I have been fraud by the insurance company.

I got an insurance as soon as possible, because my friends told me that it is much better to have insurance as young as possible so that in the future you get the benefits and your investment on the insurance will grow. I suddenly needed my insurance because I had an accident, but when I tried to check with my insurance company. They are not responding to my calls and messages. I think I have been fraud by the Insurance company I have applied.

No Name

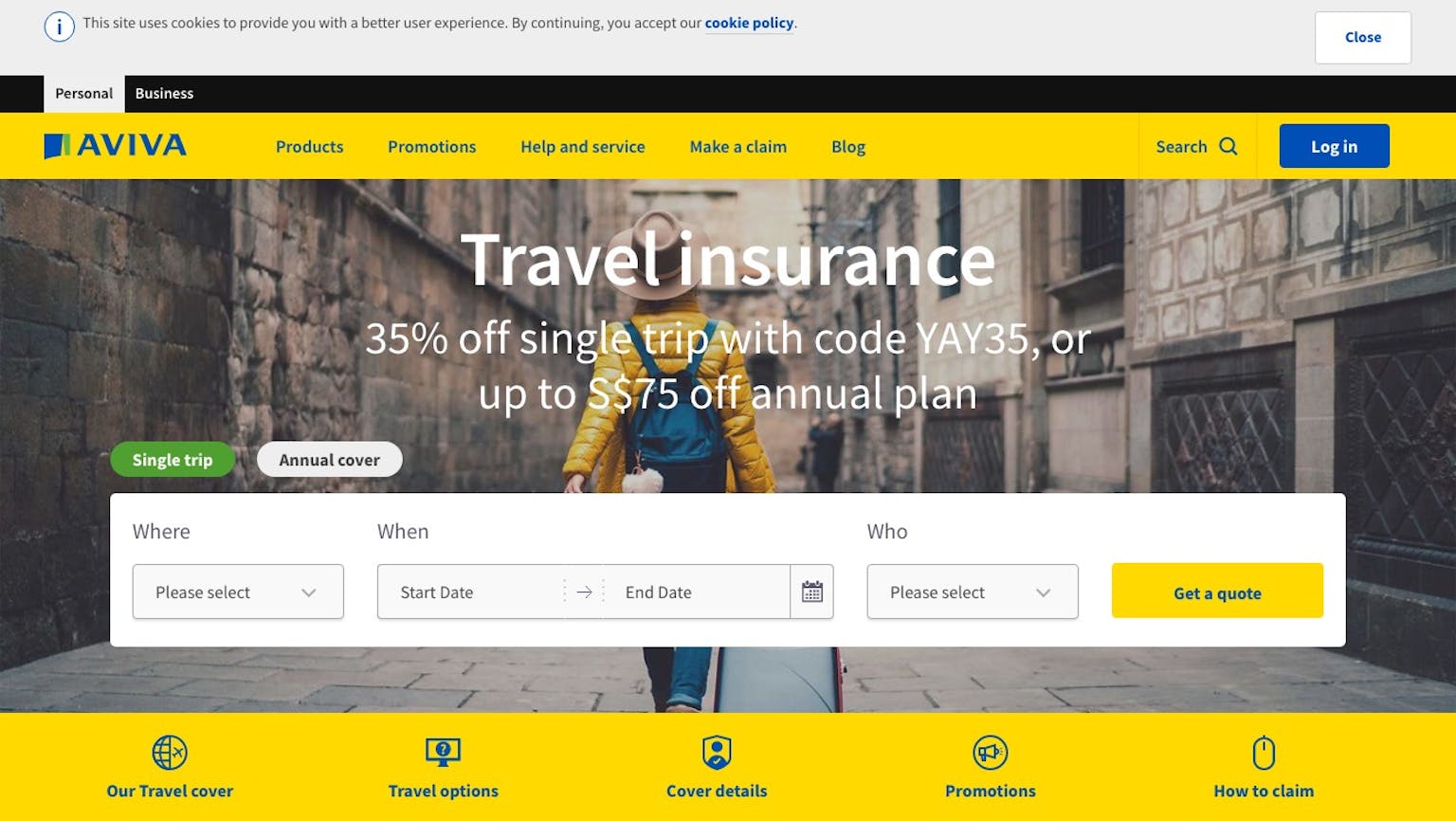

Insurances companies comes from different countries that have different branches from all over the world. But there are companies who offers insurance that has great offers that will lure you to them. It is not a good thing to invest on insurance companies that seems fishy. Always background check the insurance company before availing one. If you know a insurance company that is a fraud, report the to the authorities for them to handle.