OCBC's debt consolidation loans charge slightly higher interest rates compared to those of other lenders in Singapore. For this reason, the bank's product is not the most affordable. On the other hand, individuals who are unable to obtain the most affordable debt consolidation loan offers could consider applying for OCBC's Debt Consolidation Plan as a backup option. Unlike its competitors, OCBC does not charge a processing fee and it does not list rates "from X%", which suggests that its rates are more transparent and accessible. Another drawback of OCBC's debt consolidation loans is that they are only offered for tenures of 3 to 8 years, which is restrictive for individuals that would prefer a longer or shorter term debt consolidation plan.

No Name

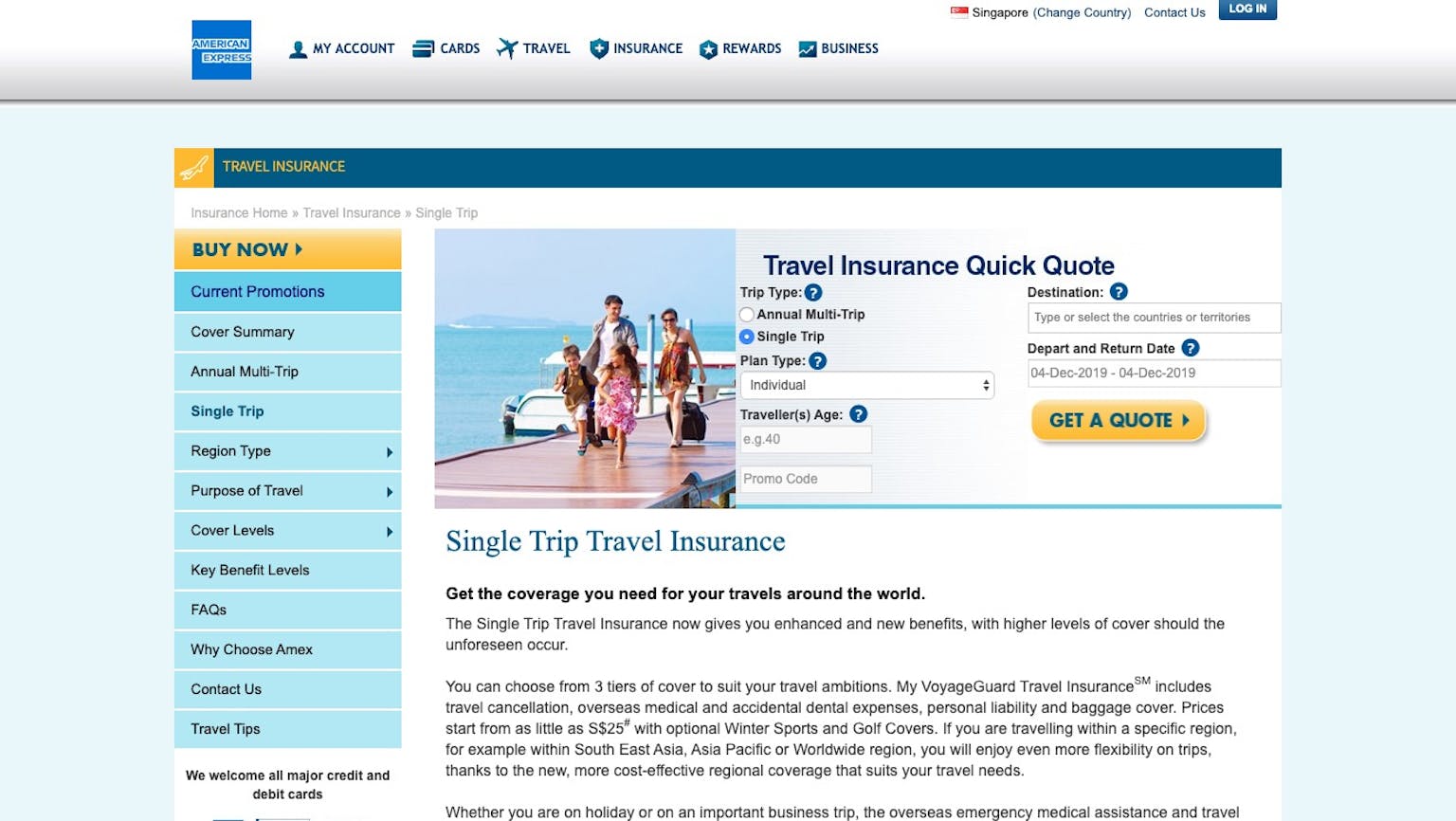

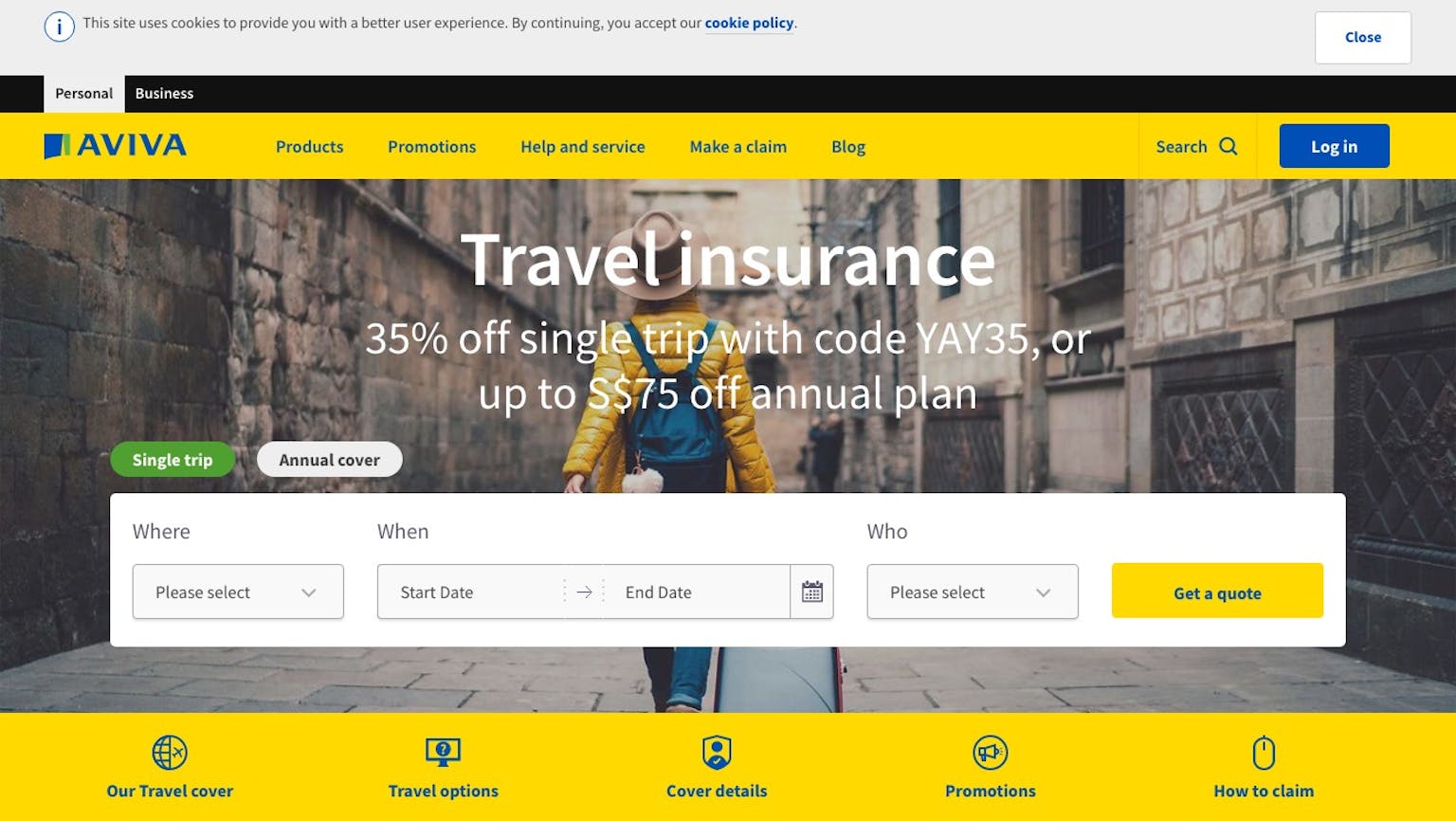

It is best to have him buy from his local insurer in Singapore. If you note the T&Cs for travel insurance state eligibility by typically residing in Singapore is required etc. For example they can specifically state that your travel has to start and end in Singapore.