How can I assure that the insurance company is legit?

There are many scammers out there. No one wants to spend money on something that would not benefit them or would get anything out of those. There are a lot of offerings that people keep on advertising to me. I do not know which are legit and which are scams. I want to ensure that the company that I will involve will secure my money and insurance.

No Name

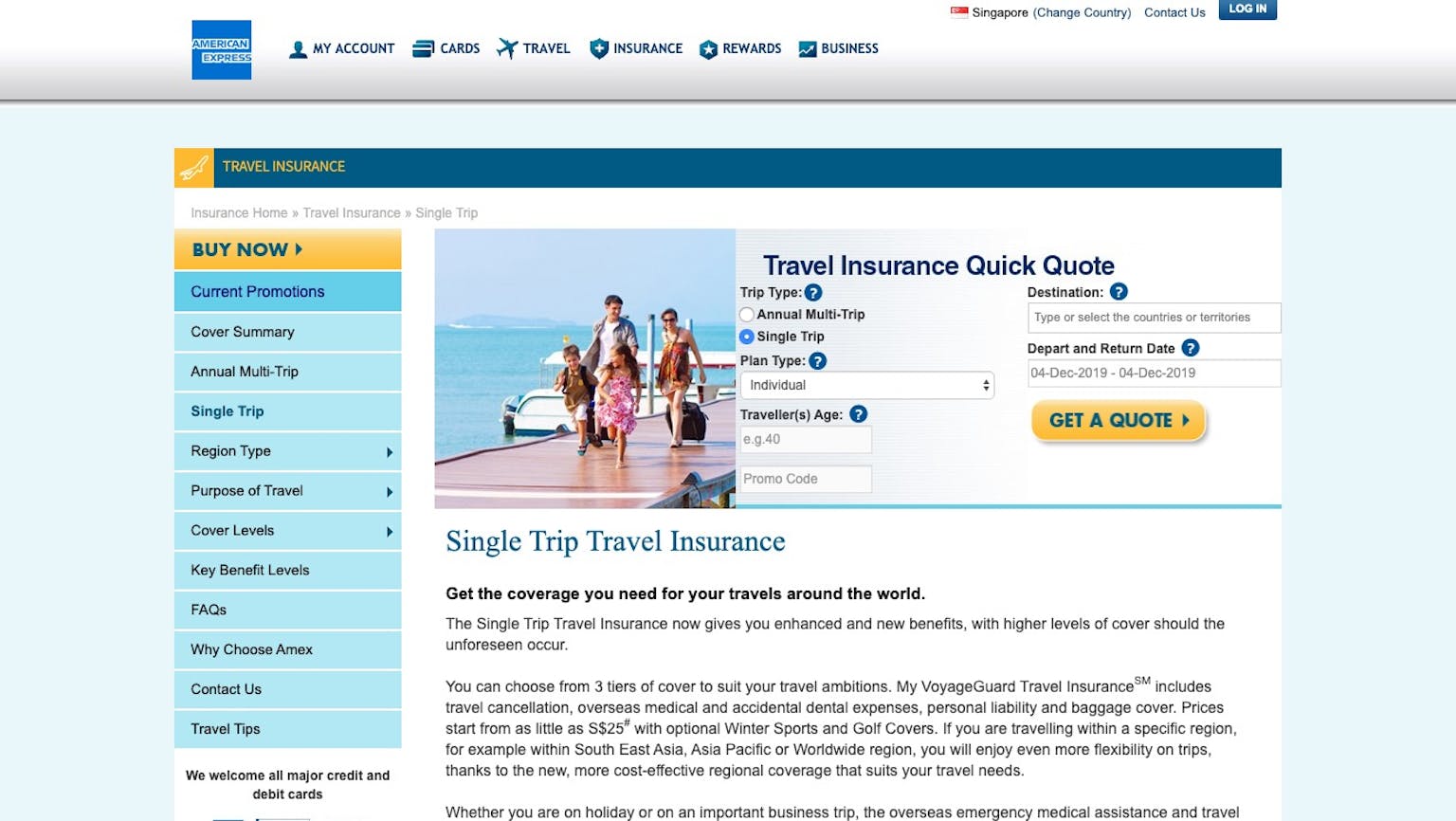

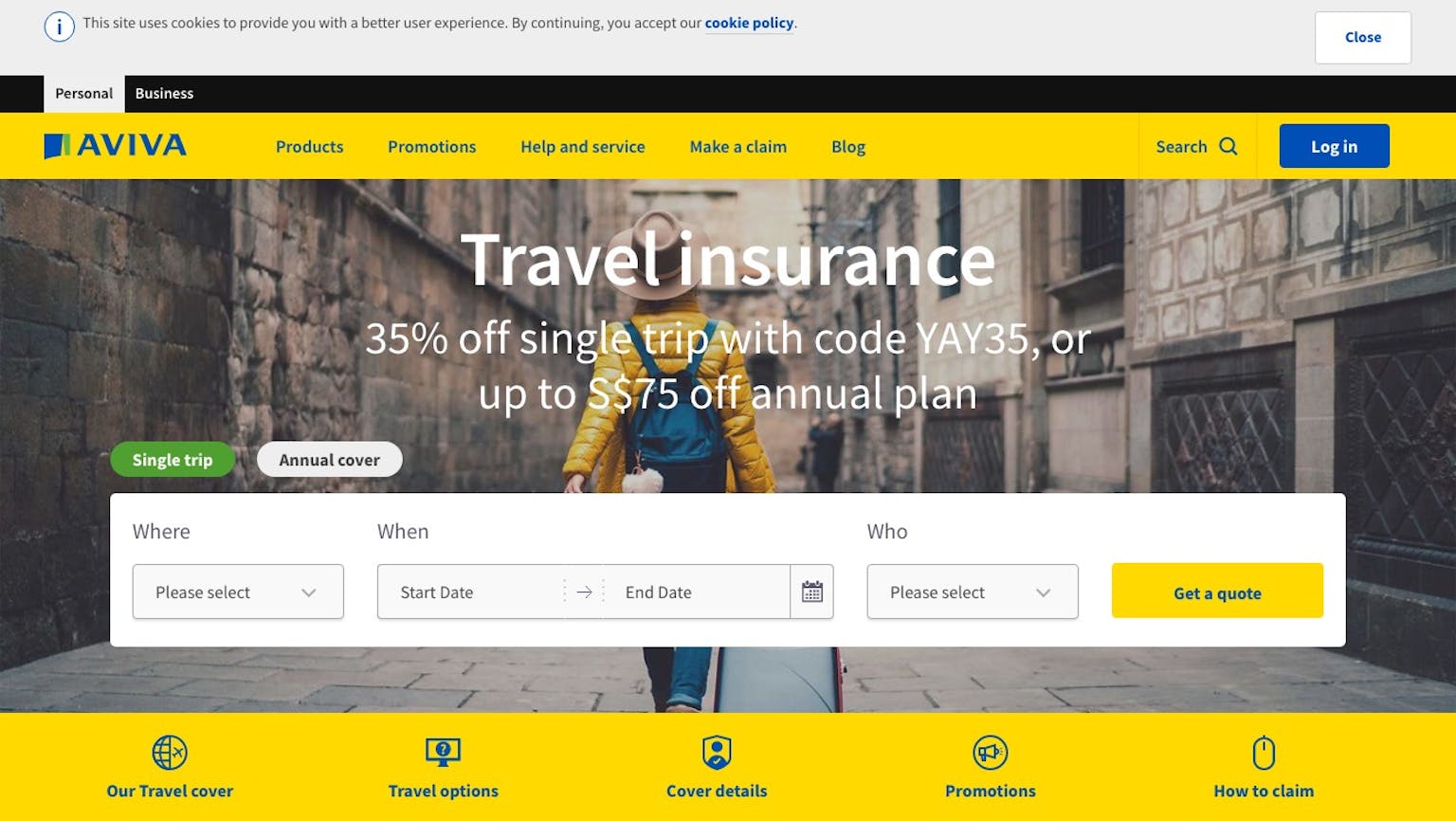

Insurance companies today are expanding and have a lot sister companies or even subordinates. It is hard to distinguish if these companies are even legit or legal. You can visit the website of these insurance companies to see what are the feed backs. There are also great advertisments that is recognized by the government.