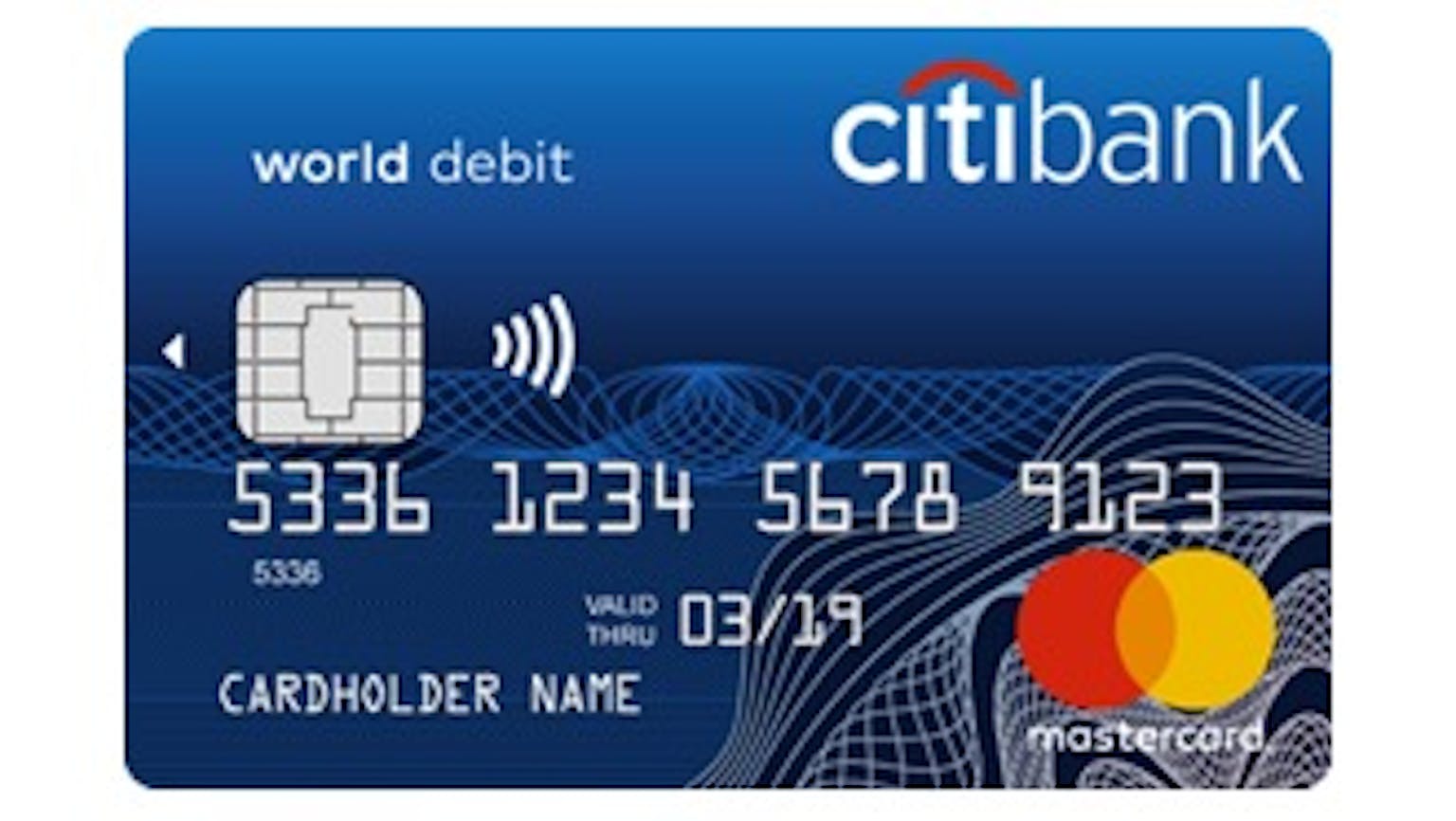

Who can please tell me the major difference or differences between the Citibank Debit MasterCard and the Citibank ATM Card?

What can someone point out to me has a difference between the Citibank Debit MasterCard and the Citibank ATM Card, how do I make the conversion from a Citibank ATM Card to a Citibank Debit MasterCard, and how can it be used?

No Name

Actually, the Citibank Debit MasterCard lets you withdraw cash from ATMs and can be used to make purchases at MasterCard accepting merchant locations. Furthermore, you get to enjoy Citibank's signature array of worldwide privileges whenever you use your Citibank Debit MasterCard. You may visit any of the Branches to apply for the conversion from Citibank ATM Card to a Citibank Debit MasterCard or contact 24 Hour CitiPhone Banking online. You can get to enjoy shopping at millions of MasterCard merchants globally, simply by signing for your purchases at places like restaurants, bars, groceries and daily needs, fashion apparels, pharmacies etc.