What is a Deposit Insurance?

Onchira Wongsiri/shutterstock.com

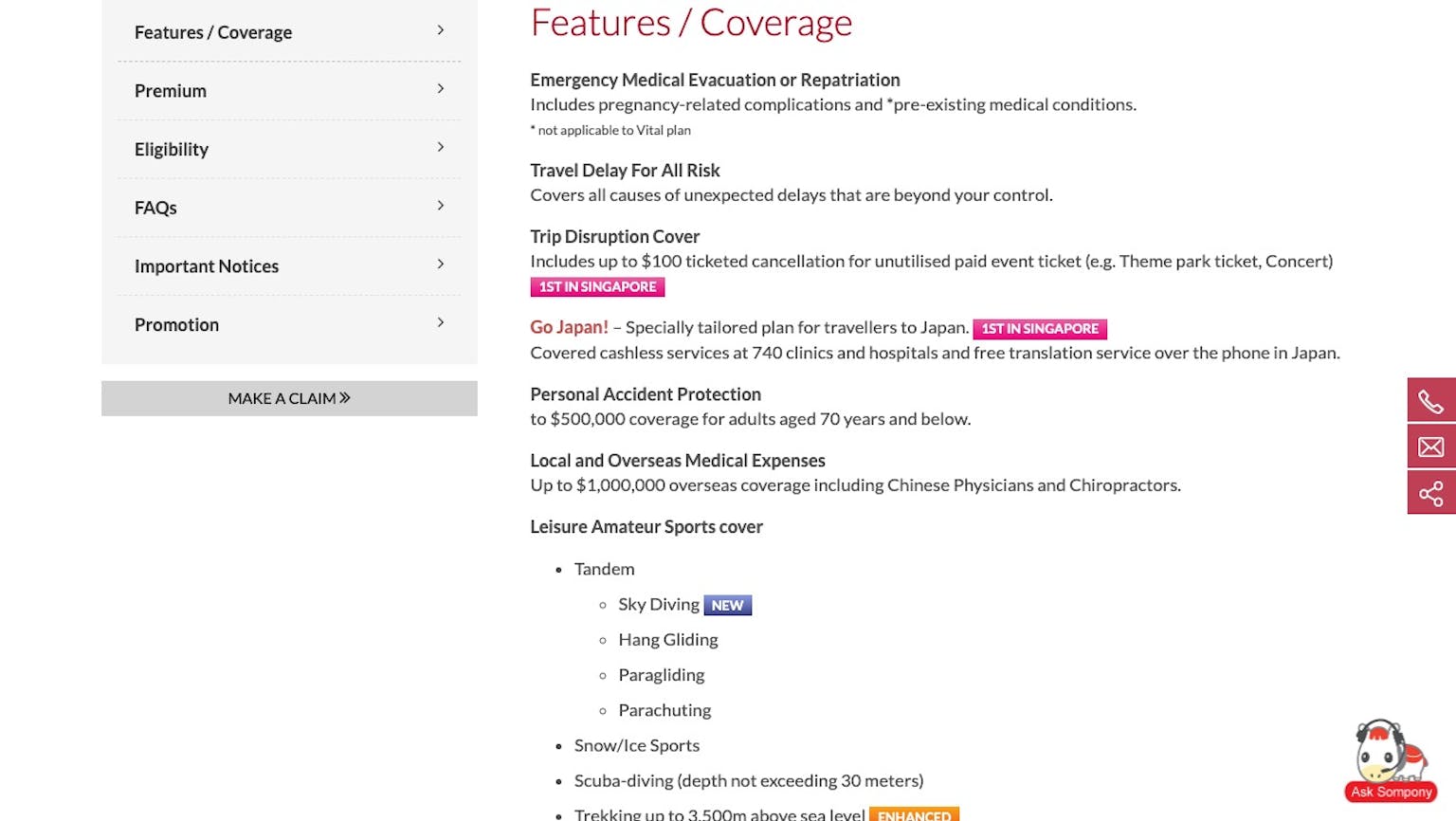

The Deposit Insurance Scheme provides a simple degree of safety to small depositors. The Singapore Deposit Insurance Corporation (SDIC) administers the scheme in Singapore. Currently, the Deposit Insurance Scheme protects non-bank depositors (individuals, charities, sole proprietorships, partnerships, companies, and unincorporated entities) by using overlaying their SGD monies placed with a Scheme member, for up to $50,000 per depositor per Scheme member. The maximum stage of insurance will be accelerated from $50,000 to $75,000 with impact from April 1, 2019.

Key points to consider: - The Deposit Insurance Scheme protects your deposits with a member bank for up to $50,000 per depositor per bank. - The coverage will be accelerated to $75,000 with impact from April 1, 2019. - All full banks and finance corporations in Singapore are contributors of the scheme.

What Happens If a Financial Institution Fails?

International journey has shown that banks can fail. Depositors can lose their financial savings even in official and well-supervised jurisdictions. While our banking system stays sound, matters can go wrong in ultra-modern complex and globalised environment.

In a financial institution failure, normal depositors may suffer the loss of their core savings. These are the money they need to get on with their lives — money for groceries, school fees, utilities, smartphone bills, etc. before the subsequent pay cheque comes in.

Scope of Deposit Insurance Coverage

Types of Depositors Covered

SDIC covers folks and other non-bank depositors with insured deposits positioned with a DI Scheme member. Other non-bank depositors encompass sole proprietorships, partnerships, agencies and unincorporated entities like associations and societies.

Types of Credit Score Merchandise Covered

SDIC insures Singapore dollar denominated deposits positioned with a DI Scheme member in any of its branches in Singapore. These include:

- A credit held in a savings account - A savings held in a fixed credit score account - A credit score in a cutting-edge account - Any monies placed under the CPF Investment Scheme - Any monies placed under the CPF Retirement Sum Scheme - Any monies placed under the Supplementary Retirement Scheme - Murabaha, as prescribed through the Authority Each DI Scheme member continues a register of insured deposits it offers. To locate out if a credit score account supplied by using your financial institution or finance corporation is insured, you can refer to the institution's register of insured deposits.

Types of Deposit Merchandise Now Not Covered

Financial products that are no longer insured via SDIC include

- Foreign money deposits - Structured deposits - Investment merchandise such as unit trusts, shares and different securities - Investment products like shares, unit trusts

Because these merchandise elevate higher risks and do not form section of the core savings or transaction money owed of small depositors. Those who purchase them should be organized to count on the greater dangers for the doubtlessly higher rewards.

Do You Want to Know If Your Deposit is Insured?

With banks and finance groups constantly creating new products, it can be hard to recognize which deposits are included via credit insurance and which are not. An convenient way to get such facts is to go to their internet site or any of their branches and ask for their register of insured products.

How Deposit Insurance Works

If a Deposit Insurance Scheme member fails, the MAS will request the Singapore Deposit Insurance Corporation (SDIC) to step in. The SDIC will put its crisis diagram into action. Arrangements will be made for depositors to be paid both by cheque or thru accounts opened for them in some other financial institution.

The SDIC will make the compensation from insurance premiums that DI Scheme contributors pay every 12 months below the Deposit Insurance Scheme.

For deposits:

The money that you deposit into every bank is assured up to 50k SGD per bank per character person. Meaning if you location deposits in financial institution A, B, and C, if they all give way and are unable to supply you again your deposits, SDIC will step in and provide you your deposits returned (up to 50k per bank, nothing more). Makes you sleep better at night, we suppose so anyway. Not all deposits are equal though. Money in savings accounts, constant deposits, CPS Investment Scheme accounts, CPF Minimum Sum Scheme money owed , SRS bills are all included and claimable.

**Not covered: Structured Deposits (a type of fairly hazard free investment), foreign money accounts, and investment products like unit trusts are now not blanketed underneath this scheme.

For Insurances:

The guaranteed sum assured quantity as properly as guaranteed give up fee quantity per character per insurer is guaranteed up to 500k (for sum assured) and up to 100k (for lay down value). Meaning if you have insurance plan policies with insurers A,B, and C, if they all give way and are unable to pay you your respective sum assured amounts, SDIC will as soon as once more be a hero and give you your dues (up to each respective cap). Even sounder sleep for all of us.

Unlike deposits, it appears that most insurance policies (the common and popular ones anyway) are all included under this scheme. You named it: Term, Whole Life, Endowment, Annuities, A&H (accident and health) policies are all beneath the umbrella of safety of SDIC.

Behind in Charge of Deposit Insurance

The Singapore Deposit Insurance Corporation (SDIC) administers the Deposit Insurance Scheme in Singapore. The board of SDIC is to blame to the Minister in cost of MAS.

Why Deposit Insurance is Mandatory

Yes, Singapore's banking machine is secure and well regulated. The MAS has policies to make certain that banks and finance agencies are properly managed, properly capitalised and have adequate liquidity to meet any unforeseen needs.

Deposit insurance is simply another layer of protection for small depositors. These are well-deserved financial savings and whilst the going is good, it is higher to build up an insurance fund than wait for a crisis to happen. Experience someplace else has proven that if you have a mechanism in location to warranty the safety of deposits, humans are much less possibly to panic if and when things go wrong.

Money Back After Bank Collapses

The SDIC guarantees depositors that they will get up to S$50,000 returned in the match of a financial institution failure. This will be executed right away both via cheque payments or credited in an account opened for you in every other bank.

Note: SDIC is absolutely free of charge and automatically set in location for all Singaporeans. With it protecting deposits and insurances, virtually speaking, consumers need now not subject themselves too plenty with the deposit ranking of each financial organization for the reason that there is an inherent protection net

Other depositors suggested that…

Deposit Insurance Must Raise the Coverage Limit

Beyond S$50,000 coverage, the incremental advantage of DI is small and may now not justify the cost. As our goal stays that of small and individual depositor protection, a coverage limit of S$50,000 would balance the objective of depositor protection, with different goals of limiting the fee of DI to Scheme individuals and depositors and retaining the incentives for large depositors to exercise market discipline.

Combination of Monies under Sole Proprietorships and Partnerships

For the purpose of identifying DI compensation in the case of an individual who is additionally a sole proprietor, deposits of the individual in his own name would be aggregated with his enterprise deposits with the identical Scheme member, since operationally, he might also commingle these deposits. However, for a partnership, it should be challenging to separately discover an individual’s share of deposits as partner, especially in the case of larger partnerships, and to aggregate them with his non-public deposits. Hence, we recommend to treat a partnership as a single entity for the purpose of DI compensation.

Gross Payout Approach

The gross payout method for DI does no longer mean the depositor’s liabilities to the Scheme member are written off as the depositor remains responsible for any liabilities owed to the Scheme member. The liquidator would be empowered to recover this amount from the depositor. As this proposal involves a departure from everyday insolvency law, MAS is also seeking the views of different Government agencies with obligations for corporate regulation and the prison framework.

Please leave your knowledge and opinion!