Are the OCBC VOYAGE Miles the same as the OCBC$ or OCBC Miles?

I would appreciate some clarifications as this is confusing to me, are the OCBC VOYAGE Miles the same as the OCBC$ or OCBC Miles and can VOYAGE Miles be converted to any frequent flyer miles with other airlines?

Products mentioned in this forum:

No Name

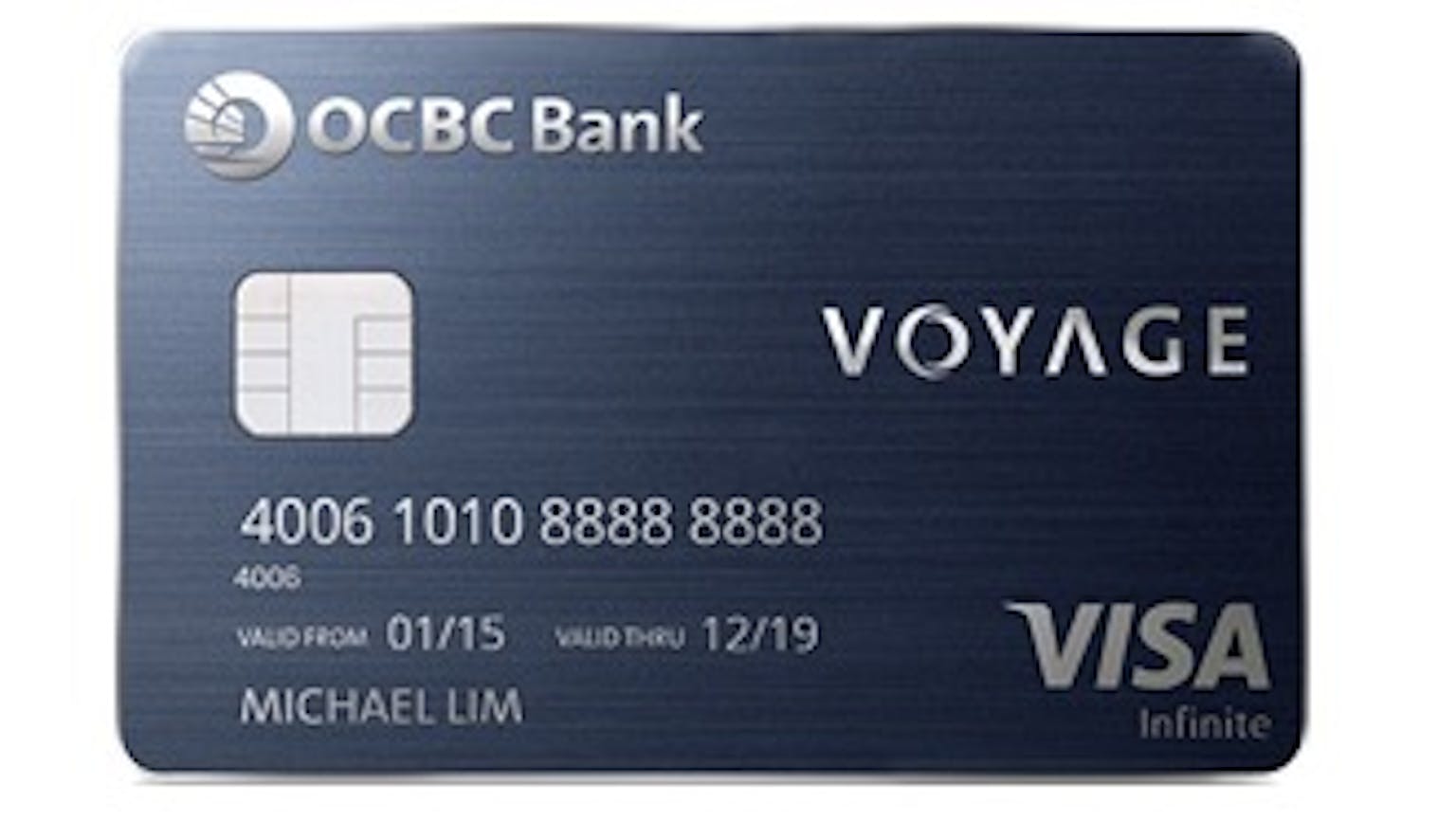

VOYAGE Miles are specifically unique to VOYAGE Cards only. VOYAGE Miles are very different from OCBC$, any other rewards programme offered by OCBC Bank or any other frequent flier miles. VOYAGE Miles are accrued only through the OCBC VOYAGE Card, OCBC Premier VOYAGE Card, OCBC Premier, Private Client VOYAGE Card or Bank of Singapore VOYAGE Card. VOYAGE Miles can be converted to KrisFlyer Miles. However, you should note that you can use VOYAGE Miles to redeem for flights on any airlines directly without converting them first.