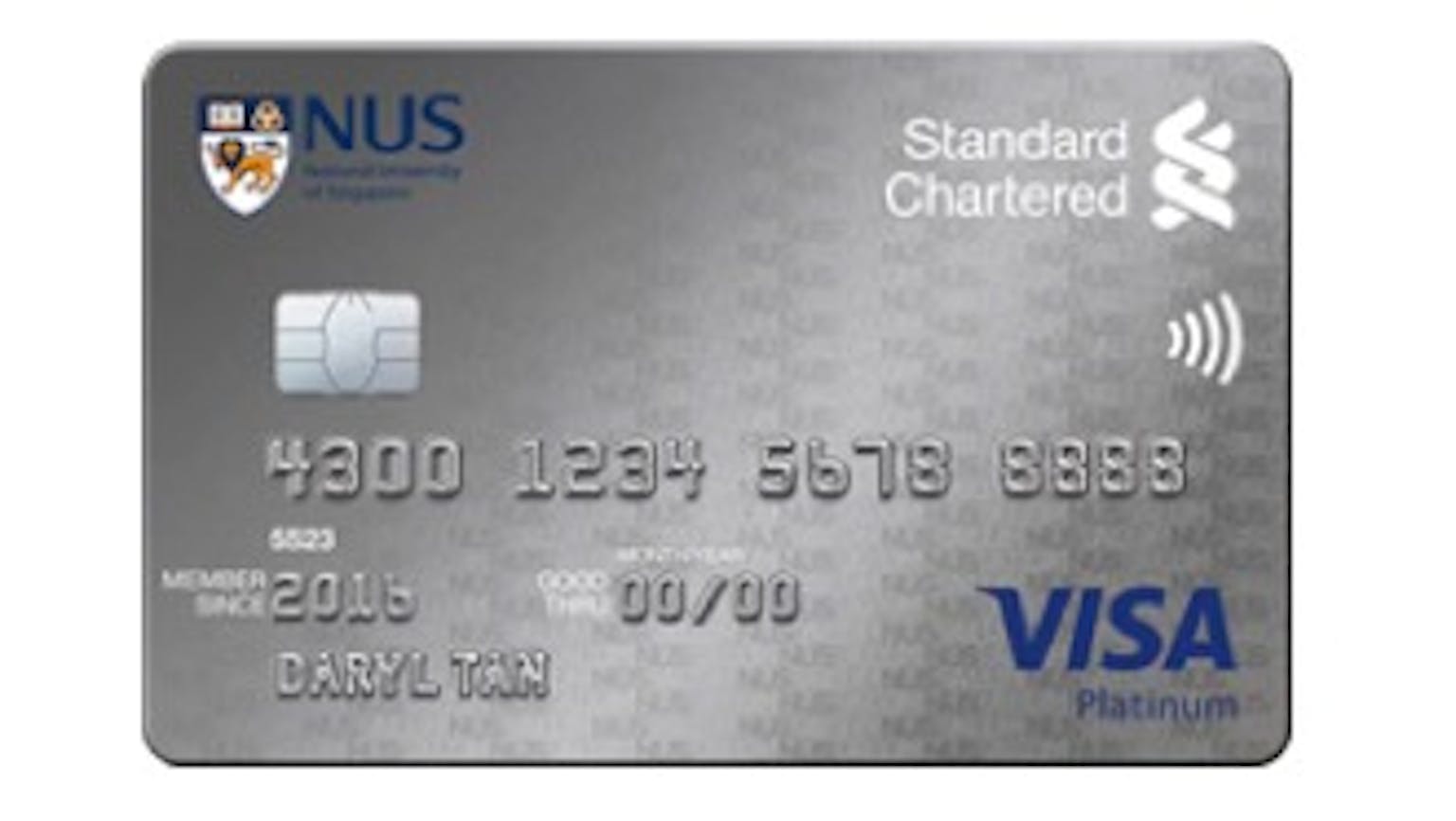

Are my personal information’s safe when paying with Visa PayWave via my NUS Alumni Platinum Card?

I am in search of a credit card that will give me ample spend freedom and also allow me to contribute to my alma mater at the same time. So I was recommend the Visa PayWave, would my information be safe when paying with Visa PayWave?

No Name

Yes! Visa PayWave transactions are just as secure as magnetic stripe transactions and are processed through the same reliable payment network. And, because you remain in control of your payment device during Visa PayWave transactions, the risk of fraud is highly reduced. With Visa PayWave, you don’t even need to enter your PIN number to pay. Since you keep hold of your device throughout, there is lower risk of fraud than with traditional swipe technology.