Technology is prevalent today as never before. The internet is one of the highest recognized tools today that even a small child can navigate. You can quickly find new information that you didn't know before. Plus, everyone I know has a smartphone that can connect you to the internet in just seconds. Did you know that developers have also created specific tools called 'Apps' for you to download to your very own smartphone? These 'apps' or mobile applications were originally proposed for productivity assistance for emails, calendars, and contact databases, but the public demand for apps caused an accelerated extension into other areas such as ordering food, playing mobile games, and connecting to social media. But here's a topic to consider - have you thought that one of these apps on your phone could help you save money?

Seriously instead of wasting time playing video games on your phone, why not take some time to reconsider what you download into your phone to enjoy some extra cash in your wallet.

Here are some 'Apps' that Singaporeans are using right now to help manage money and save money on a variety of topics from dining and travel to beauty and entertainment!

Let's take a look at a couple of these apps:

TierneyMJ/shutterstock.com

Vaniday - Beauty Booking App

Vaniday offers 10% cashback on every booking you can do for your next appointment. Other salons also list exclusive promotions with Vaniday cashback and flash sales. If you are interested in getting a manicure or pedicure for a great price I would highly recommend taking a glance at this app. You can download this app on the Apple App Store or Google Play store.

But what if I'm not into manicures and pedicures? Don't worry, there are other apps we will explore. Does traveling at a cheaper cost stir your curiosity? No need to look any further try looking into downloading the app called Klook

Klook: Travel Activities, Day Trips & Guided Tours

Klook helps you find and reserve travel experiences and dining vouchers at discounted prices. Keep your notifications turned on for this app because discount codes come with minimum spend and seasonal promotions! The app is available on the Apple App Store and Google Play.

ShopBack | Cashback on Shopping & Restaurants

Shopback is a must have when it comes to apps! The app partners with many websites to bring you cashback on your spending. In order for you to receive the cashback reward, you will have to buy via the app or be redirected from their website. Once you earned at least S$10 of cashback, you can withdraw it and deposit it into your bank or Paypal account.

These are just some examples of the top three apps that can help save you money by not spending full prices on certain items.

The apps discussed above are great for the average consumer who wants to save a little money but if you are serious about saving money, by restricting how much you spend every day and growing a potential savings account take a glance at the next list below.

The apps listed below are the next step above from your average consumer savings.

Hektor

Hektor is a savings app that aids you in developing a habit for saving money by automatically transferring money from your bank account (through your personal debit card) to your Hektor savings account.

You have total control of this app, you set the rules and goals of what you want to achieve. Did you know that Hektor comes with AI (Artificial Intelligence)? Hektors AI can detect when you save money, for example, if you decided to skip Uber today and concluded that the restaurant you liked was actually closer than you thought. Hektors AI can detect how you saved money just by skipping Uber.

It is important to note that the set amount of money you would have spent would be automatically transferred into your Hektor savings account (your savings are kept in CIMB Bank, Singapore) Then the AI in Hektor splits the savings amount into your goals you created.

But the only drawback from this app is that you don't earn any interest on your Hektor savings account plus some people don't feel easy putting their personal money into the app.

Spendio - Spending Tracker for iPhone & Apple Watch

https://spendio.io/

There are tons of apps that can help budget your money but what makes Spendio stand out from the rest? Spendio is a spending tracker for iPhone and Apple Watch moreover it’s one of the best there is.

This app is appealing to the eyes with its modern interface that helps you track your spending, create goals and manage multiple wallets of different currencies. If you own an Apple Watch you can tell your Watch how much you spent and the language processing algorithm will fill in the transaction type, amount, and category for you.

Seedly

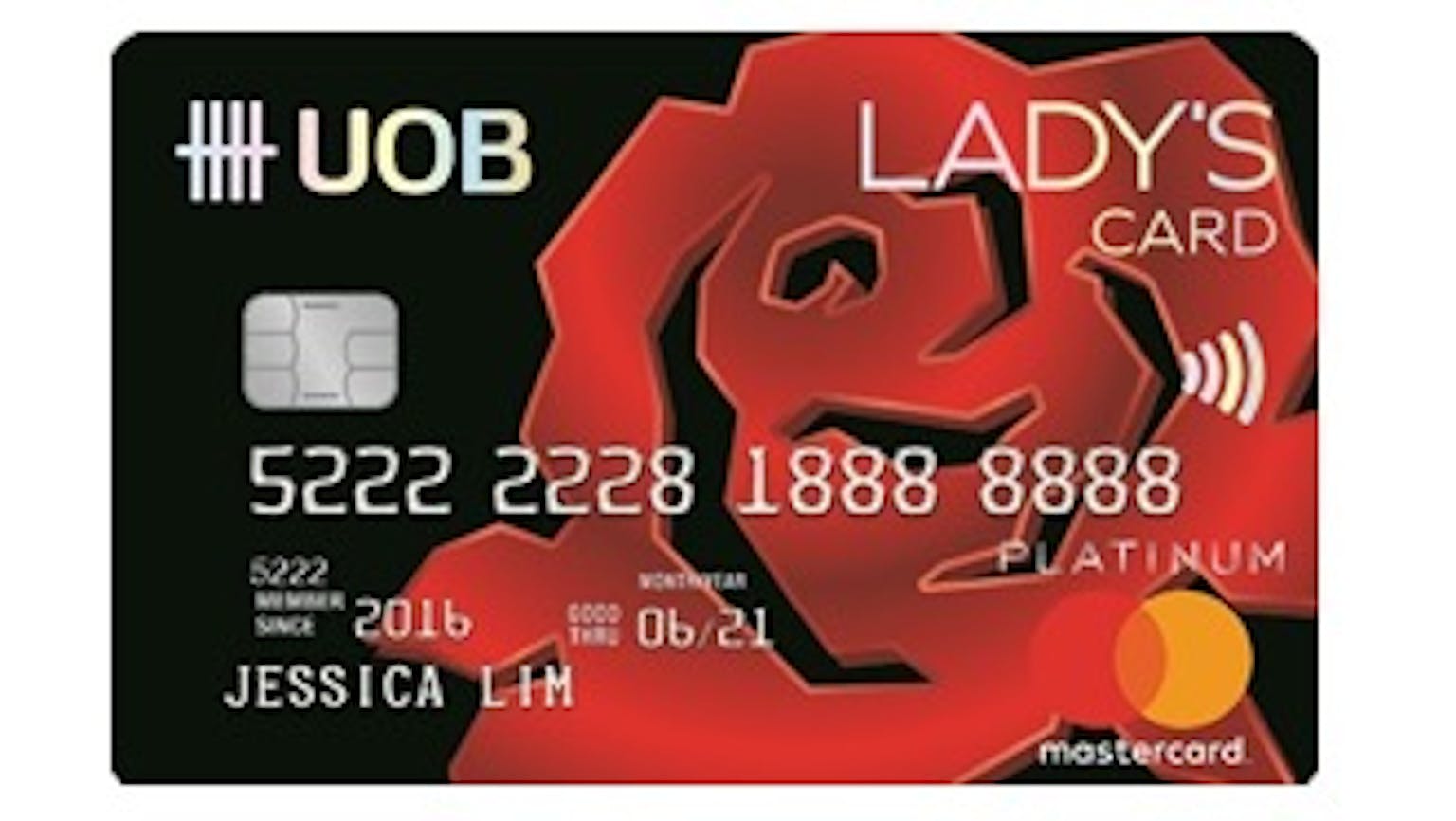

Seedly main goal is to be a reliable financial app for Singaporeans to manage their money. What makes this app stand out from the rest is that it has the ability to sync and import transactions from banks. Here's the list of banks that Seedly is in connection with such as DBS, POSB, OCBC, UOB, Standard Chartered, Citibank, American Express and credit cards.

In other words, you can view your account balances and expenses from various bank accounts and cards all in one place. While the app has room for improvement, it is on the list for its potential.

There are many more apps out there that can help improve how you save money but the list provided is a quick glance at a top few apps that are being used today. Technology is moving more rapidly than ever before so what's holding you back from saving yourself some money? Start today by exploring these apps and watch how rapidly you'll be saving money today!

Please leave your knowledge and opinion!