This card offers a few thrills if you are one for accumulating miles as you can earn 1.3 KrisFlyer miles for every S$1 equivalent in foreign currency spent overseas on eligible purchases up to S$3,800 each month. On such purchases above S$3,800 each month, you can earn 2 KrisFlyer miles. Furthermore the card allows earnings of 1.3 KrisFlyer miles for every S$1 spent locally in Singapore dollars on eligible purchases up to S$3,800 each month. On such purchases above S$3,800 each month, earnings are 1.4 KrisFlyer miles. Highly recommended for those who seek to accumulate miles.

No Name

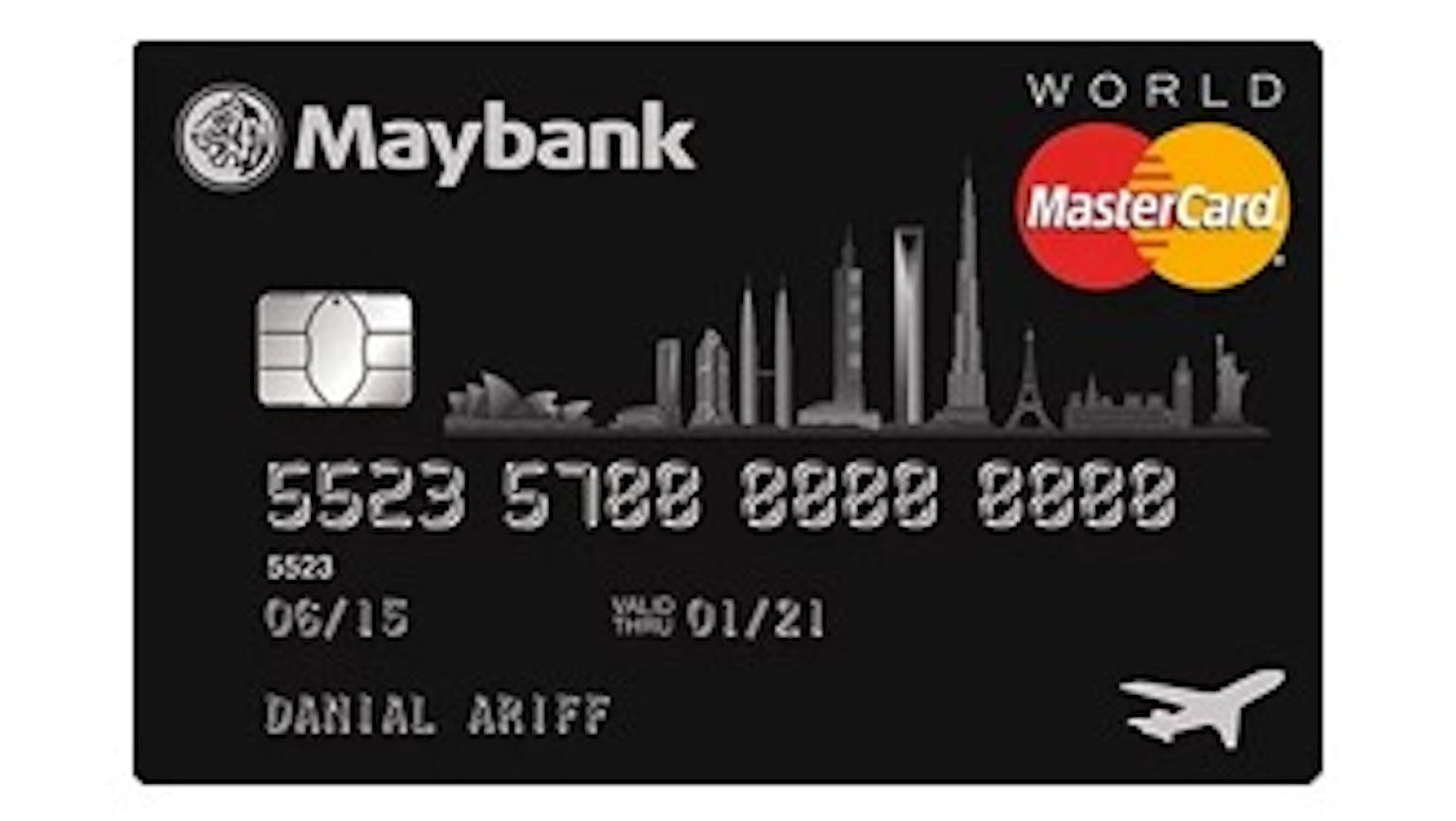

It should go thus; all payments must be made with a Maybank World MasterCard. The selected 10X TREATS Points merchants are valid till 31 December 2019, unless otherwise stated. The 10X TREATS Points at the selected merchants will automatically be awarded to the eligible Card member’s account if the designated merchant's outlet, where the required transaction is made, is on record with Maybank. 10X TREATS Points are awarded for each dollar spent at the selected merchants, which is equivalent to a conversion rate of 4 air miles for every S$1 spent. In the event the outlet is not on record with Maybank, the TREATS Points will only be awarded once Maybank is informed of the new outlet and has updated its records accordingly. TREATS Points will not be awarded to any transactions that Maybank deem to be corporate/commercial transactions. The 10X TREATS Points will not be awarded for any online transactions. In the event a card transaction is cancelled or reversed by any party for any reason, Maybank shall reverse all TREATS Points awarded for that card transaction. The awarding of 10X TREATS Points is only applicable at the selected merchants advertised by Maybank. Maybank reserves the right to change or delete the selected merchants at any time without notice. The general Terms and Conditions governing TREATS Points Rewards and the Card member’s card account shall apply. Maybank reserves the right to terminate this promotion or vary, delete or add to any of these Terms and Conditions from time to time and to exclude any person from participating in the promotion without prior notice. Maybank makes no representation as to the quality of the goods and services provided under the Promotion. Maybank shall not be liable to any person for any loss, damage and/or injury whatsoever or howsoever caused arising from the Promotion. I hope that helps you but you can take out time and study it more in-depth at their website.