Questions & Answers about Bank of China Great Wall International Debit Card 2024

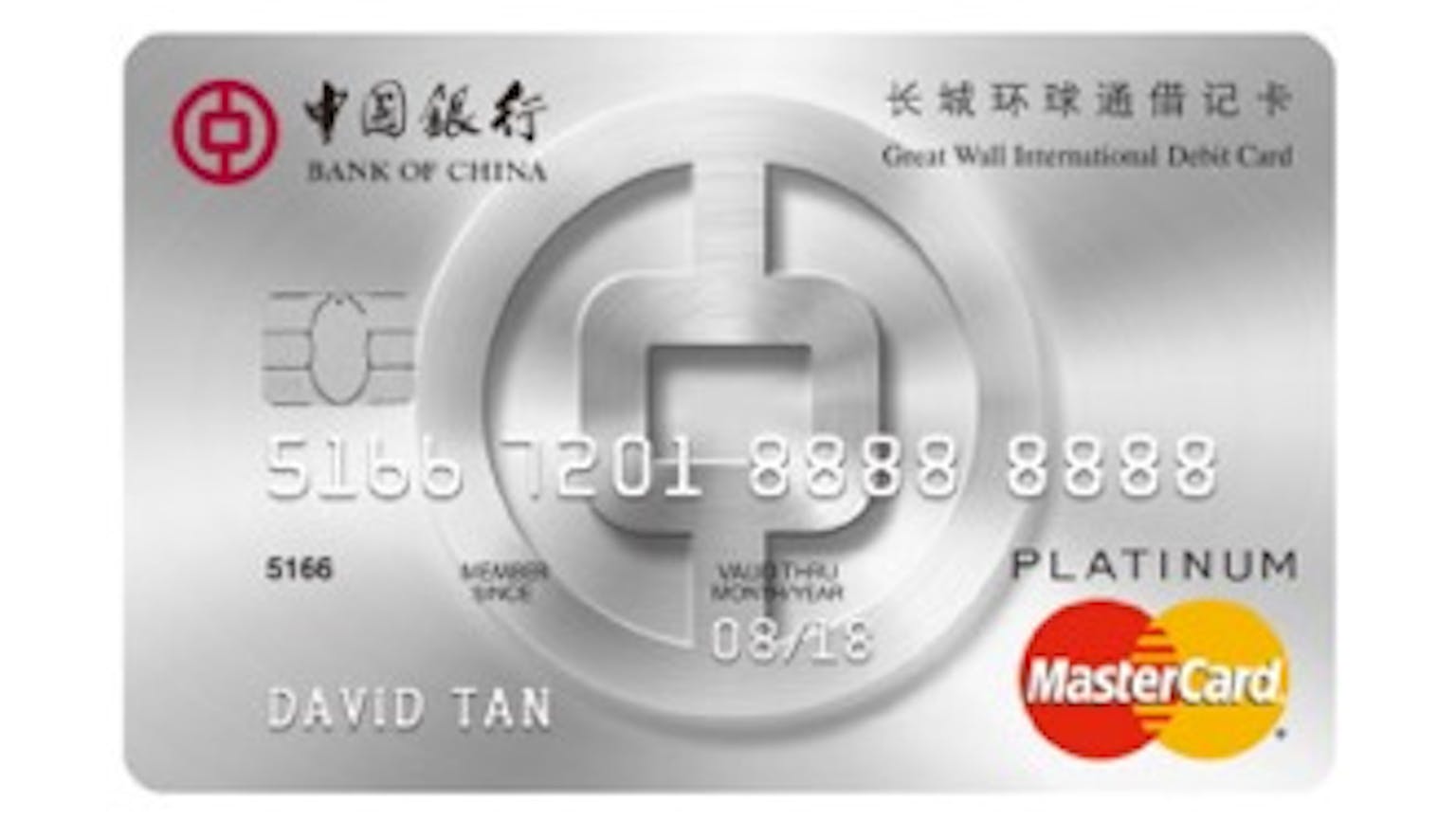

Bank of China's Great Wall International Debit Card is a debit card that allows you to enjoy fast, convenient and better services such as global ATM access/withdrawals, processing payments at participating merchants both online and in-store. The BOC's Great Wall International Debit Card is a Platinum MasterCard.

Bank of China

Bank of China, the Bank with the longest continuous operation among Chinese banks, is one of the four biggest state-owned commercial banks in China. It was founded in 1912 by the Republican government and as of 31 December 2009, was the second-largest lender in China overall. Bank of China Limited provides banking services to individuals, enterprises, and other clients. The Company offers deposits, loans, foreign currency transaction, fund settlement, and other services. As China’s most globally active bank, Bank of China has a well-established global service network with institutions set up across the Chinese mainland as well as in 57 countries and regions. It has established an integrated service platform based on the pillars of its corporate banking, personal banking, financial markets, and other commercial banking business, which offers investment banking, direct investment, securities, insurance, funds, aircraft leasing, and other areas, thus providing its customers with an extensive range of financial services.

Apart from global ATM withdrawals and making payments at participating merchants and online payments, what other card benefits exist with the Bank of China Great Wall International Debit Card?

Bank of China Great Wall International Debit Card

The first main benefit is Card Security as the card promises enhanced card protection with EMV Chip that allows for 24-hour SMS notification, monitoring of suspicious transactions and secured online payment. Subsequently, online shopping is made safer with a one-time password (OTP) authentication for secured payments on participating websites showing MasterCard SecureCode logo. There are no annual fees but you can be rewarded with cash rebates 0.1% for your purchases made with your Debit Card in Singapore and overseas with a minimum spend of S$100 monthly!