Gonna cost me a lot of money for my surgery

At a very young age I saved money for me to avail an insurance that can help me with my expenses if something horrible happns to me. I admit that I do not take care of my health that much that is why I need to ensure my expenses is secured if something unfortunate happens. Preparing for the future cannot harm the present. It will ease you afterwards.

No Name

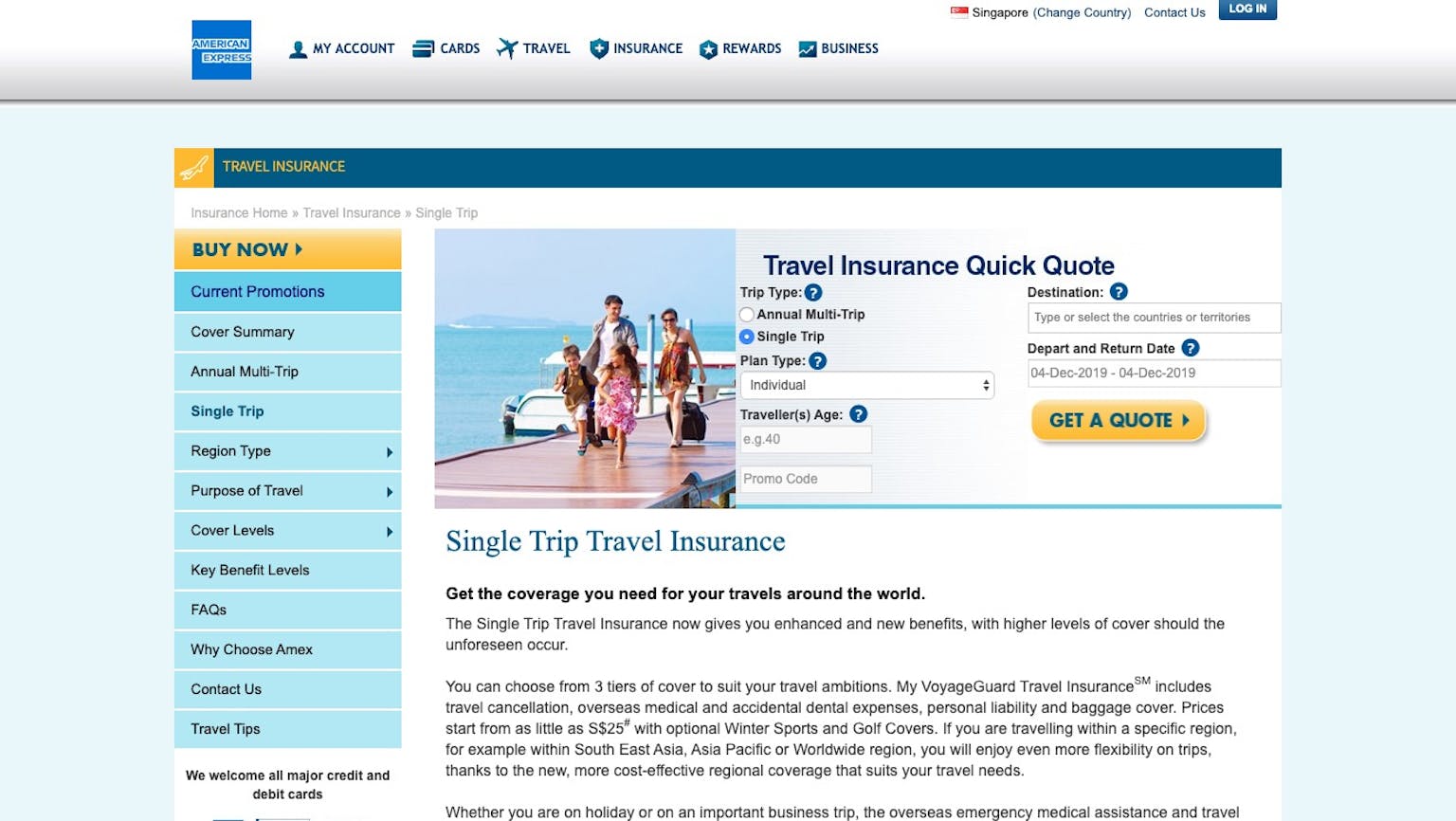

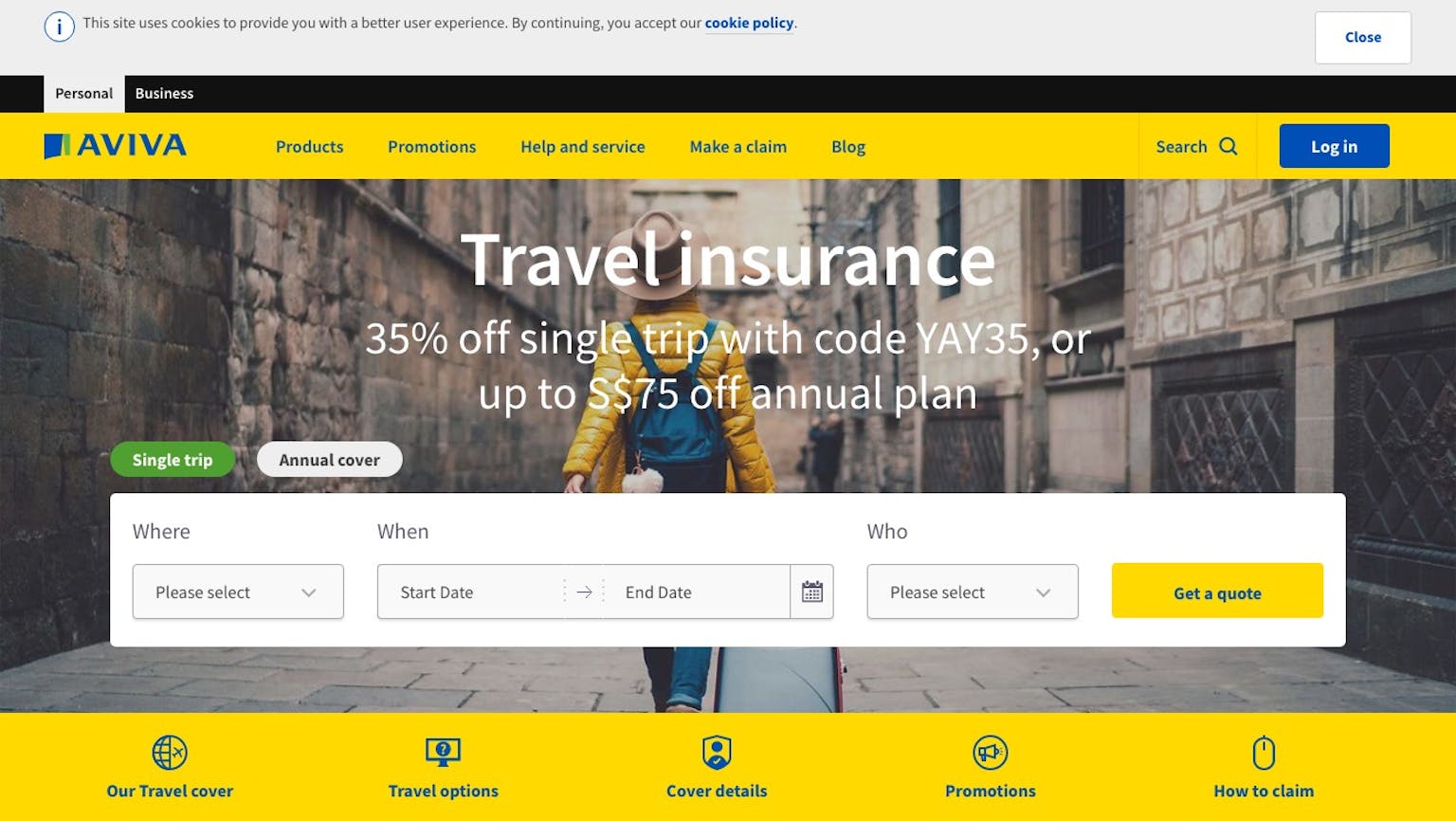

Insurances covers medical bills, hospital bills and surgical bills. It can depend on what insurance you availed before. But most of the insurance that are being offered has medicinal coverage/ hopital coverage that will help you with the expenses. Saving for the future at a young age makes your life easier.