Apart from global ATM withdrawals and making payments at participating merchants and online payments, what other card benefits exist with the Bank of China Great Wall International Debit Card?

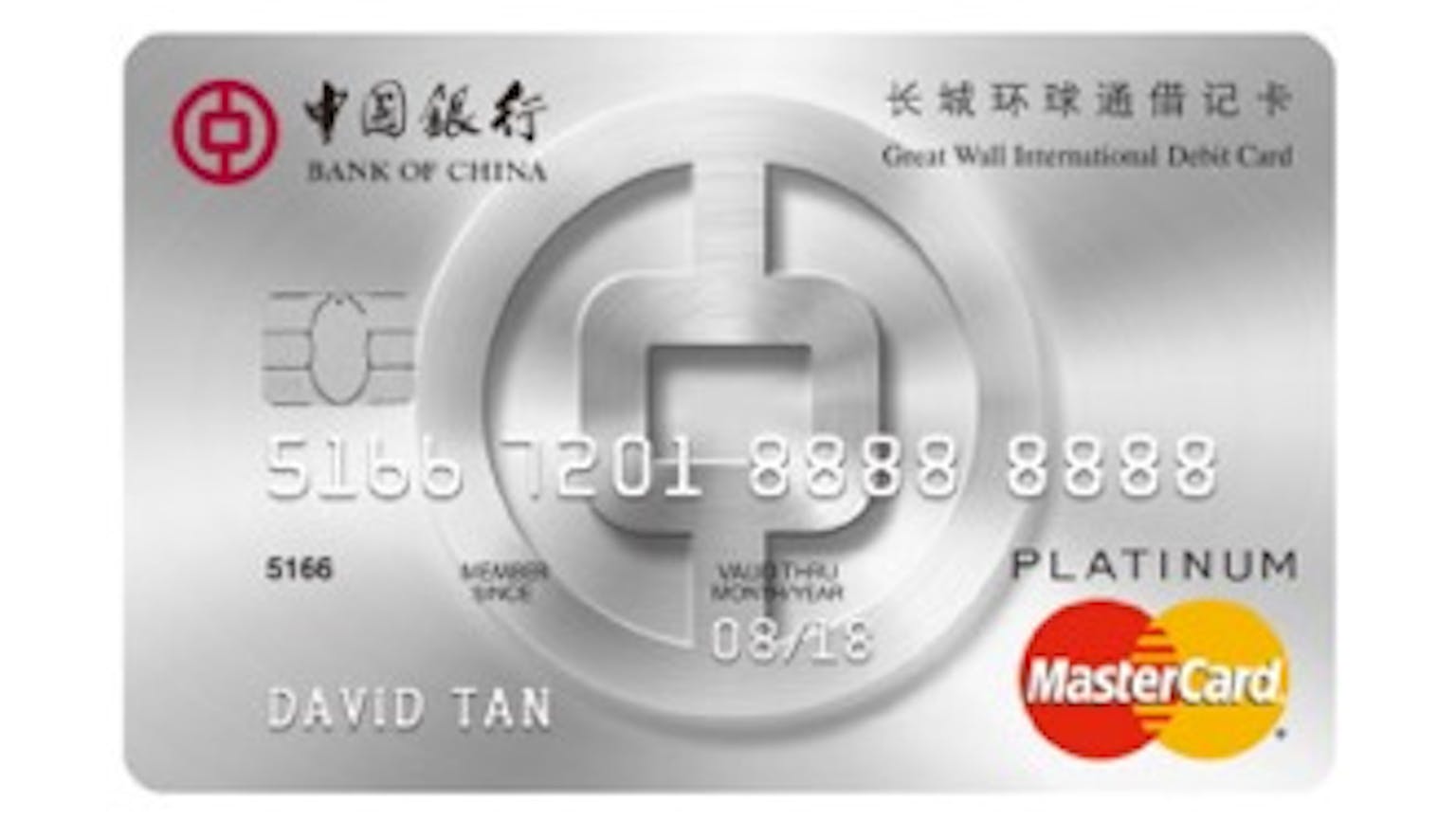

I gather that the Bank of China Singapore Branch has issued a platinum MasterCard called the Great Wall International Debit Card which also allows faster and better services and greater savings when you spend at our participating merchants.

No Name

The first main benefit is Card Security as the card promises enhanced card protection with EMV Chip that allows for 24-hour SMS notification, monitoring of suspicious transactions and secured online payment. Subsequently, online shopping is made safer with a one-time password (OTP) authentication for secured payments on participating websites showing MasterCard SecureCode logo. There are no annual fees but you can be rewarded with cash rebates 0.1% for your purchases made with your Debit Card in Singapore and overseas with a minimum spend of S$100 monthly!