How do I earn bonus KrisFlyer miles with the KrisFlyer UOB Deposit Account?

I recently opened up a KrisFlyer UOB Deposit Account and would like to know how to go about earning bonus miles. Also I would like to know if there is any extra bonus miles for doing so. I appreciate the feedback.

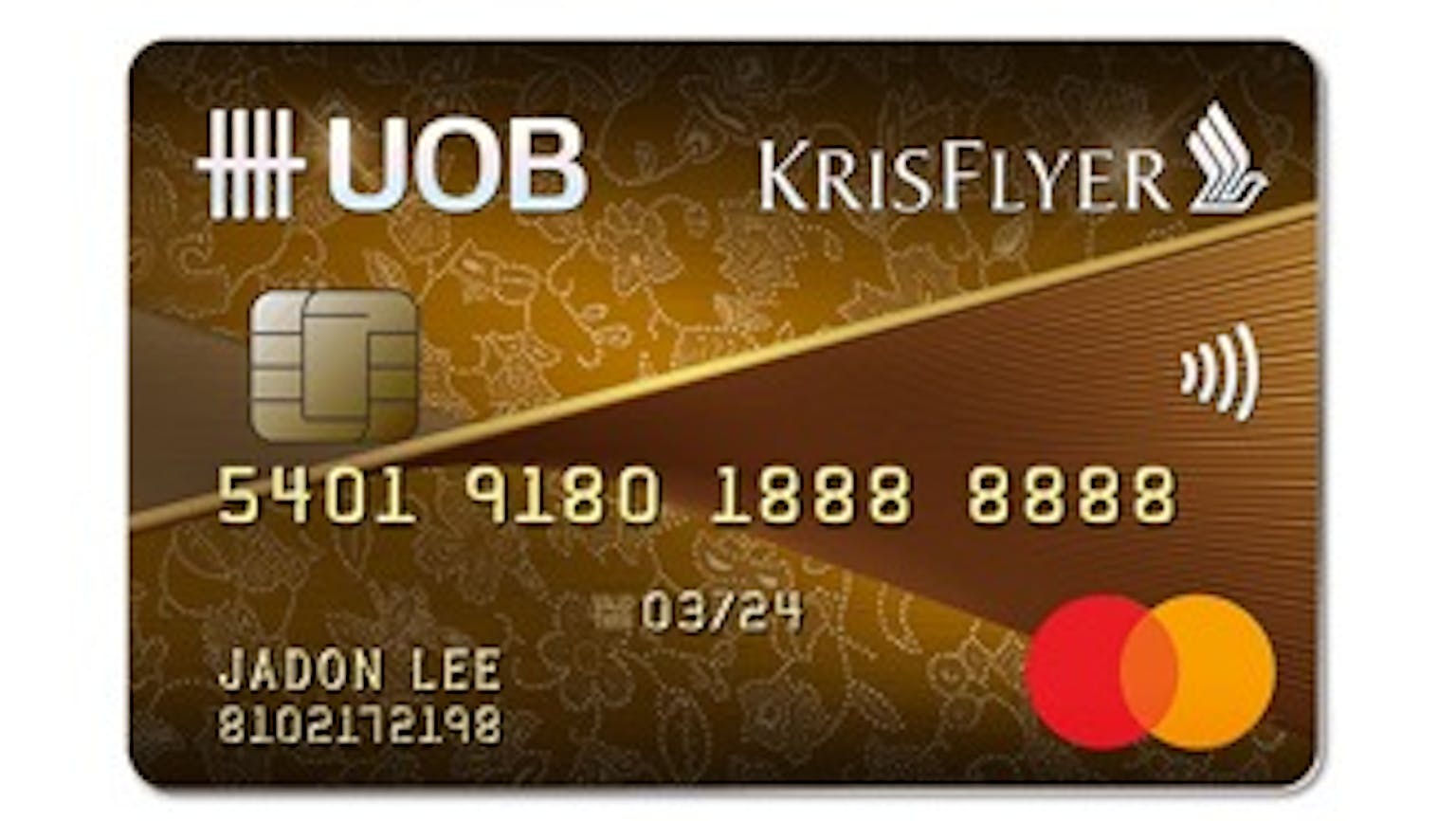

Products mentioned in this forum:

No Name

To earn bonus KrisFlyer miles with the KrisFlyer UOB Deposit Account, you simple save more mecause the more bonus KrisFlyer miles you get when you spend on your KrisFlyer UOB Credit Card. You also earn additional bonus KrisFlyer miles for per S$1 spend when you open a KrisFlyer UOB Deposit Account. Total bonus miles are capped at 5% of your monthly average balance.