An overseas worker needs his insurance abroad.

An overseas worker that is a resident in Singapore needs his medical insurance right away due to an accident that happens to him abroad. He is conscious but he needs to pay the bills from the hospital. The hospital asks if he has insurance, but he is in another country and he doesn't know if it is covered by his insurance while abroad.

No Name

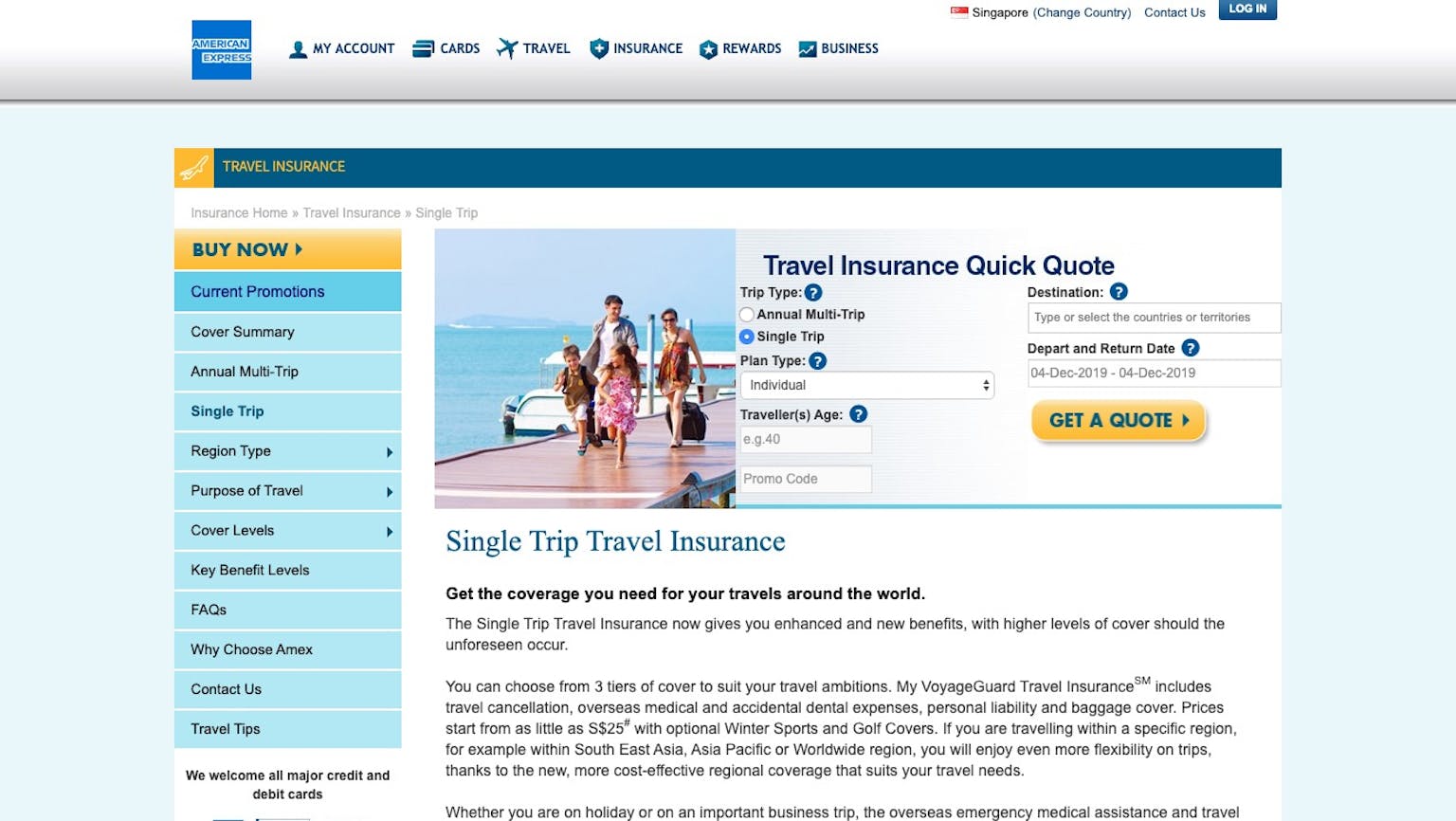

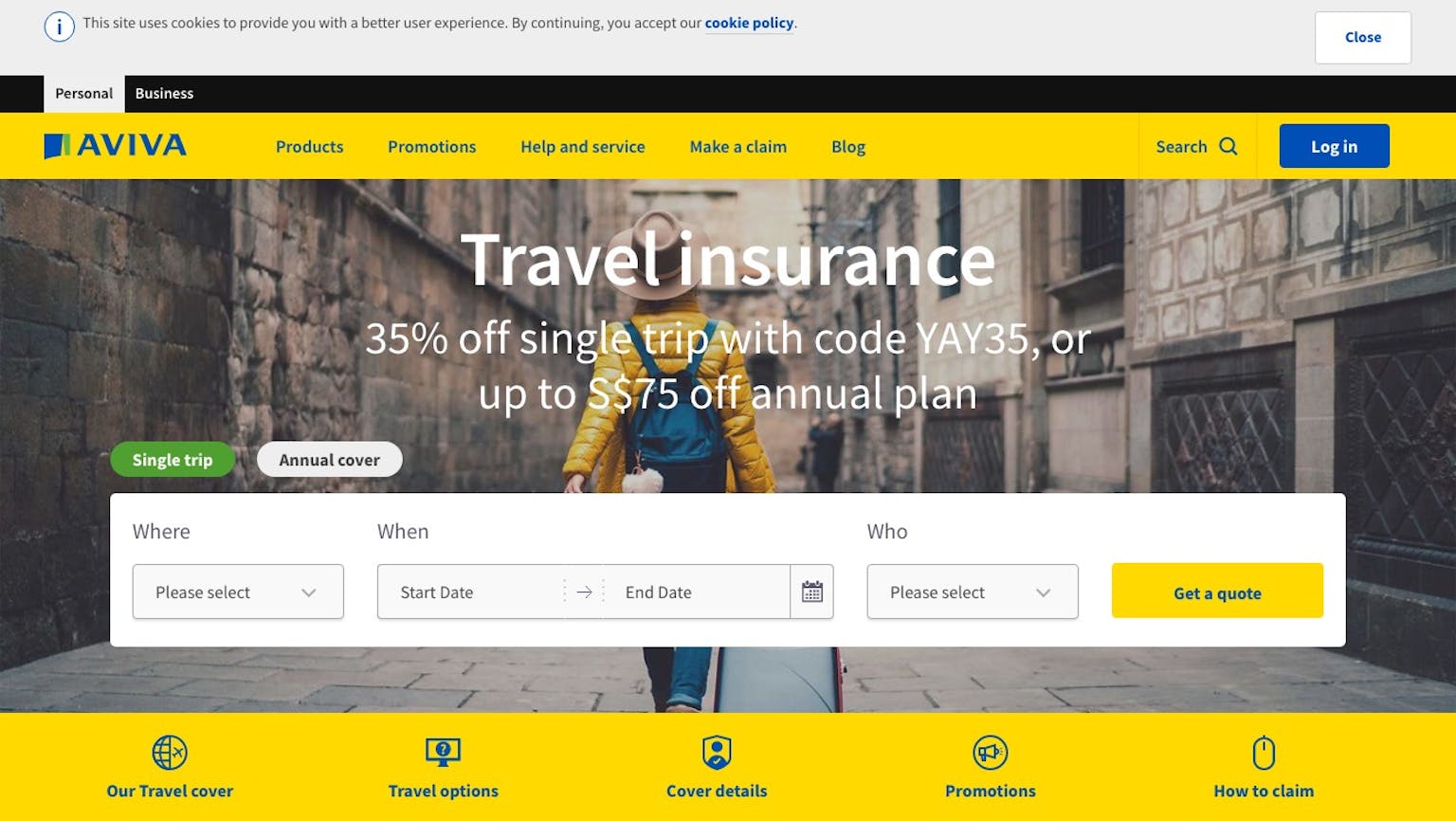

It is a good thing to avail insurance while you are still young to be protected whenever an accident happened to you. Many insurance companies will satisfy your needs that you will benefit from soon. Most of this insurance can cover you even in abroad. You just need to give your details to confirm if you have availed it.