Easily qualify for the various interest types like the base interest

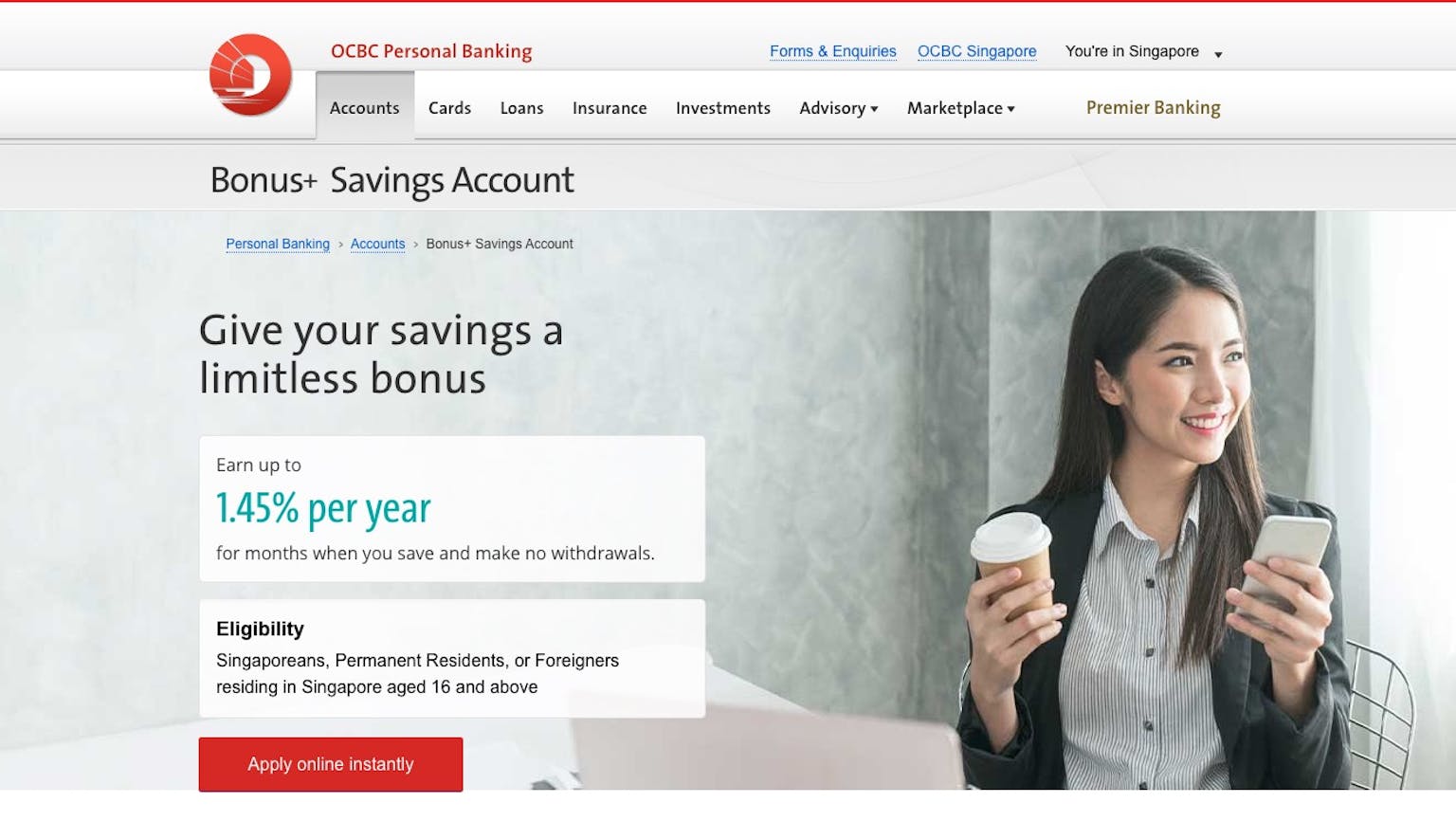

You can easily qualify for the various interest types like the base interest, which is accrued daily based on your account's day-end balance and you will receive this at the end of the month or the bonus interest were you earn 2 types of bonus interest on your account’s average daily balance and you will receive this on the 1st business day of the following month. You can earn a Monthly no withdrawal bonus interest of 1.0% per year for months when you do not make any withdrawals and a monthly no wthdrawal & save bonus interest of 0.40% per year for months when you do not make any withdrawals and deposit at least S$500.

Please leave your knowledge and opinion!