Contract and agreements of owning a credit card

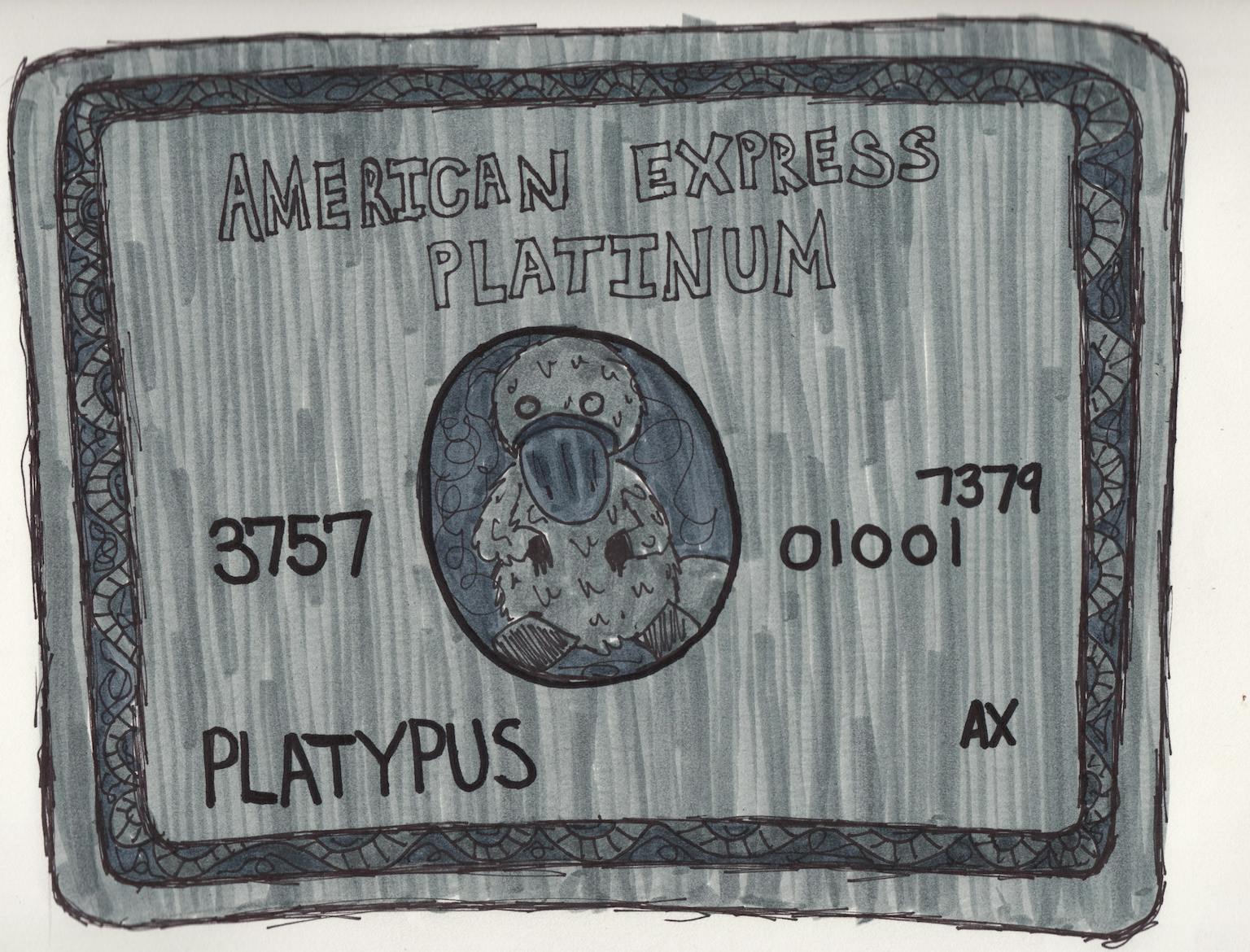

I am planning to get a credit card because I am planning to buy a printer, but I do not know how it works. I am afraid that this compay offering me a credit card is a scam. I want to deepen my knowledge regarding credit cards before I get one for myself. I also wanted to know what is the best company to get credit card wherein there is small interest.

No Name

Credit cards is like a loan but in the form of cards. Credit card, just like loans, allows us to borrow money from the bank for a period of time together with the borrowed money, you will also be need to pay interest. Before accepting the card, make sure that you have read what you are going to sign. The only difference in the credit card companies are the benefits you will get if you avail the card, plus the percentage of interest to the borrowed money.