Neutral tones of silvery hair along with slow-paced actions, including a face shaped with wrinkles of experience formed by wisdom. Simply reading the description above you can quickly recognize I am describing someone who is elderly. The aging population in Singapore is a familiar sight to see plus most of us have elderly parents or grandparents who we know and love.

Old age certainly brings challenges that come with a cost, for some, this can be a battle with normal daily activities of life. You may already know the struggles with helping your aging parents who need aid to perform daily tasks. Accompanying old age comes deteriorating health that can result in medical bills and medications that add to the burden of old age thus this can be a struggle financially. Supporting your own family and the needs of your elderly parents financially can bring unwanted stress.

But did you know from a recent study 86% of aged Singaporeans stated that they could rely on their adult children to care for financial support? How can that be? Maybe we, as caregivers of our aging parents feel like we can barely pay off our own bills including the cost of helping our grandparents or elderly parents.

Of course, we cannot eliminate the process of getting old but we can make a difference in helping our aging parents financially. In this article, we will discuss some helpful tips about lowering the cost of being elderly in Singapore.

What Is the Cost Of Taking Care Of Your Aging Parents and Your Offspring

Take for example, if you have two kids who are still in primary school who are taking tuition classes within a reasonable price range. Your elderly parents are semi-retired who are ordinarily healthy but they do require monthly medical visits at an average cost that is reasonable.

Your monthly outlook could look like this:

Expense

Monthly Expenditure

Child pocket money allowance for two primary students

$200.00

Child expenditures (Shopping, Food, etc) for two

$200.00

Tuition fees for two kids

$600.00

Elderly parents allowance

$600.00

Medical Fees for parents

$300.00

Grand Total

$1,900.00

Besides your own food, transport, phone bills, housing loan, shopping and so forth you are looking at close to $2,000 for your dependents at least, so plan early to help your older ones while in the process of taking care of yourself. It can seem overwhelming but careful planning of future events always helps.

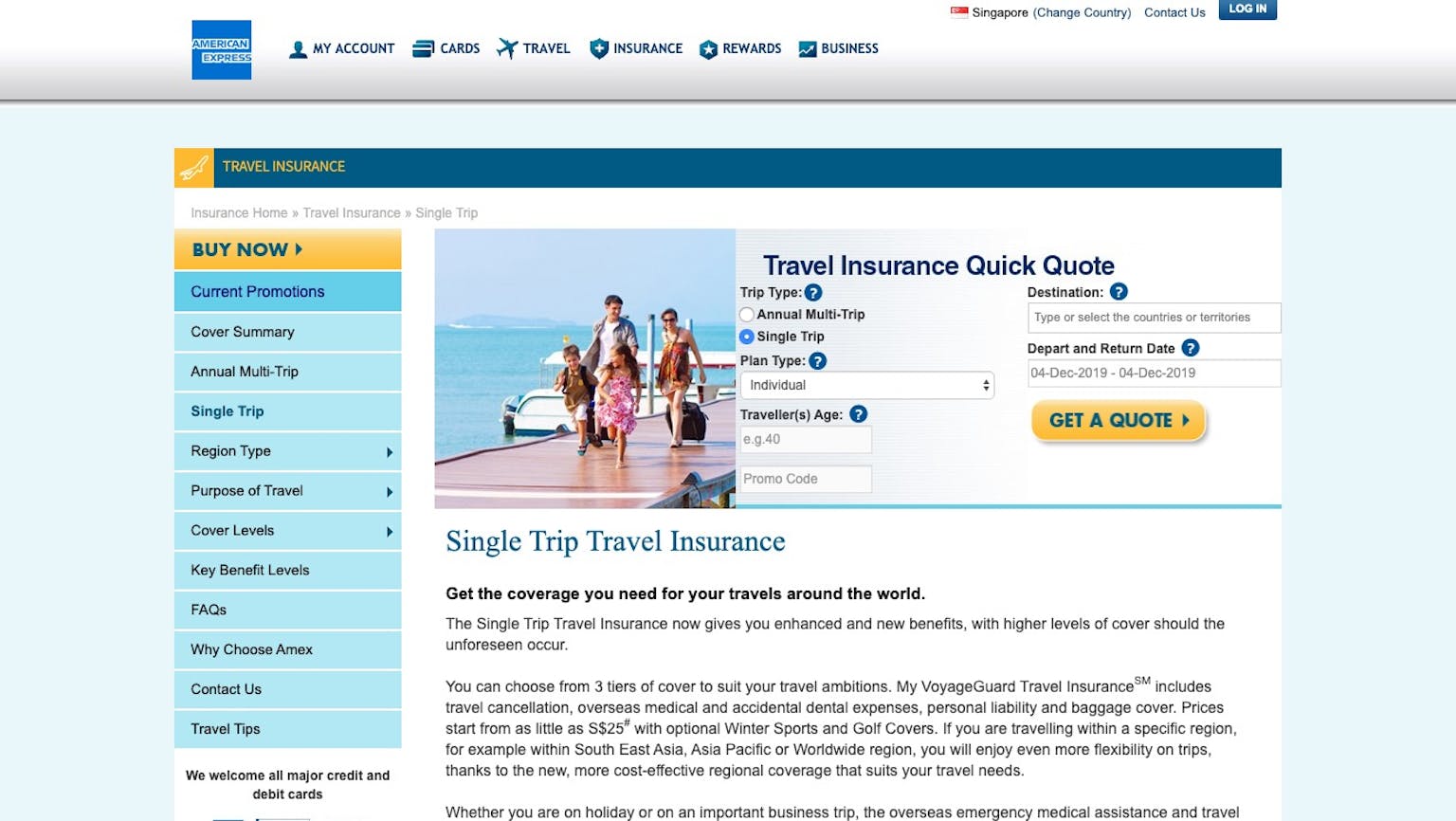

To combat the problem of growing old, let's start off by making sure your aged parents have adequate health insurance. Although they might be healthy in the present, it may be a smart decision for you to start looking into good health insurance policies for them. Your aged parents may already own some type of medical insurance, as a precaution, you should try taking a review of it while they are still in good health and determine if they need to join additional coverage to their plan. You really want to make a thorough search for good medical insurance for your aged parents for their protection. Silvercare insurance may be worth the time, this insurance covers the cost of caregiving and rehabilitation.

Did You Hate Going to the Doctor When You Were Younger?

Have a nice day Photo/shutterstock.com

Well, it may be time to return your parents a favor. Routine checkups for your elderly parents can help detect any early signs of major health problems that may develop later on. Are your parents the 'pantang' type? Who willfully avoid medical checkups because they don’t want to know if something is wrong with them, it may be time to help them to see that medical check-ups are necessary.

Medical care can seem like it can cost a large amount especially when it's not being paid for by the state which may be the cause for many of the elderly to avoid going for routine check-ups. If you are already financially supporting your parents, the responsibility relies on you to make sure they get their regular health check-ups, however, the subsidies will fall on you but remember who took care for you when you were sick? It may be a time to return a favor to your elderly parents.

Is it worth the cost? Let's take the example if your mother is over the age of 50 years old, did you know that the subsidized price for mammograms are $50 ($75 for PRs) for the detection of breast cancer, which can be paid for through her family's Medisave account and for your dad for the cost of $15 for Singaporeans ($22.50 for PRs) at participating polyclinics.

Financial Planning With Aged Parents

CA-SSIS/shutterstock.com

Talking to your elderly parents about how they could do better financially is not an easy subject to get into but is necessary. If they already have an adequate retirement plan, well that's one step ahead, but if they don't you might want to help them consider helping map out their investments and assets so that they can live a comfortable life after 50.

Adequate insurance is so important as well! Aside to the basic MediShield Life, they may want to look into getting Integrated Shield Plans and supplement their ElderShield Plan.

What Can Insurance Cover for My Aging Parents?

Andrey_Popov/shutterstock.com

While we cannot control time, growing old will happen. But as discussed before diligent planning is necessary for healthcare financing to ensure we can afford any care needed, without burdening our family members.

In Singapore, ElderShield is offered as part of a nation-wide scheme which provides a basic monthly payout to help reduce the out-of-pocket expenses for long-term care needed. All Singaporeans are automatically enrolled in the ElderShield scheme at the age of 40, but they can choose to opt out.

We never know what tomorrow could bring or what 5 years in the future could look like for us and our elderly parents. But careful planning and help in reducing cost for our aging parents can help them. If your parents cared for you, is it time we return a favor and start taking care of them?

Please leave your knowledge and opinion!