Enjoy up to 10% off on travel related bookings with participating merchants

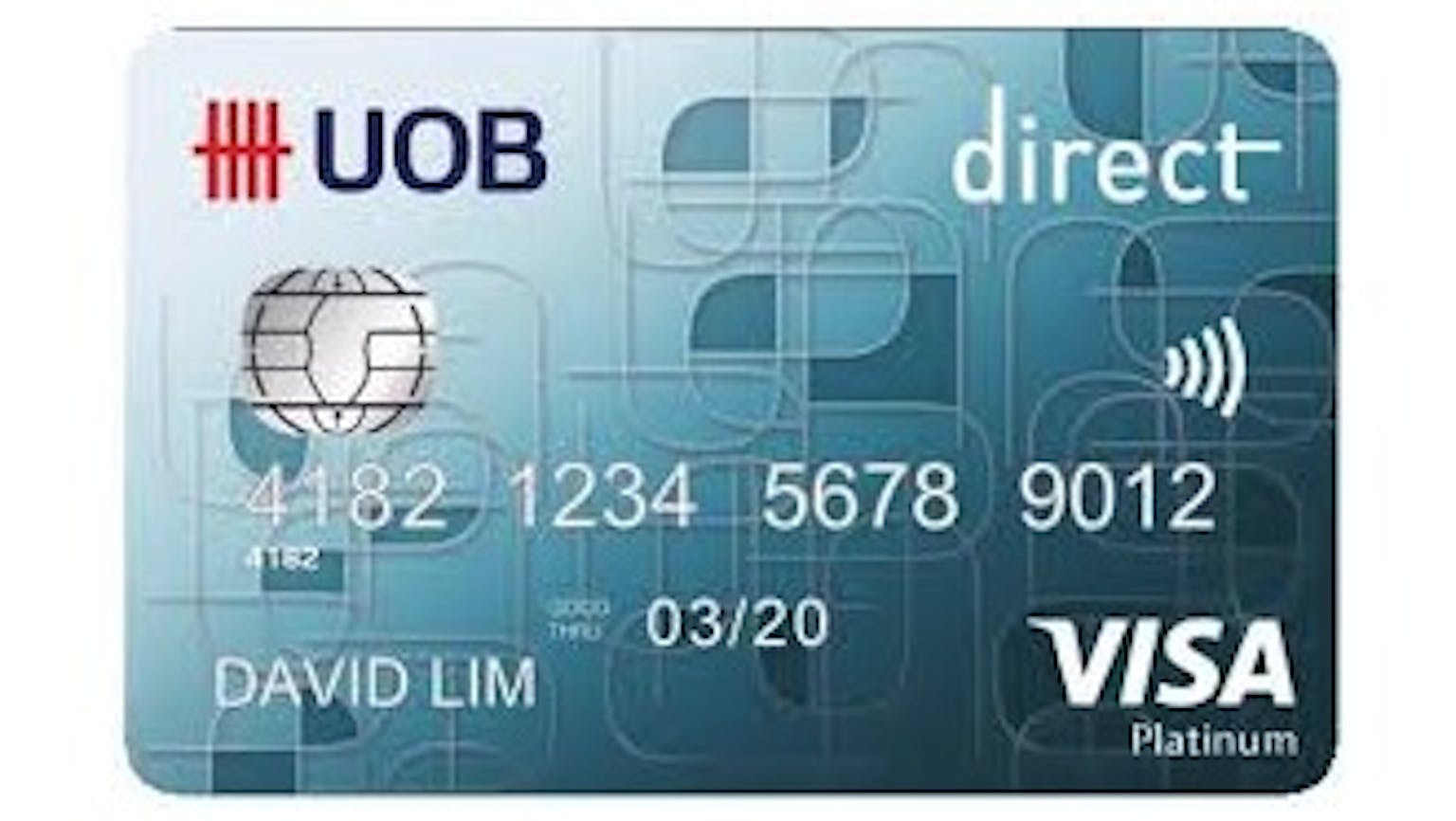

With this card, you’ll be able to get cash rebates of up to 10% when you use your card to make purchases at participating merchants such as Cathay Cineplexes and Cold Storage.If you’re one for travelling and adventure, you can also enjoy up to 10% off on travel related bookings with participating merchants.There is no minimum income and annual fee required for this card.You only need to be 16 years or older with a UOB Savings Account or Current Account

Please leave your knowledge and opinion!