I want to sell insurance too

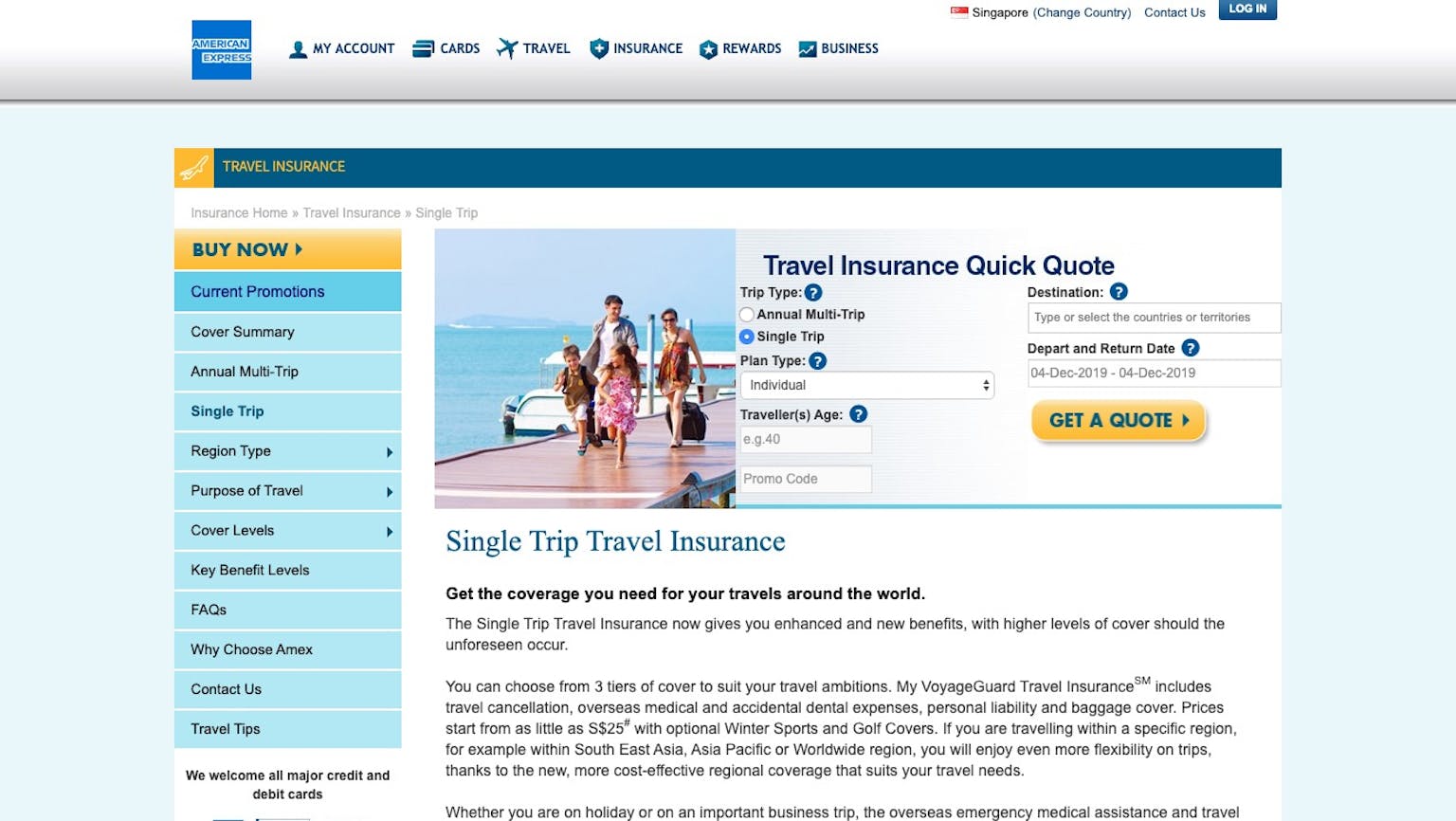

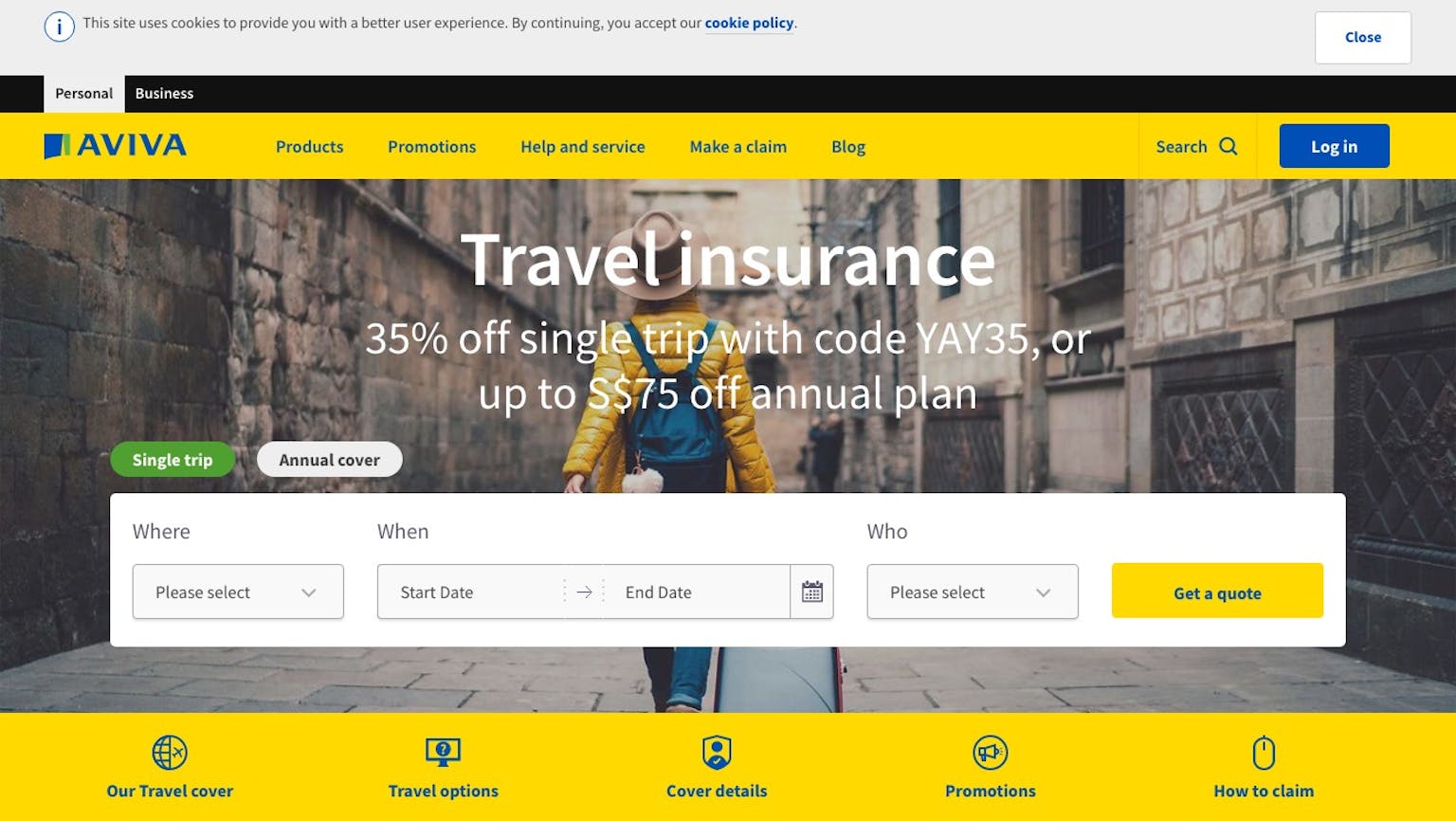

I was wondering if I can sell this insurances too and would be able to have an income while being insured. I know that insurances are a hit today and especially to business personnels. I want to share this insurance company where I bought my insurance and I want to know if I will get a referral for this. I brought them a consumer and they should reward me for that right?

No Name

Insurance companies are spread through out the world. They almost covered every country in the map. Not all people have insurances but people refer it to them. Some companies use this strategy for them to get more costumers in buying insurances. Most companies allow those people who have bought there insurance to sell and will give them a percentage of the product.