What is the auto-activation magstripe feature of the DBS Takashimaya Cards all about?

I will be grateful if someone can educate me on the auto-activation magstripe feature of the DBS Takashimaya Cards and how soon after successful completion will my card’s magstripe be activated or deactivated as the case may be?

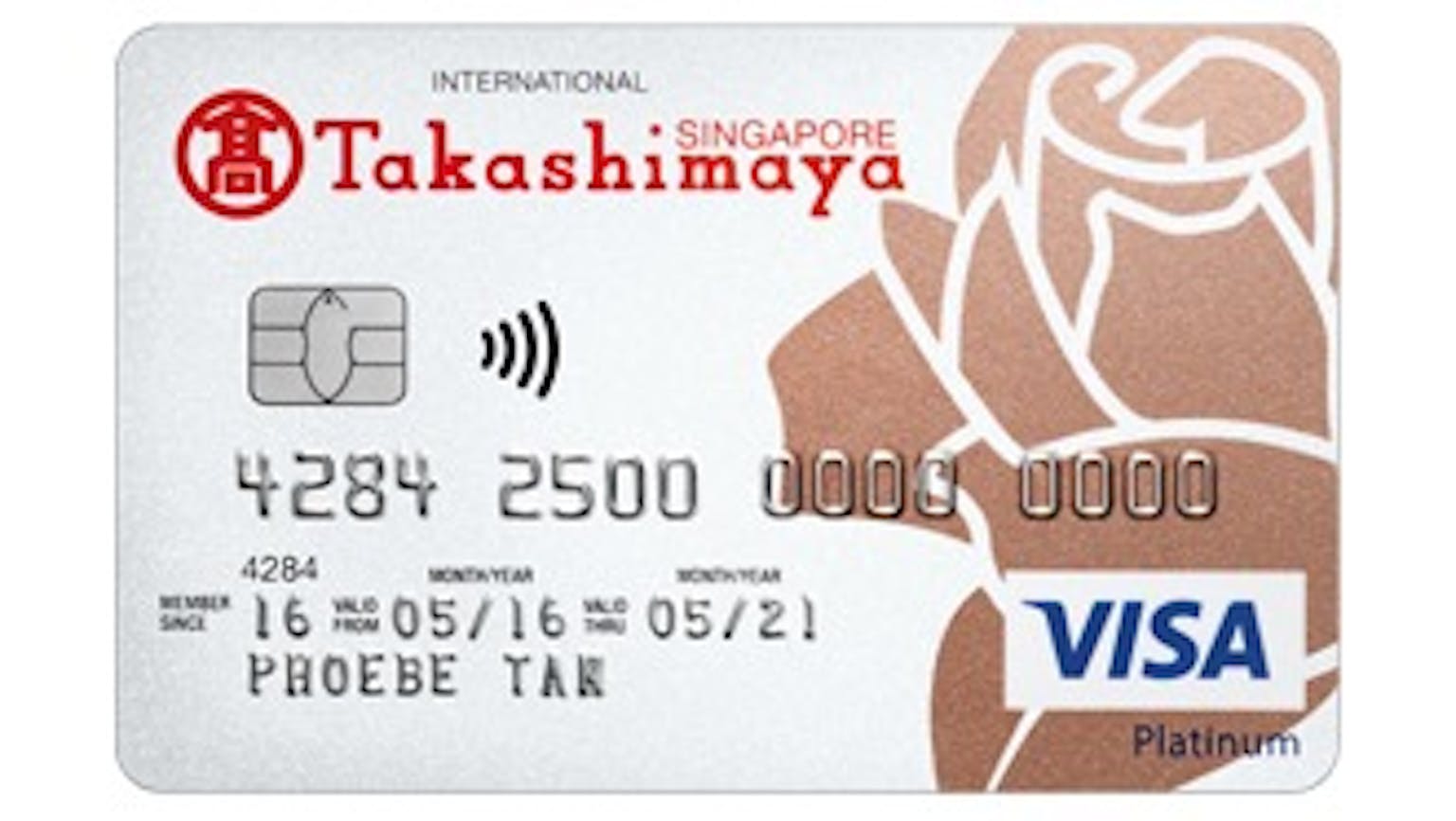

Products mentioned in this forum:

No Name

The auto-activation magstripe feature is a new feature only available on the DBS Lifestyle app. Once you have enabled the auto-activation magstripe feature, it will detect your device’s location and automatically activates your card’s magstripe when you travel, and deactivate it when you are home, in the process providing you convenience and card security.