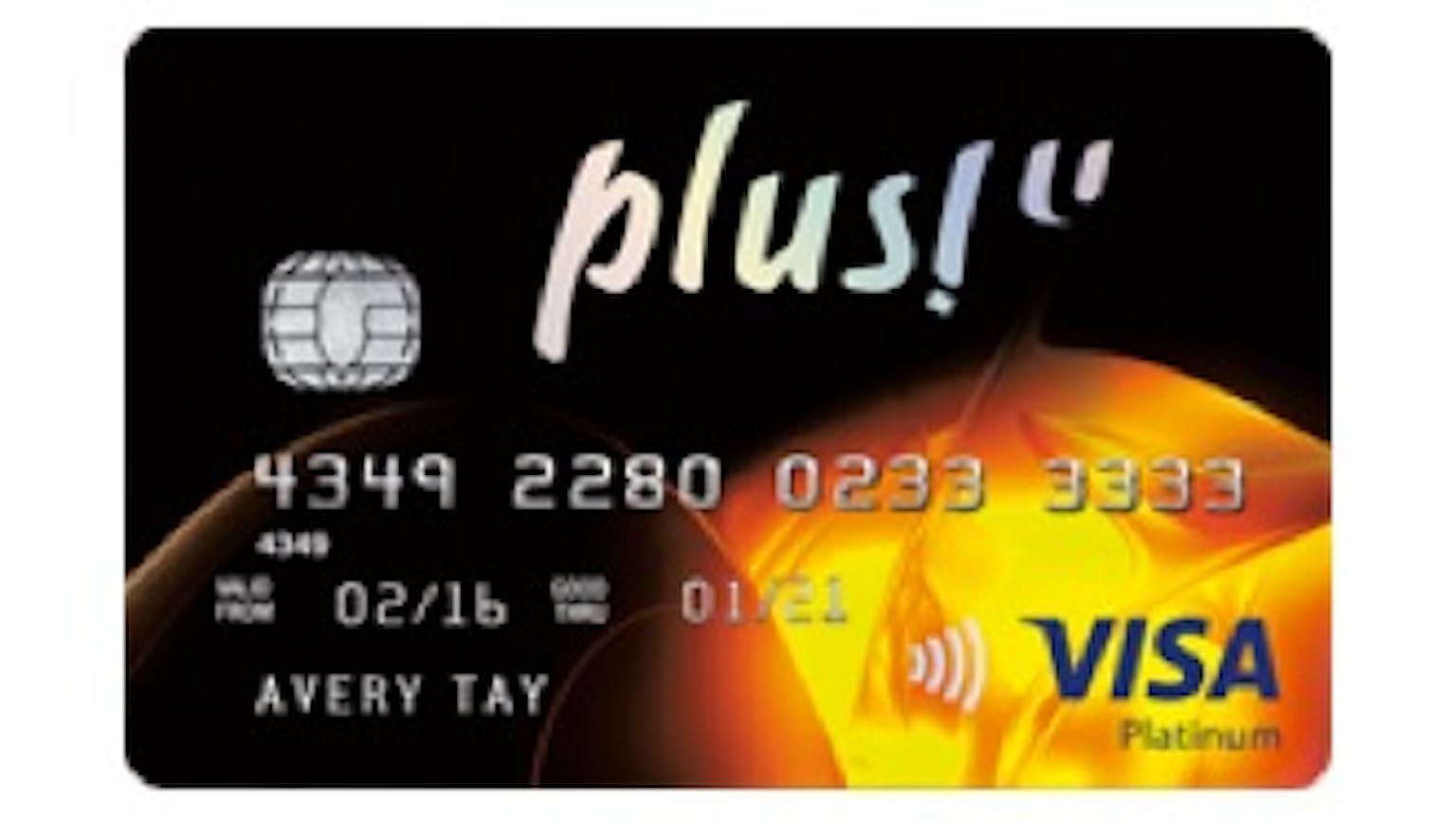

Questions & Answers about OCBC Plus! VISA Debit Card 2024

With the OCBC Plus! Visa Card, it gives you a world full of rewards and rebates. It has an instan approval and instant use feature which you can perform or apply through the MyInfo and enjoy S$20 cash credit for the deposit account that is opened along with your debit card.

Oversea-Chinese Banking Corporation

Oversea-Chinese Banking Corporation, Limited (OCBC), is consistently ranked amongst the World's Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker, was formed in 1932 by the merger of three local banks, oldest of which was founded in 1912. It is one of the highest-ranked banks as it is the second-largest financial services group in Southeast Asia by assets and is recognized for its financial strength and stability. OCBC Bank and its subsidiaries are widely acclaimed all throughout Singapore, Malaysia, Indonesia, and Greater China. It has more than 560 branches and representative offices in 19 countries and regions. OCBC Bank and its subsidiaries offer a comprehensive range of specialist financial and wealth management services and are listed on the SGT-ST as one of the largest listed companies in Singapore by market capitalization. It is also one of the largest listed banks in Southeast Asia by market capitalization and has more than 29,000 employees globally.

Firstly, you would need to be an existing OCBC card member holding any one of the Eligible Cards and have activated your OCBC-SCORE benefit via SCORE. The eligible cards are - OCBC Plus! Visa Credit Card; NTUC Plus! Visa Credit Card; OCBC Plus! Visa Debit Card; NTUC Plus! Visa Debit Card and FRANK Visa Debit Card. As for when and how you will receive the additional rebate, the consolidated rebate amount earned from your FairPrice store and Grab ride spend will be credited into the activated Eligible Card account within 60 days in which the spend occurred.