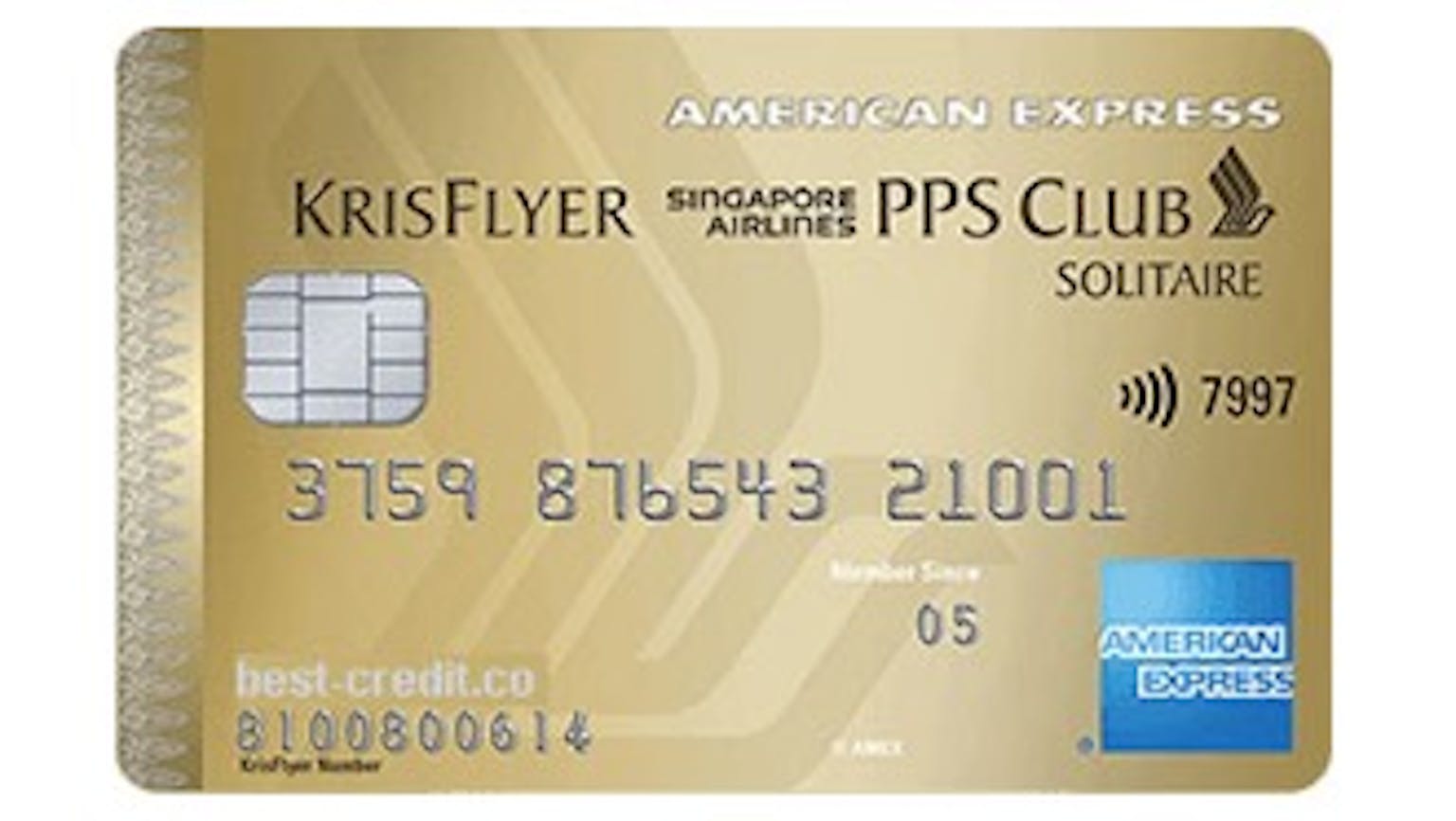

Anybody here willing to elaborate on the Amex Singapore Airlines Solitaire PPS Credit Card special introductory offer?

. I will be grateful for an explanation of the Amex Singapore Airlines Solitaire PPS Credit Card special introductory offer. I am considering purchasing the card, if the special introduction offer is exciting enough.

No Name

If I am correct, by special introductory offer are you referring to the promotion requesting you to purchase a Worldwide annual multi-trip called My VoyageGuard Travel InsuranceSM Essential plan at S$188 (Usual S$299)? Well that may be exciting but you should also know that if you Purchase your travel tickets with your American Express Singapore Airlines Solitaire PPS Credit Card, you receive free travel inconvenience & travel accident benefits of up to S$1 million. Then if you are one that does a lot of online shopping then shop with confidence as you are protected against any unauthorised charges made on your Credit Card, both online and offline. Finally the icing on the cake is that emergency Card Replacement within one business day, virtually anywhere in the world.