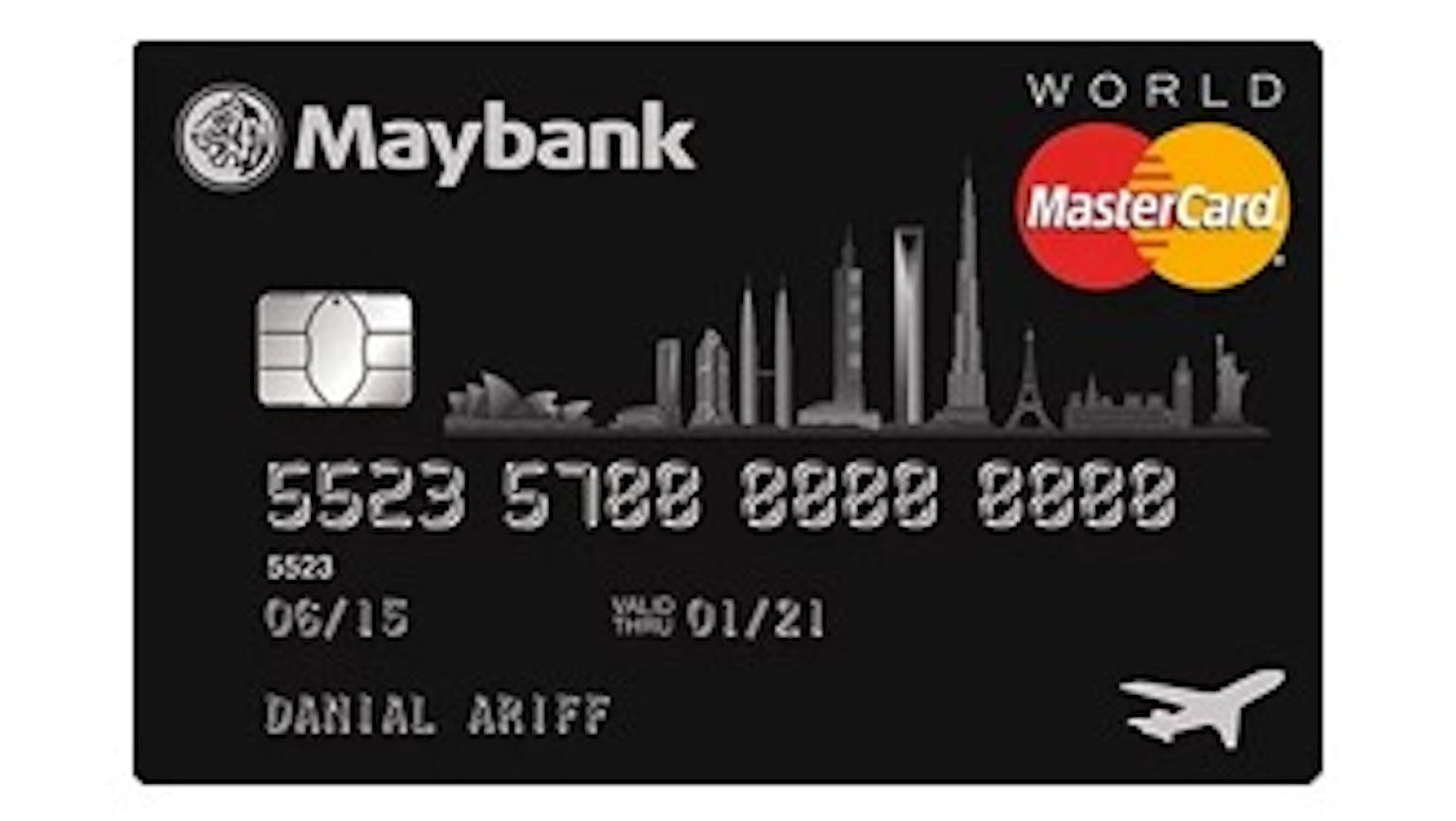

How are Card Transactions in Foreign Currencies and Transactions Processed Overseas processed by Maybank World MasterCard?

Just trying to prep myself for an overseas trip to Malaysia with my girlfriend, and I don’t want to carry too much cash on me but would like to use my card most of the time. What would be the manner of transaction processing by the card?

Products mentioned in this forum:

No Name

Card Transactions in foreign currencies other than the US Dollars will be converted into US Dollars before being converted into Singapore Dollars. Card Transactions in US Dollars shall be converted to Singapore Dollars on the date of conversion. All conversions are determined by the relevant ATM operator, merchant or dynamic currency conversion service provider, as the case may be. The conversion rate applied is based on the Posting Date of the Card Transaction to the Card Account which may be different to the rate in effect on the date of the Card Transaction. In addition, all Card Transactions in foreign currency will be subject to a charge of up to 1% on the converted Singapore dollar amount by the respective card associations while all card transactions in Singapore dollars but processed overseas will be subject to an administrative fee of up to 1%.