I want to register for Travel Insurance. So what I will have to follow which rules and what will need document?

Actually, I want to take Travel Insurance. So that in life sometimes will be Accident. So then some help could towards Travel Insurance. Because I'm a poor man. Therefore what I will have to follow which rules and what will need document?

No Name

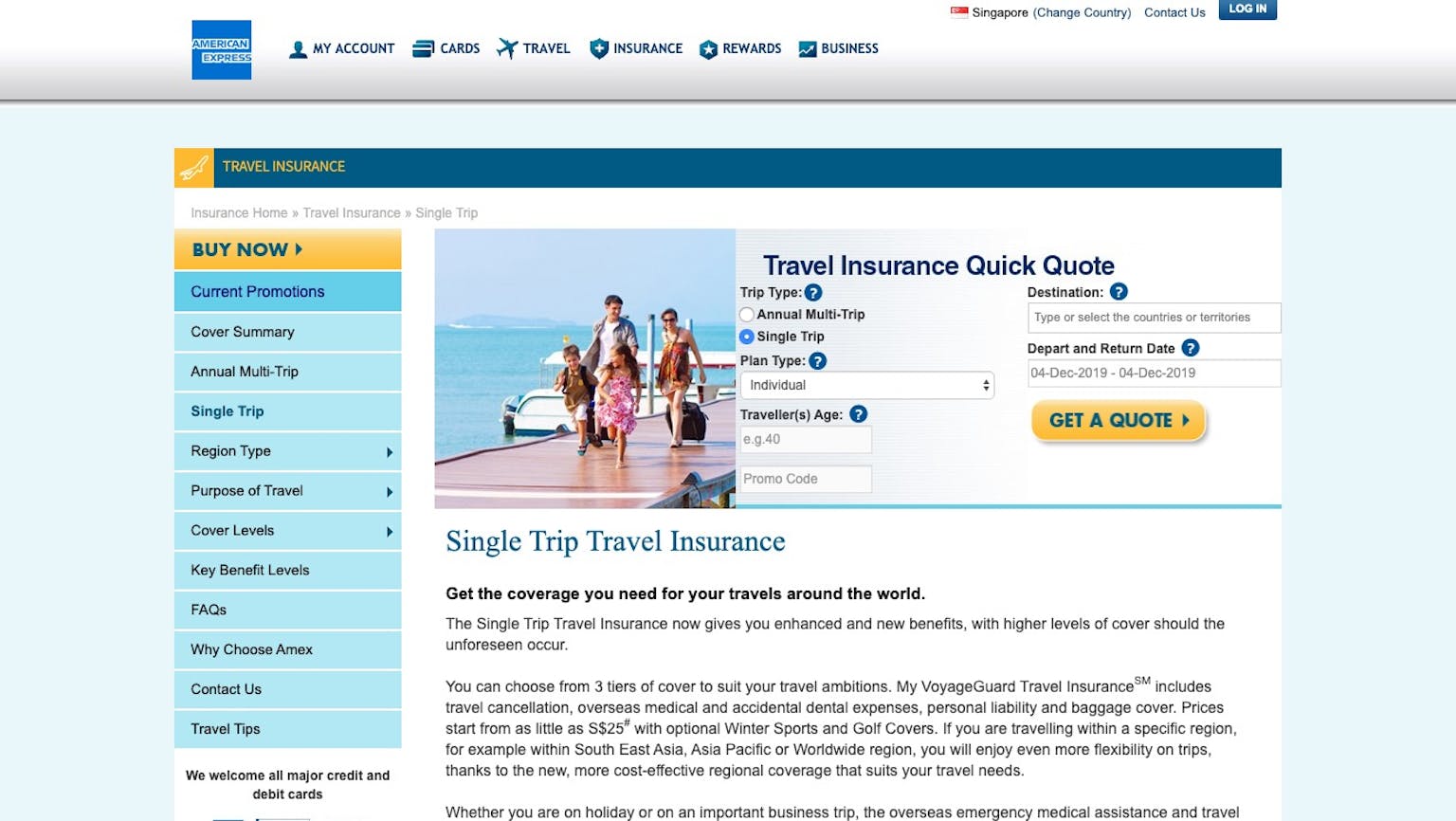

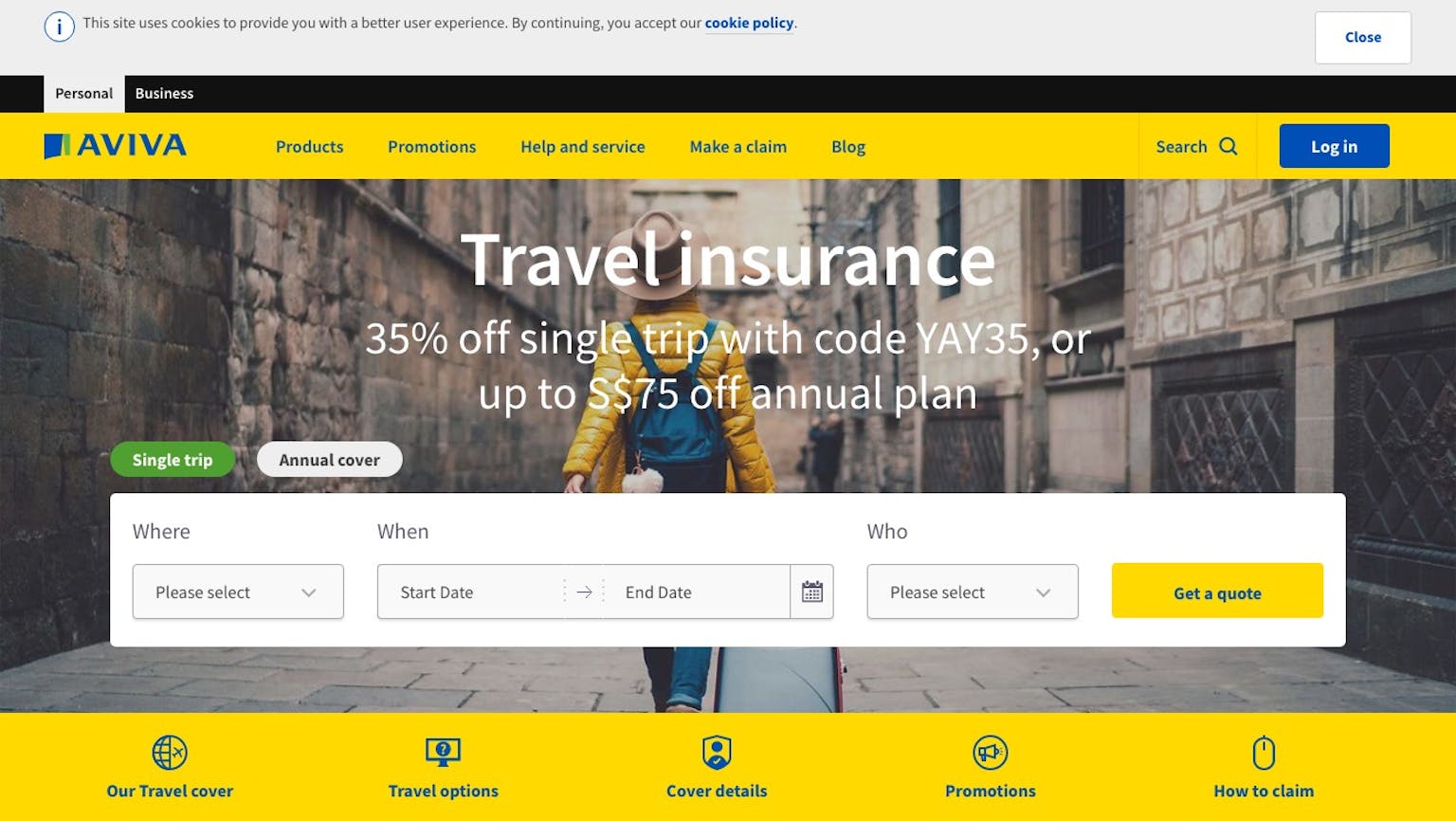

Basically, you need will have to these documents to register Travel Insurance. (1) Travel insurance claims form (2) Copy of Policy and policy number, Travel dates (3) Copy of tickets (4) Amount of loss (5) Identity card (6) Proof of age (7) Any government documents If you've these all documents so you can easily register Travel Insurance. There's no problem. And talk is of the rule. So rule does apply on the document. And if you've legal documents. So it's no problem! So go and register!